In what has been a rollercoaster in the previous day, investors have witnessed the historic approval of a spot-Bitcoin exchange-traded fund (ETF), just for it to turn out fake, sending waves across the cryptocurrency market and influencing Bitcoin (BTC) and other crypto assets price.

Observations indicate a significant market response characterized by a substantial shift in trader interest toward Ethereum (ETH), marked by a pronounced surge in price and trading volume. This noteworthy move underscores a sentiment shift within the market, per a post on X from crypto analyst The Wolf of All Streets on January 10.

ETH price movement on January 9. Source: The Wolf of All Streets

With the recent data and the potential that this approval holds over the altcoins price, Finbold utilized artificial intelligence (AI) chatbot ChatGPT from OpenAI to predict the Ethereum price in the case of ETF approval by the Security and Exchanges Commission (SEC).

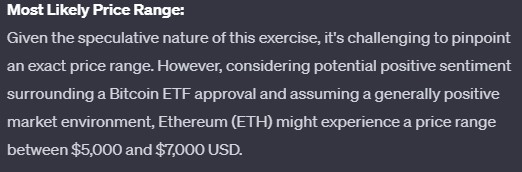

Most likely ETH price range scenario. Source: ChatGPT and Finbold

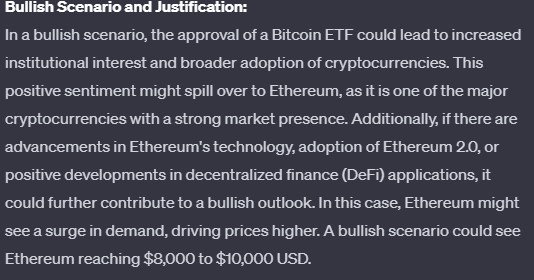

In a bullish scenario, approval of a Bitcoin ETF may spark greater institutional interest in cryptocurrencies, benefiting Ethereum due to its significant market presence. Positive developments such as advancements in Ethereum’s technology, adoption of Ethereum 2.0, or favorable progress in decentralized finance (DeFi) applications could amplify the optimistic outlook and propel the price range from $8,000 to $10,000.

Bullish ETH price range scenario. Source: ChatGPT and Finbold

In a bearish scenario, regulatory setbacks, security issues, or market downturns may occur, leading to adverse developments and a potential sell-off in the cryptocurrency market. Technical challenges or delays in Ethereum 2.0 implementation could further undermine investor confidence, resulting in downward pressure on Ethereum’s price, potentially increasing it from $3,000 to $4,000, noted the AI.

Ethereum price analysis

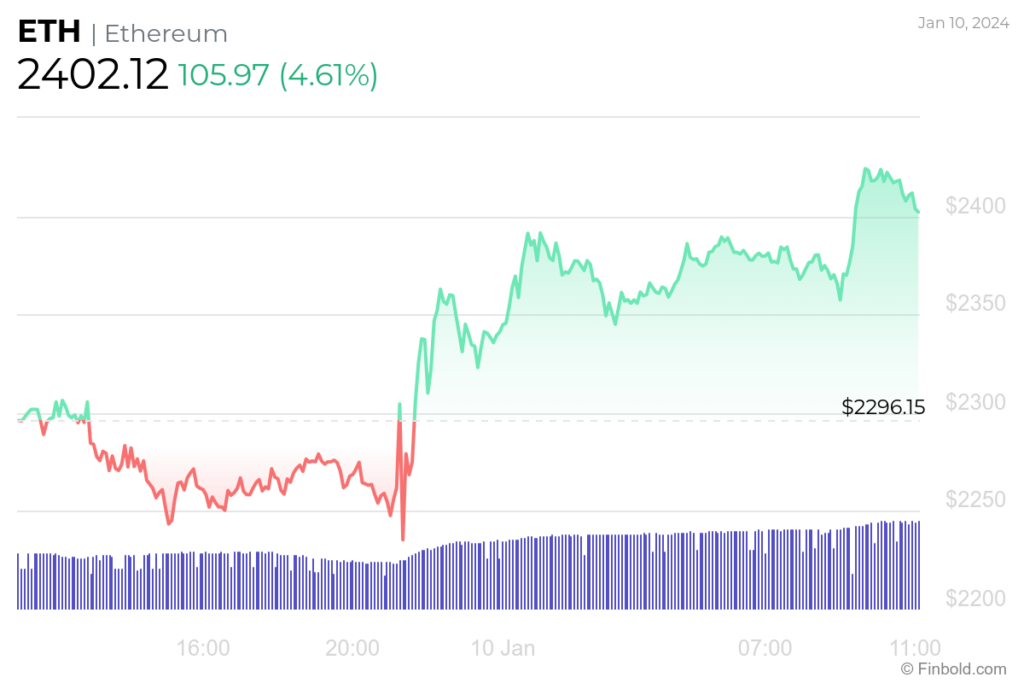

At the time of press, ETH was trading at $2,402, rising 4.61% in the previous 24 hours, adding to gains of 1.44% in the last week and an increase of 6.95% in the past 30 days.

ETH 24-hour price chart. Source: Finbold

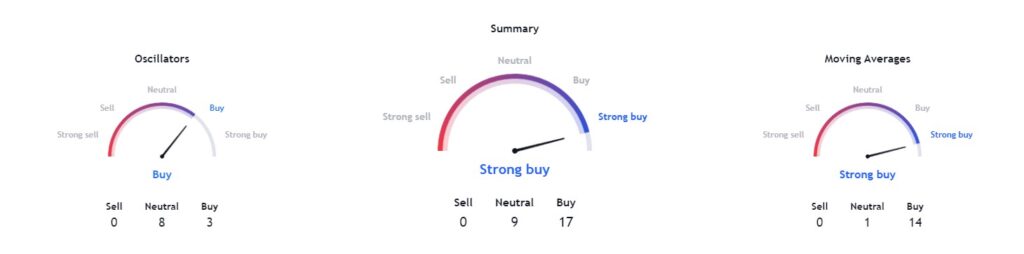

Technical indicators suggest a bullish outlook for ETH. There is a consensus of a ‘strong buy’ with 17 buy signals, supported by moving averages confirming another ‘strong buy’ with 14 buy signs. Additionally, oscillators align with a ‘buy’ rating, featuring 3 buy signals.

ETH technical analysis. Source: TradingView

Whether the potential approval of a Bitcoin ETF will positively impact Ethereum price remains to be seen. However, technical indicators and AI have given their highly optimistic verdict.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.