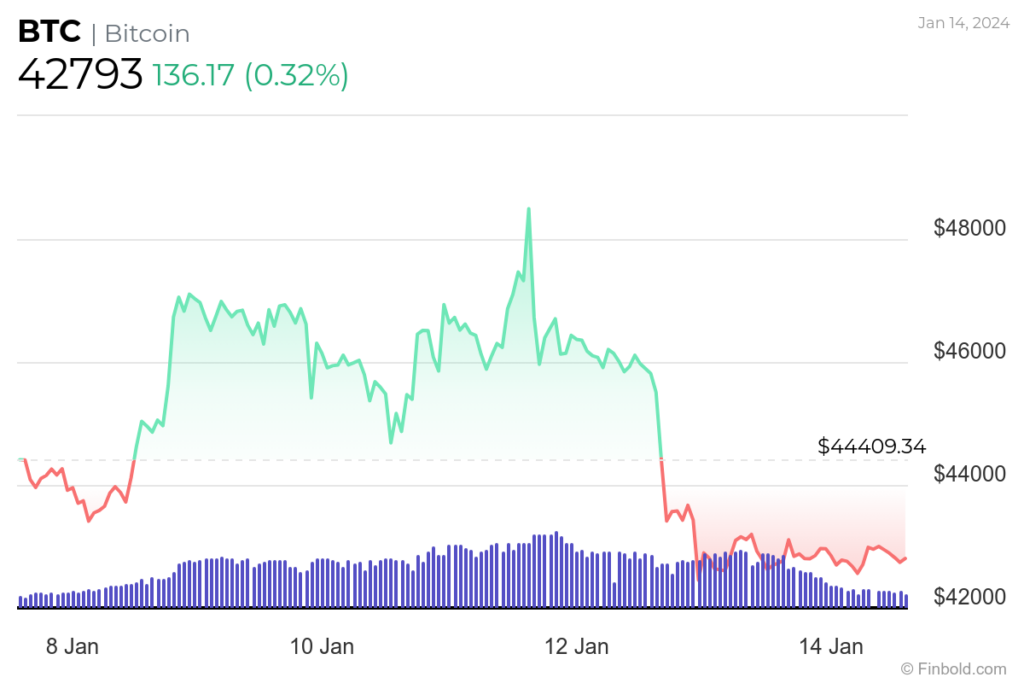

After reaching a two-year high of almost $49,000, Bitcoin’s (BTC) valuation has receded, leaving the market uncertain about the next trajectory for the maiden cryptocurrency. The surge in value was prompted by the approval of a spot Bitcoin exchange-traded fund (ETF) in the United States.

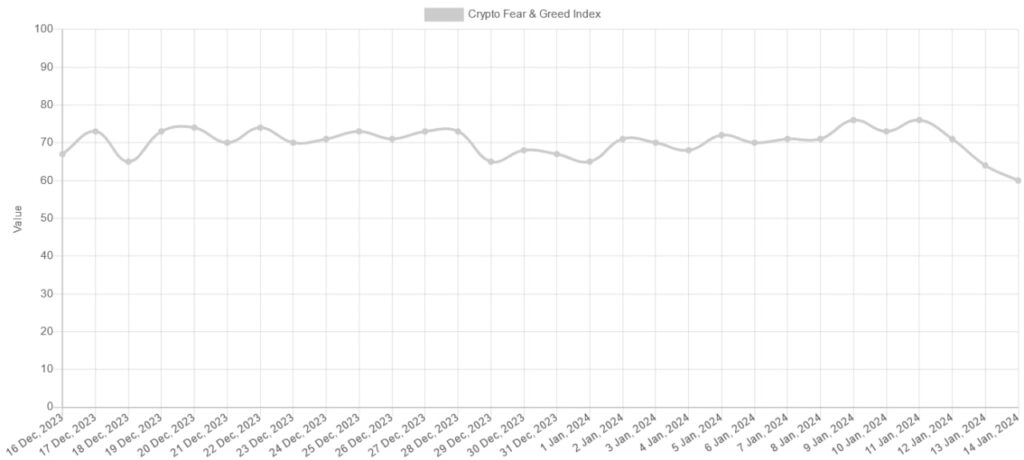

Significantly, the impact of the ETF on Bitcoin seems to be diminishing, as investors appear to be taking profits amid subdued hype. This shift in sentiment is reflected in the movement of Bitcoin, now observable on the Crypto Fear & Greed Index—an important gauge in the financial market that measures sentiments among participants.

Specifically, data obtained by Finbold on January 14 indicates a consistent decline in the index. For example, between January 11 and January 14, the index steadily dropped from 76 to 60, representing a 21% decrease.

Crypto Fear & Greed Index chart. Source: Alternative.me

Although the index is dropping, it remains in the ‘Greed’ zone. However, the gauge mostly recorded steady readings over the past month, mainly due to anticipation of the spot ETF launch. By press time, the index was 60.

Crypto Fear & Greed Index. Source: Alternative.me

The index holds significant importance within the cryptocurrency community as it is a key indicator of general market sentiments, providing insights into expected price movements.

Higher readings suggest that greed dominates the market, indicating many buyers. On the contrary, lower readings suggest investor skepticism about participating in the crypto market, with minimal selling activity.

ETF hype fails to hold

It is worth noting that the market seems to be moving on from the enthusiasm surrounding spot Bitcoin ETFs. The impact of this shift in conversation is evident as discussions now revolve around the potential approval of a similar product for Ethereum (ETH).

This aspect is influencing the price of Bitcoin. Given the cryptocurrency’s multiple days of price increases leading up to the approval, the asset is now vulnerable to dropping below the $40,000 support zone.

Notably, the first day of trading for the Bitcoin ETF marked a peak in hype, with a subsequent 12% decline in the following days. The underwhelming performance of the spot Bitcoin ETFs has raised questions about the actual market demand for such products.

Interestingly, the drop in Bitcoin price did not surprise some analysts who have termed the event “buying the rumor and selling the news.” This market behavior involves an asset experiencing a surge before a significant event, only to see a decline once the event takes place.

Bitcoin price analysis

By press time, Bitcoin was trading at $42,793 with weekly losses of almost 4%. Since the ETF approval on January 10, BTC has plunged by about 14%.

Bitcoin seven-day price chart. Source: Finbold

In terms of technical analysis, the asset is characterized by bearish sentiments. A summary of the one-day gauges retrieved from TradingView indicates a ‘sell’ rating at 10, with moving averages signaling a ‘sell’ sentiment at 8. Additionally, oscillators are holding a ‘neutral’ position at 8.

Bitcoin technical analysis. Source: TradingView

In conclusion, with the hype around the ETF appearing to diminish, attention has turned to Bitcoin’s ability to sustain gains above the $40,000 mark.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.