Dozens of investment firms have filed within the Security and Exchanges Commission (SEC) to launch a Bitcoin spot ETF. If approved, this would be the first United States ETF to offer exposure to Bitcoin (BTC) in the spot market.

VanEck is one of these investment firms, with $76.4 billion in assets under management (AUM) as of September 2023. Interestingly, the asset manager pledged to donate 5% of its profits with the spot ETF to Bitcoin’s open-source development.

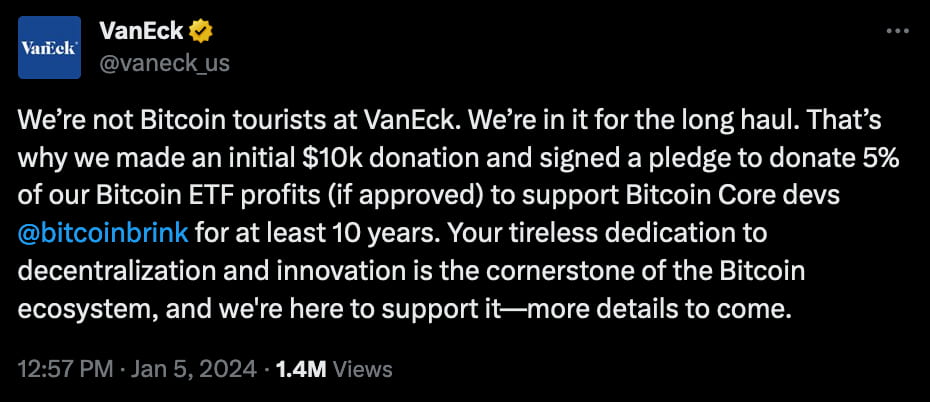

The pledge announcement came on January 5, together with an effective donation of $10,000.

VanEck announcement. Source: X (formerly Twitter)

VanEck to support Bitcoin Core devs at Brink with the spot ETF

As announced, VanEck will use Brink (@bitcoinbrink, on X) as its donation venue to support the Bitcoin Core software.

Notably, Brink was founded by the former Blockstream’s product manager, Mike Schmidt, to fund, educate, and mentor Bitcoin developers. The institution has Dave Harding, Christian Decker, and Gloria Zhao composing the Grant Committee, currently sponsoring seven Core developers.

Nevertheless, some influential figures in the cryptocurrency community raised concerns following the announcement. For example, Joel Valenzuela and Toby Cunningham commented directly on the original post by VanEck, suggesting malicious intents.

“There’s NO free cheese in a mouse trap. Paying off developers to influence the direction of Bitcoin. Nice try Van Eck. I’ve been in this space longer than you guys have ever heard of Bitcoin. You ain’t fooling me.”

— Toby Cunningham

Comments on VanEck’s announcement post. Source: X (formerly Twitter)

However, it is worth mentioning that VanEck made a similar pledge related to Ethereum, as reported by CoinDesk in October 2023. On this occasion, the asset manager promised 10% of its Ethereum Futures ETF profits to support ETH developers.

All things considered, VanEck signals its intention to support cryptocurrencies offered as speculative products. These pledges show commitment to the cryptocurrency market and open-source development, which could boost contributions somehow influenced by the asset manager’s ideals.