A new year has started, and cryptocurrency investors are preparing their investment strategies for 2024. In the expectations of a bull market, correctly building and adapting crypto portfolios is crucial for a better yearly performance.

In particular, the metaverse and web3 investor Adriano Feria shared his investment strategy for this expected bull cycle. Notably, Feria mostly bets on Ethereum (ETH), with 75% of his portfolio. Scalable solutions and alternatives to his main bet compose the resting 25%.

These alternative tokens are made of Ethereum second layers and rollups or parallelized EVMs. Nevertheless, the investor warned of caution, considering “significantly higher risks” among these digital assets.

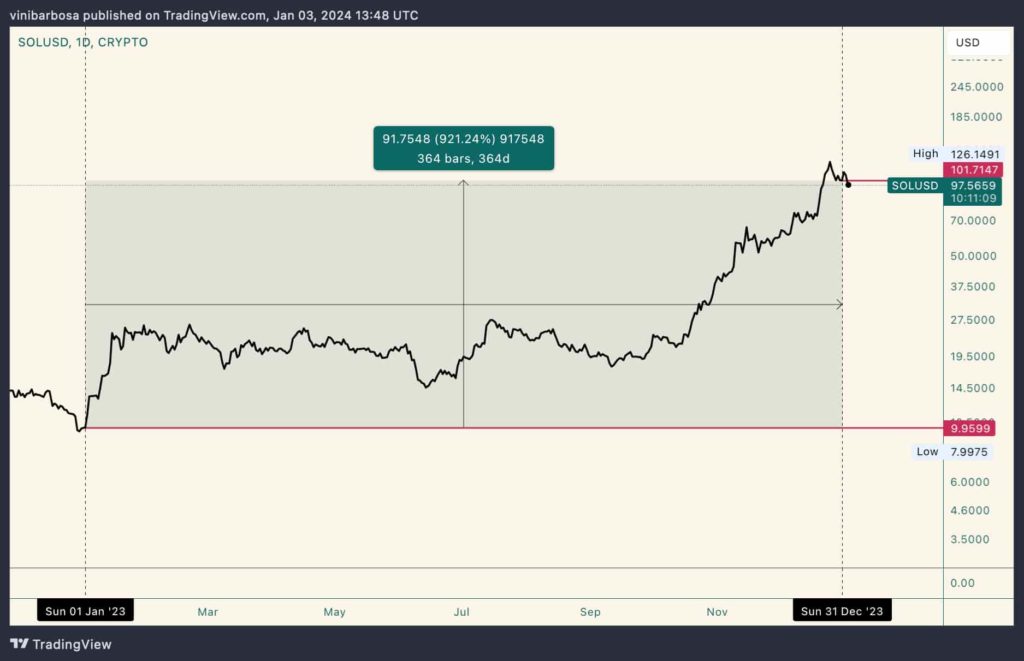

SOL daily chart in 2023. Source: TradingView

Moreover, Adriano also moved part of his ETH to a “diversified mixing” of Sei Network (SEI), Arbitrum (ARB), Celestia (TIA), Optimism (OP), ImmutableX (IMX), Polygon (MATIC), and Coinbase Global Inc (NASDAQ: COIN). The first three are fairly new tokens, recently launched.

As promised, this is my investment strategy and portfolio for this bull cycle. ?Tokens focused on rollups and parallelized EVMs are likely to outperform $ETH, but be aware, they come with a significantly higher risk.There are three main risks for these altcoins to keep in…

— AdrianoFeria.eth ?? ?️ (@AdrianoFeria) January 4, 2024According to the Web3 investor, the plan is to look for cash-out opportunities on SEI as soon as possible. Therefore, shifting his expected profits with Sei Network back to ETH and COIN. Further, the rollup tokens should face the same fate.

In closing, Adriano Feria explained that he expects everything else to outperform COIN during a bull market. However, Coinbase stocks should “hold up better during the next crash,” in his words. Feria believes the U.S. cryptocurrency exchange will play an important role in the Ethereum ecosystem moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.