XRP is back trading above the $0.60 resistance, priced as high as $0.6237 so far in the day. Following the recent Bitcoin spot ETF approval, the token continued its climb from a low of $0.50 just over a week earlier on January 3.

XRP daily price chart. Source: TradingView

In particular, the positive sentiment comes from a historical regulatory breakthrough in the United States. On January 10, the Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETFs, which began trading across US exchanges.

These ETFs have outshined Bitcoin’s (BTC) daily price action, suggesting a broader market acceptance and institutional interest in cryptocurrencies.

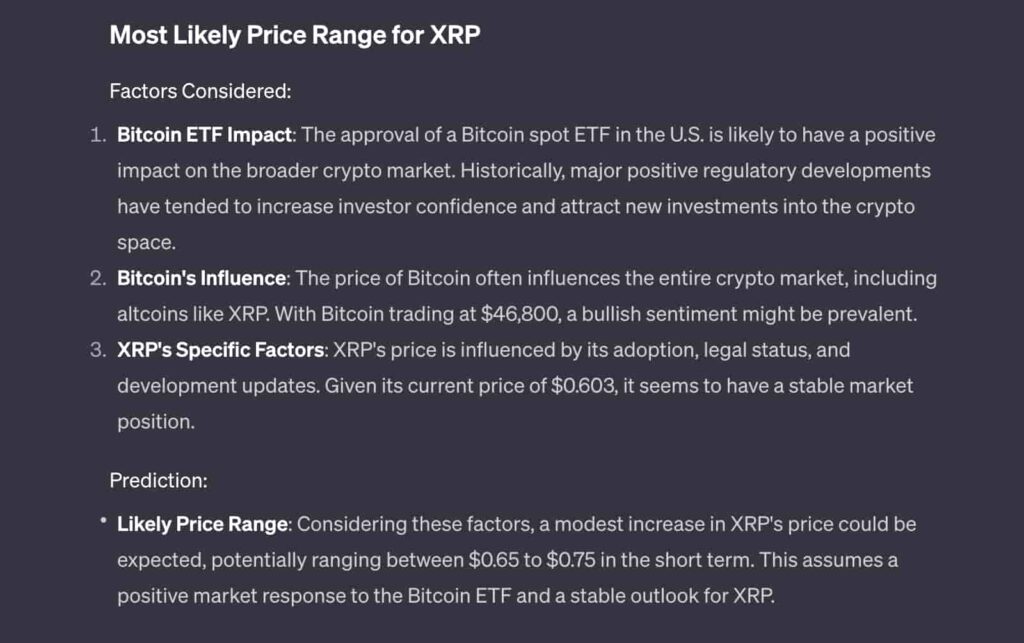

ChatGPT-4 output on the most likely XRP price prediction. Source: Finbold

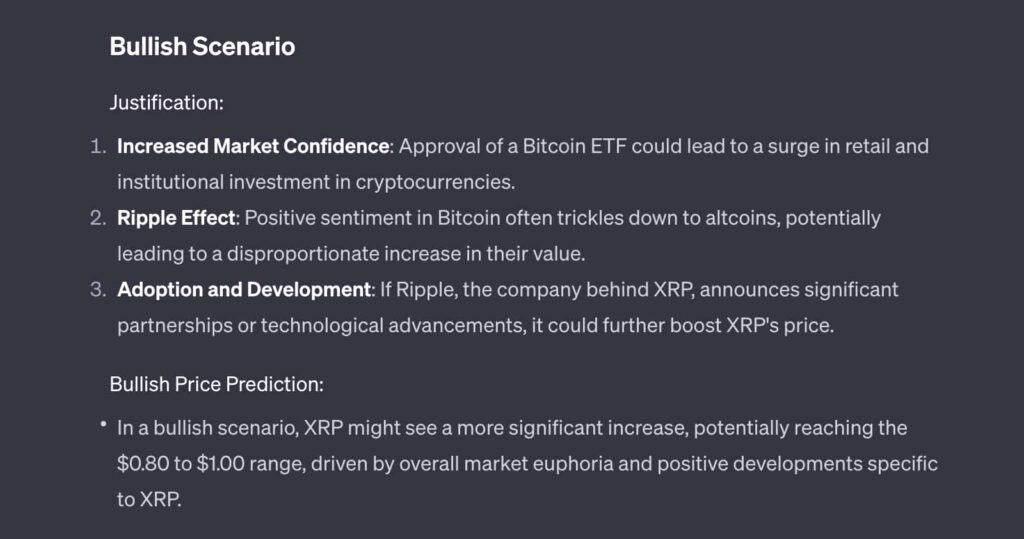

Meanwhile, a more optimistic outcome could potentially drive the XRP price to the $0.80 to $1.00 range. ChatGPT mentioned increased market confidence with the Bitcoin ETF approval and to other factors of influence:

“Ripple Effect: Positive sentiment in Bitcoin often trickles down to altcoins, potentially leading to a disproportionate increase in their value. Adoption and Development: If Ripple, the company behind XRP, announces significant partnerships or technological advancements, it could further boost XRP’s price.”

– ChatGPT

ChatGPT-4 output on the bullish scenario for XRP. Source: Finbold

Nevertheless, a losing scenario could put XRP in a bearish trend towards the $0.50 to $0.55 price range. This would send Ripple’s token back to weekly lows.

“In a bearish scenario, XRP could face a decline, potentially dropping below its current level to around $0.50 to $0.55, influenced by negative market sentiments or adverse developments.”

– ChatGPTConclusion

Interestingly, Ripple continued its routine token releases, selling 100 million XRP, which Finbold reported on January 9. While such a significant sell-off could have dampened XRP’s rise, the prevailing market optimism has overridden any negative sentiment, propelling the XRP price upwards.

Investors are now speculating whether this could signify a shift in market dynamics, with altcoins leading the charge ahead of Bitcoin.

In conclusion, the crypto market awaits to see how sustainable this bull trend is. With the SEC’s nod to Bitcoin ETFs and the consequent altcoin rally, the dawn of 2024 paints a promising picture for cryptocurrency enthusiasts and investors alike.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.