XRP has undergone a sharp short-term price correction after trading within a consolidated zone for several months despite gaining partial legal clarity that deemed it not a security.

As the new week begins, XRP and the broader cryptocurrency market face critical moments, with all eyes on the anticipated spot Bitcoin (BTC) exchange-traded fund (ETF) approval. This event is closely monitored for its potential impact on the market.

In this line, crypto analyst Cryptoinsightsuk, in an X (formerly Twitter) post on January 7, highlighted the significance of this event and its potential influence on the trajectory of XRP. From his perspective, XRP is poised for a breakout, but investors need to monitor various developments closely.

XRP price analysis chart. Source: TradingView

The analyst pointed out that the current technical characteristics of XRP resemble those of previous bear markets.

“XRP is displaying similar technical characteristics to 2021s bear market. Two tests of the $0.56 range as resistance, a breakthrough on the third test and then a consolidation. in 2021, the next phase was a breakout,” he said.

He also observed a tight consolidation structure in XRP. From a technical standpoint, the rising consolidation is considered a more bullish structure than that seen in 2017.

“I’m not suggesting we see a 60,000% move like we have previously (although history suggests this is a technical possibility). I am suggesting that a breakout with a $BTC ETF for $XRP could be more explosive than most imagine and that $XRP has 1 Bull Cycle to catch up to potentially,” he added.

Impact of XRP community

The analysis also touched upon the sentiment within the XRP community, noting a sense of capitulation with emotions running high and individuals selling due to frustration with what some term a “Shitcoin that never moves.”

Cryptoinsightuk sees this emotional response as a potential contrarian indicator, suggesting that such extreme sentiment often precedes a market reversal. The analyst reminded traders that buying during times of fear rather than greed can be profitable.

Another significant aspect highlighted is the legal status of XRP in the United States. Despite the ongoing legal battle between Ripple and the Securities Exchnage Commission (SEC),

The expert pointed out that XRP is legally not considered a security in the US. This distinction, a cloud over XRP for almost three years, may have led to recent selling by holders looking to exit the asset at break-even or a slight loss of around $0.90.

As XRP targets a return to $1, the SEC case remains pivotal for the token’s value. Hopes for an early SEC-Ripple settlement have notably dwindled as both parties proceed with remedies-related discovery, scheduled to conclude by February 12, 2024.

XRP price analysis

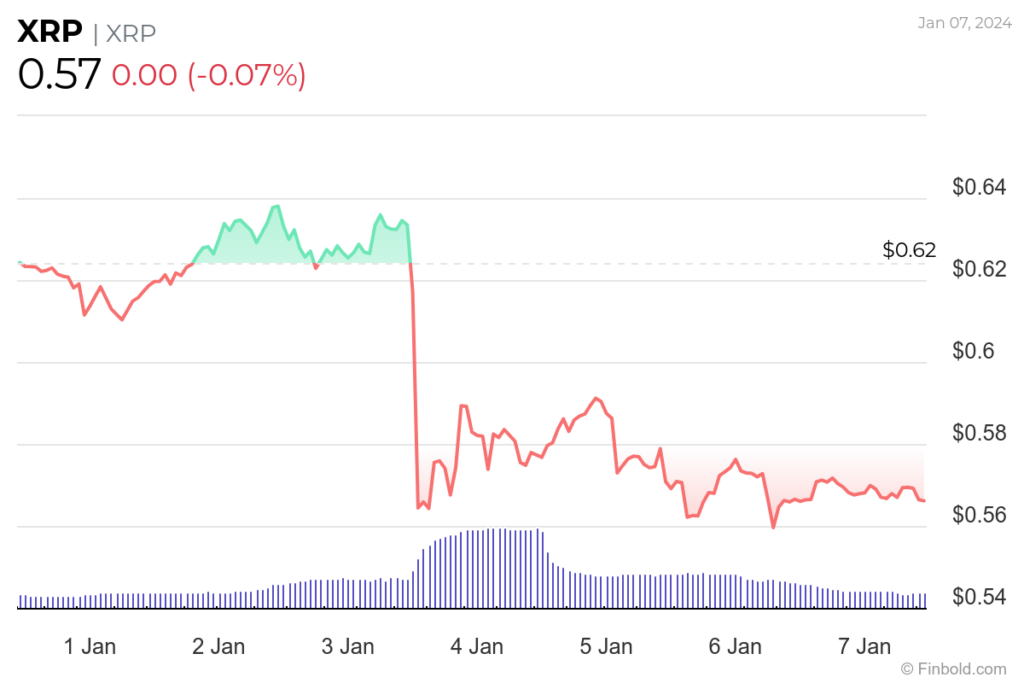

By press time, XRP is trading at $0.57. Over the past seven days, the token has experienced a correction of nearly 10%.

XRP seven-day price chart. Source: Finbold

An analysis of technical indicators suggests a prevailing bearish sentiment for XRP. A summary of the one-week gauges obtained from TradingView alludes to a ‘sell’ rating of 10. This sentiment is consistently mirrored in moving averages, with a rating of eight, and oscillators, which register a rating of two.

XRP technical analysis. Source: TradingView

In the meantime, the focus is now on XRP reclaiming the $0.60 spot as it targets the wider goal of hitting $1.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.