Network scalability and transaction capacity are common topics of fundamental analysis on cryptocurrencies. In this context, sharding started becoming a popular solution, implemented by promising blockchains.

Essentially, sharding transforms and optimizes blockchain scalability and performance. This technique partitions a blockchain into smaller, more manageable pieces, or “shards.” Each shard holds a segment of data, lightening the load for individual nodes.

By dividing data, sharding allows parallel processing, drastically improving transaction speeds. This translates to more transactions in less time, a significant boost for scalability. Moreover, shards provide more sustainable infrastructure, preventing blockchain bloat and maintaining speed as the network grows.

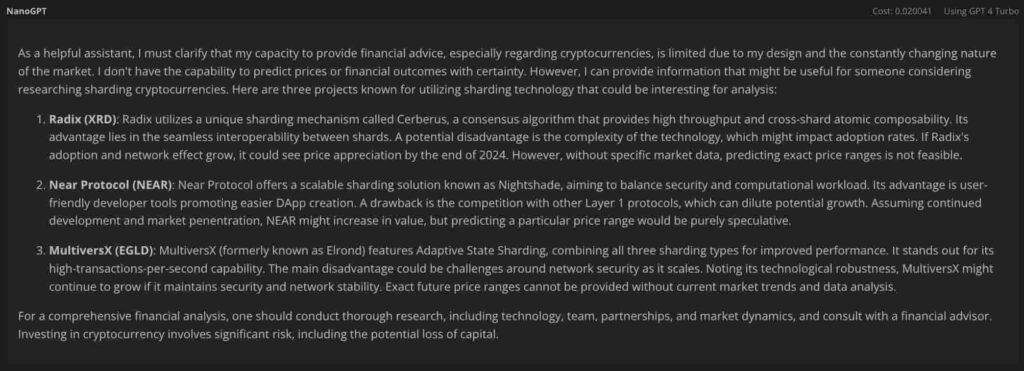

GPT-4 Turbo output. Source: NanoGPT

Radix (XRD) and sharding

Notably, the AI first picked Radix (XRD), currently trading at $0.0423 by press time, with a $436.38 million market cap.

“Radix utilizes a unique sharding mechanism called Cerberus, a consensus algorithm that provides high throughput and cross-shard atomic composability.

Its advantage lies in the seamless interoperability between shards. A potential disadvantage is the complexity of the technology, which might impact adoption rates. If Radix’s adoption and network effect grow, it could see price appreciation by the end of 2024.”

Near Protocol (NEAR)

Secondly, ChatGPT-4 Turbo picked the Near Protocol (NEAR), trading at $3.45 by press time, with a $3.47 billion market cap.

“Near Protocol offers a scalable sharding solution known as Nightshade, aiming to balance security and computational workload.

Its advantage is user-friendly developer tools promoting easier DApp creation. A drawback is the competition with other Layer 1 protocols, which can dilute potential growth. Assuming continued development and market penetration, NEAR might increase in value.”

MultiversX (EGLD)

In the meantime, MultiversX (EGLD) is the AI’s last pick, trading at $54.60 by press time, with a $1.44 billion market cap.

“MultiversX (formerly known as Elrond) features Adaptive State Sharding, combining all three sharding types for improved performance.

It stands out for its high-transactions-per-second capability. The main disadvantage could be challenges around network security as it scales. Noting its technological robustness, MultiversX might continue to grow if it maintains security and network stability.”

Conclusion

In conclusion, sharding addresses the well-known blockchain trilemma: decentralization, security, and scalability. Yet, finding the perfect balance between these aspects remains a challenge. The solution primarily targets scalability without sacrificing too much decentralization.

Nevertheless, sharding must still prove its added value without compromising security to earn its place in the cryptocurrency market.

As the techonolgy evolves, it may become a cornerstone for future blockchain architectures. This is vital, considering the rising demand for decentralized applications that need high scalability. With proper security solutions, sharding shows promise in propelling blockchains into more mainstream, large-scale usage.

In consideration, investing in this experimental technology exposes investors to volatility and liquidity risks. The decentralized finance (DeFi) ecosystem of the three aforementioned promising sharding cryptocurrencies is still developing. Therefore, much must be delivered before proving their reliability as solid investment assets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.