The Bitcoin spot ETF approval brought volatility to the cryptocurrency market, mostly favoring altcoins for the weekend. Meanwhile, smart money in and outflows hint at which cryptocurrencies profitable traders are accumulating and getting rid of.

In onchain analysis, smart traders are active crypto addresses with a profitable history considering tokens’ inflow and outflow. If the address acquired tokens at a lower average price than what they later spent, it is smart money.

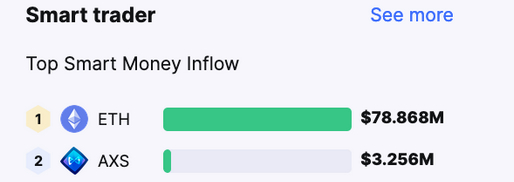

Notably, the smart money inflow was massively dominated by Ethereum (ETH) in the past 24 hours, according to SpotOnChain data. $78.87 million in ETH entered smart traders’ accounts, while the second place had only a $3.25 million inflow.

Smart trader monitor – Top smart money inflow. Source: SpotOnChain

In the meantime, the top 2 smart money outflows were Injective (INJ) and Wrapped BTC (WBTC). Smart traders dumped $12.05 million and $6.66 million worth of INJ and WBTC, respectively.

Smart trader monitor – Top smart money outflow. Source: SpotOnChain

What do WBTC and Bitcoin ETFs have in common?

Essentially, WBTC is a synthetic version of Bitcoin (BTC), running on Ethereum and other DeFi blockchains, similar to Bitcoin ETFs. Someone does the custody of the real Bitcoin, while the traders get exposure to its price activity on other markets.

Arbitrage might occur if any connected assets have a huge price variation. In particular, arbitrage smart money profits from the price difference of a base asset in different markets. These dynamics guarantee a price balance and that each connected asset can serve as a leading indicator to the other.

Therefore, if there is a considerable outflow of WBTC, a similar sell-off is expected for Bitcoin or its ETFs. As one usually influences the other, it is tough to distinguish between cause and effect — a “chicken-egg” paradox.

Bitcoin price analysis amid smart money outflow

Interestingly, a sell-the-news event occurred after a quick pump to $48,965 per BTC following the Bitcoin spot ETF approval. The leading cryptocurrency lost 12.4% of its value from this peak to its current price of $42,550

BTC hourly price chart. Source: TradingView

Simultaneously, Bloomberg’s ETF analyst James Seyffart reported a $484 million outflow from Grayscale Bitcoin Trust (GBTC). Thus, in a similar flow direction to the one from smart money DeFi traders.

UPDATE: Looks like @Grayscale's $GBTC saw $484 million in outflows today. @ARKInvest/@21Shares' $ARKB saw $42.5 million of INflows. @BitwiseInvest's $BITB flat on flows today. Don't have the data on any of the others yet. Total out of $GBTC is now ~$579 million pic.twitter.com/Ocuw9eHaHs

— James Seyffart (@JSeyff) January 13, 2024In this context, it is evident that ETFs might have a more extensive influence on Bitcoin’s price and vice-versa. Now, the narrative is shifting towards an awaited Ethereum spot ETF approval, possibly motivating the first-mentioned smart money inflows to ETH.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.