Larry Fink is the CEO of the world’s largest asset manager, BlackRock Inc. (NYSE: BLK). The finance titan is diving deeper into cryptocurrencies, first through Bitcoin (BTC) and now turning its eyes to Ethereum (ETH).

BlackRock’s CEO appeared on CNBC to discuss the company’s focus on infrastructure, following a “macro trend,” in his words.

Notably, Larry Fink addressed investments in the cryptocurrency market and the recently approved Bitcoin spot ETF with its redemption model. However, the spotlight went to Fink’s forecast of an Ethereum spot ETF approval, which he sees as likely to happen.

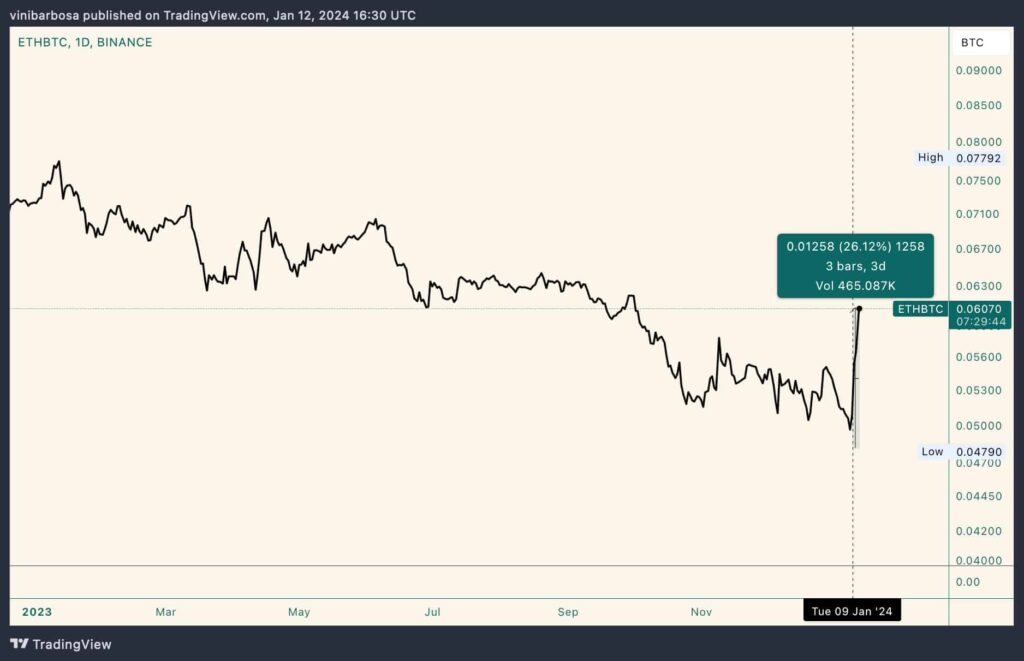

ETH/BTC daily chart. Source: TradingView

Other cryptocurrencies mirrored this reaction, driving Bitcoin’s market cap dominance to yearly lows and fuelling altcoins’ rallies for trending projects.

Interestingly, BlackRock’s new focus on Ethereum and tokenization aligns with the company’s infrastructure investment strategy. In the crypto realm, ETH is the leading Web3 infrastructure — home of hundreds of other projects and apps.

Nevertheless, Larry Fink refused to further comment on a possible Ethereum ETF approval by Gary Gensler and the SEC.

All things considered, the market should expect the risen narrative to dominate in the coming months if the pattern repeats. An increased interest in Ethereum could positively bring demand and value to the native token ETH and its price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.