Solana (SOL) was one of the best-performing cryptocurrencies in 2023, surging by 920% in the year. Part of this was due to an increased network activity, bringing more value to the ecosystem and more demand for its native token.

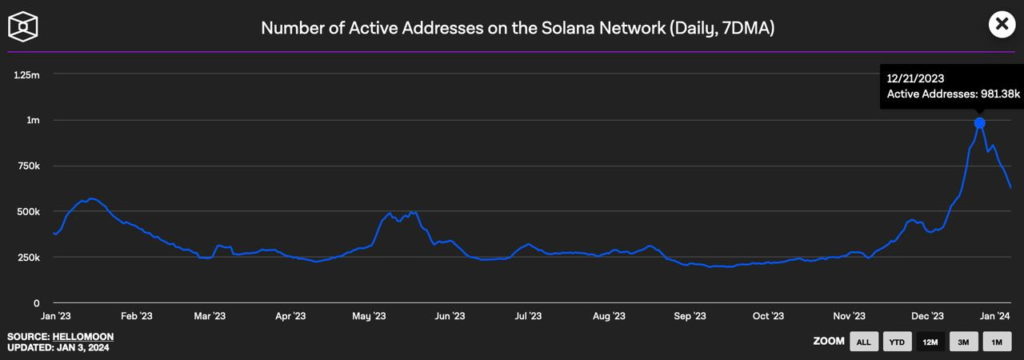

In particular, the Solana network has seen an increase of approximately 600,000 more active addresses in a month. Daily active addresses went from 382,700 on November 21 to a yearly high of 981,380 on December 21.

Current address activity is still above a 1-year average, according to The Block’s chart, with data from Hellomoon. Currently, 625,160 Solana addresses are actively used in a 7-day moving average.

Number of active addresses on the Solana network (Daily, 7DMA). Source: The Block

Solana increased active demand and price analysis for SOL

The number of active addresses is one metric that evidences the increased activity for Solana’s network. However, it is not the only one. During 2023, Solana also saw a surge in its DeFi ecosystem, joining the top five chains with the highest total value locked (TVL).

Once again, the increased activity for its infrastructure affects the demand for SOL, the token. Despite having one of the most inflationary tokenomics among all cryptocurrencies, this demand favored Solana investors.

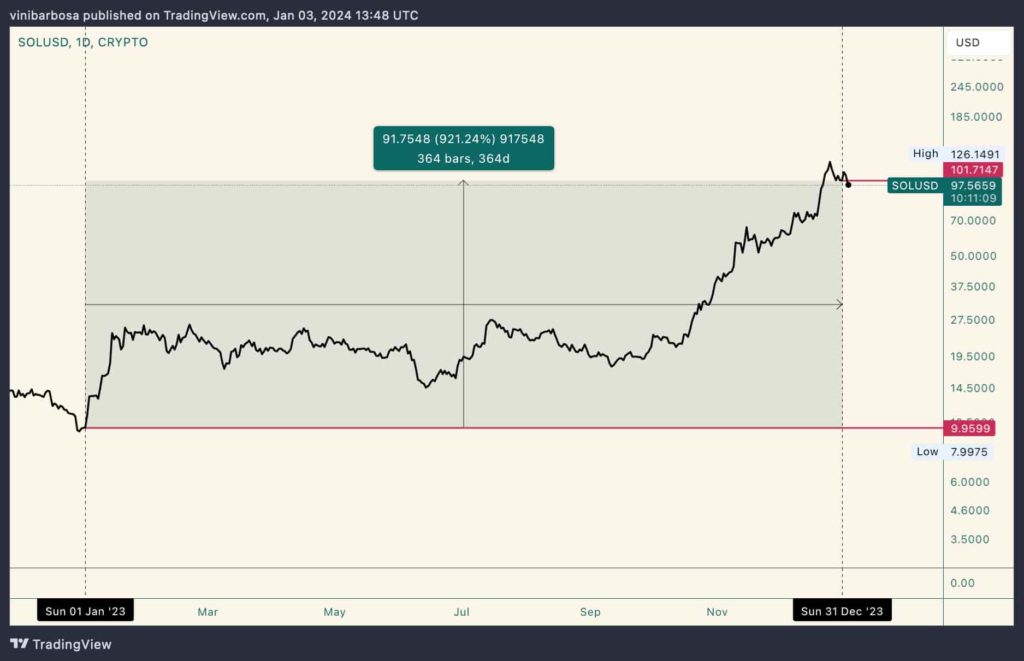

Interestingly, SOL started trading in 2023 at $9.95 per token, closing the year at $101.71 for a 921% surge. As of writing, SOL trades at $97.56, holding the 100 times price increase.

SOL daily price chart of 2023. Source: TradingView

Nevertheless, past performance is no guarantee of the future. Solana must be able to constantly attract demand and network activity for it to continue rewarding its investors.

Moreover, this demand must overcome the recurrent daily unlocks worth over $8 million in SOL. Plus, Solana’s observed yearly inflation of around 18% might create strong selling pressures in the future.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.