With the previous week bringing gains for the cryptocurrency market, some digital assets displayed promising signals that might indicate their future movement. Dogecoin (DOGE) is one of those.

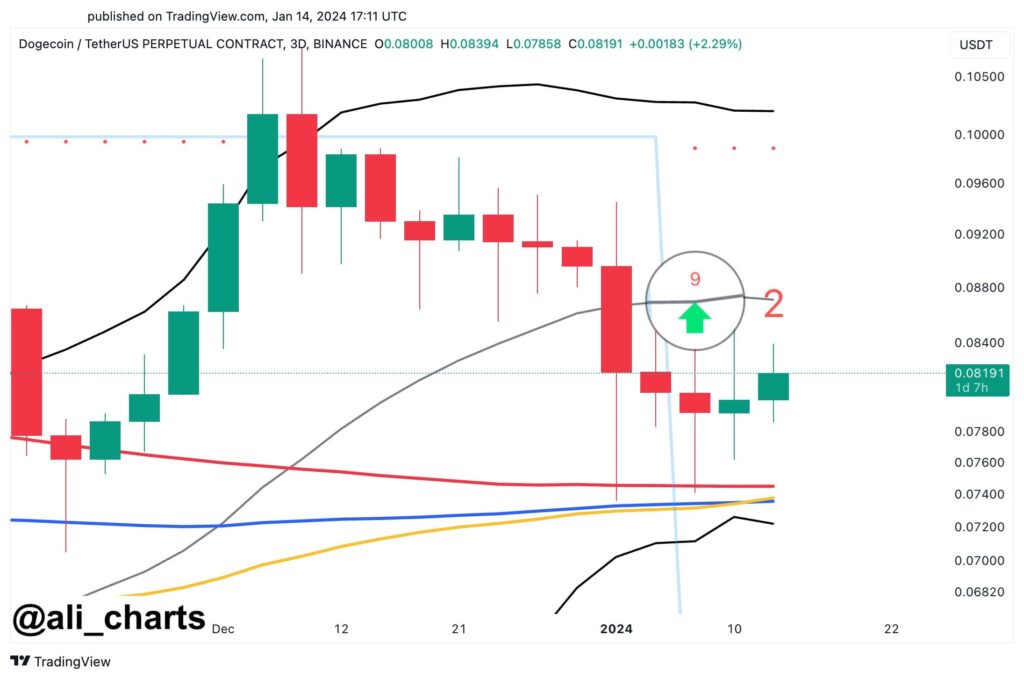

The TD Sequential has recently generated a buy signal on the 3-day chart for Dogecoin. The probability of a resurgence to $0.100 or beyond appears favorable, contingent upon the sustained stability of the $0.074 support cluster, per a post on X by crypto analyst Ali Martinez on January 14.

TD sequential for Dogecoin on a 3-day price chart. Source: Ali Martinez

The TD sequential is a robust tool crafted to pinpoint the precise moment of trend fatigue and subsequent price reversal. As a counter-trend instrument, it addresses the limitations observed in various technical analysis indicators that prove profitable in trending markets but exhibit suboptimal performance in sideways or ranging markets.

Dogecoin price RSI. Source: TradingView

Dogecoin price analysis

At the time of press, DOGE was trading at $0.0809, marking a daily decrease of -1.83%, contrary to the gains of 3.77% on the weekly chart and losing -16.22% in the previous month.

DOGE 24-hour price chart. Source: Finbold

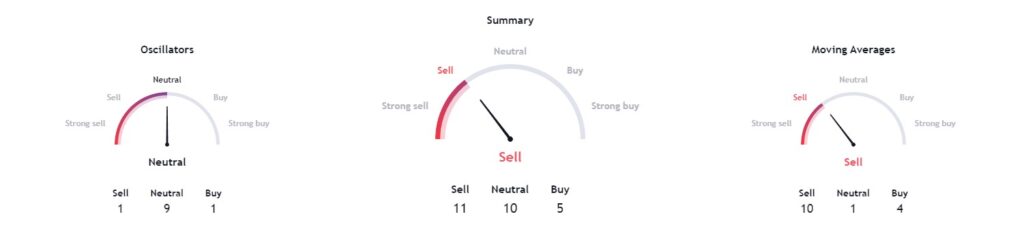

Technical indicators are currently unfavorable for the DOGE price, leaning towards a ‘sell’ signal at 11, with moving averages aligning with a ‘sell’ recommendation at 10. On the other hand, oscillators maintain a neutral stance, registering a value of 9.

DOGE technical analysis. Source: TradingView

When looking at digital asset prices, it is essential to look at as many indicators as possible, as only then will investors be able to see the bigger picture. This helps in preventing unnecessary risks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.