After years of rejections, the United States Securities Exchange Commission (SEC) finally approved a spot Bitcoin exchange-traded fund (ETF), marking the first of its kind in the country with anticipated bullish consequences for cryptocurrencies.

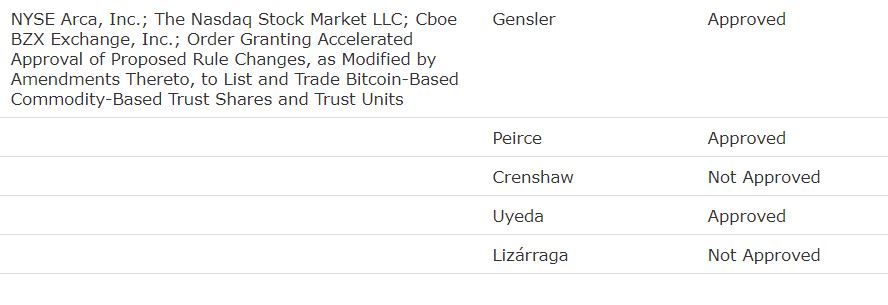

In this context, the commission’s voting notice published on January 10 revealed insights into which commissioners supported the product.

Interestingly, Chair Gary Gensler, previously accused of stifling the cryptocurrency sector, voted to favor the ETF. Commissioners Hester Peirce and Mark Uyeda joined Gensler in approving the product.

SEC commissioners voting on spot Bitcoin ETF. Source: SEC

Divisions among SEC commissioners

It is worth noting that among the SEC Commissioners, Peirce has publicly expressed support for the cryptocurrency sector, sometimes disagreeing with the agency’s stance on digital assets.

Meanwhile, despite voting in favor, Gensler has remained skeptical of the industry, a sentiment expressed in his statement following the approval.

“Bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity, including ransomware, money laundering, sanction evasion, and terrorist financing. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin,” Gensler said.

On the other hand, Pierce accused the commission of missing the opportunity for failing to approve the product earlier.

“We squandered a decade of opportunities to do our job. If we had applied the standard we use for other commodity-based ETPs, we could have approved these products years ago, but we refused to do so until a court called our bluff,” Peirce said.

On her part, Crenshaw cited issues she considered flaws in the crypto space that warranted the dissenting vote. For instance, she pointed to concentrated ownership as a critical concern, highlighting the potential for manipulating Bitcoin (BTC) spot trading that could lead to fraud.

Genesis of spot ETF approval

Notably, the anticipation of approving a spot Bitcoin ETF surged in 2023 after an appeals court pointed out that the SEC’s rejection of Grayscale Investments’ application to convert its Grayscale Bitcoin Trust into an ETF was incorrect.

In response, Gensler emphasized that following the court’s ruling, approving the product was “the most sustainable path forward.”

Attention has turned to how Bitcoin might perform following the approval, considering that the product is touted to increase institutional interest in the cryptocurrency.

Meanwhile, Bitcoin had again breached the $47,000 mark by press time, trading at $47,282, with daily gains of over 5% in the last 24 hours.