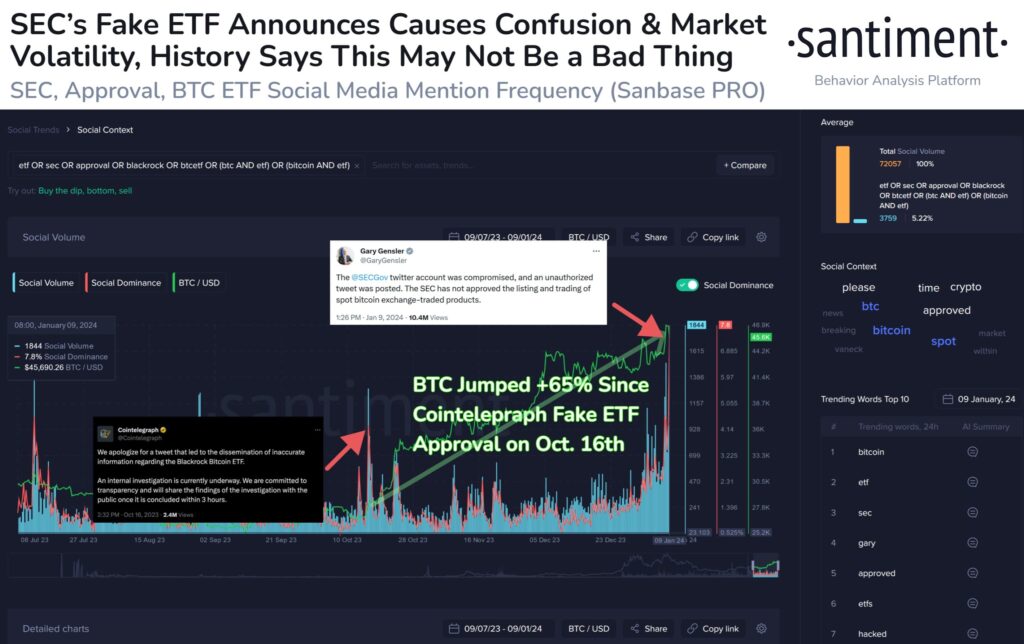

The highly anticipated spot-Bitcoin exchange-traded fund (ETF) approval finally seemed to arrive on January 9. However, it turned out to be false hope for investors, as a tweet that announced it was deleted, and Security and Exchange Commission (SEC) chairman Gary Gensler said the SEC’s X profile was hacked.

The recent dissemination of inaccurate information has resulted in the liquidation of over $300 million in Bitcoin (BTC) markets. Despite the disappointment surrounding the disapproval of Blackrock’s ETF, it essentially marked the market bottom, per a post on X from crypto analytics platform Santiment on January 9.

Bitcoin price movement after two fake SEC approvals. Source: Santiment

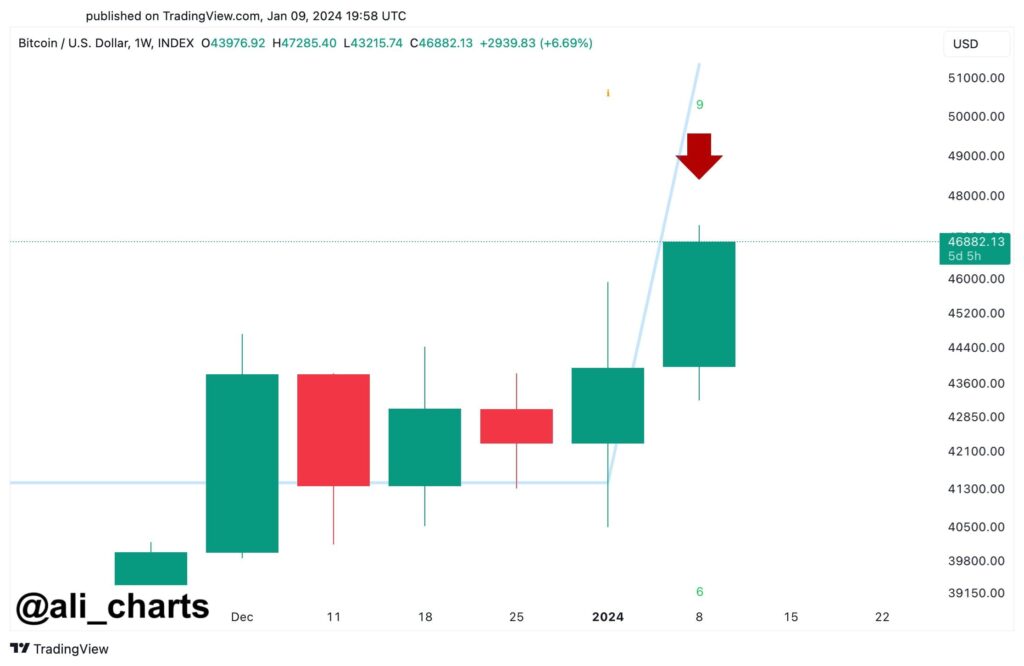

Bitcoin sell signal on a weekly chart. Source: Ali Martinez

However, it is too early to tell whether the same pattern from the previous event will repeat itself and bring a bull cycle of flagship crypto.

Bitcoin price analysis

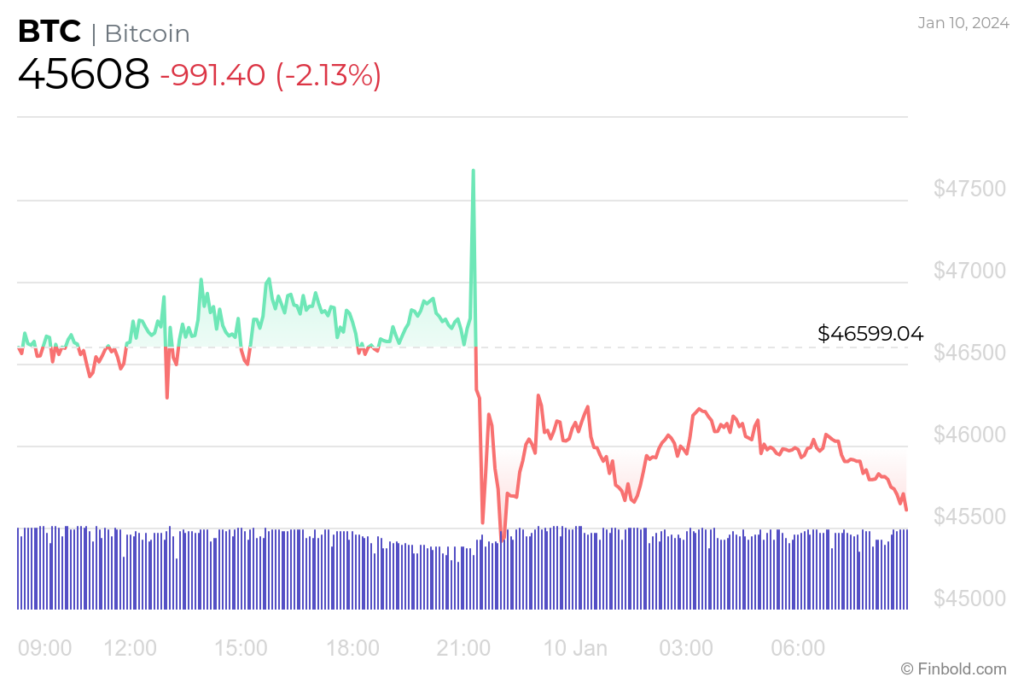

At the time of press, Bitcoin was trading at $45,608, marking a -2.13% decrease on the daily chart, contrary to the gains of 1.27% and 8.25% made on the weekly and monthly chart, respectively.

BTC 24-hour chart. Source: Finbold

It is worth noting that the spike between the fake announcement and the release of hack information has marked a turbulence of over $2,000 in the BTC price, or almost 5% of the total price at the time.

Whether this fake news event will send the maiden crypto into the bullish cycle or the consolidation phase remains to be seen.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.