Recently, publicly traded cryptocurrency-related companies have taken center stage in the financial world, particularly after the approval of the Bitcoin spot exchange-traded fund (ETF).

Traditionally, the performance of these companies in the stock market has exhibited a significant correlation with the overall trajectory of the cryptocurrency sector.

The spotlight remains on the performance of these companies, especially as the cryptocurrency industry has several possible bullish catalysts lined up for 2024, including the Bitcoin (BTC) halving. This attention persists even as the ETF approval failed to meet expectations in propelling a new rally in the market.

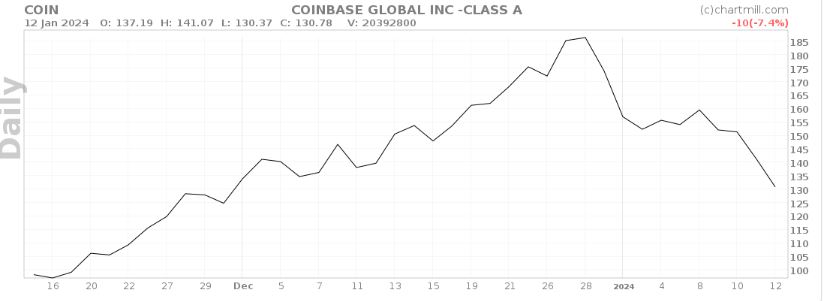

COIN one-month stock price chart. Source: ChartMill

MicroStrategy Inc. (NASDAQ: MSTR)

The tool acknowledged that MicroStrategy Inc.(NASDAQ: MSTR) stands out as a publicly traded company with a unique value proposition – significant Bitcoin holdings, effectively making it a proxy for Bitcoin investment. Indeed, the company currently holds a Bitcoin haul of almost 190,000.

Bard also highlighted that the company’s executive chairman, Michael Saylor,’s commitment to Bitcoin adds to the company’s appeal. The potential for substantial gains exists if Bitcoin experiences price appreciation.

However, MicroStrategy’s high-stakes strategy exposes investors to amplified Bitcoin price swings. The company’s limited diversification in its business portfolio increases its risk profile. The tool added that the success is intricately tied to BTC’s performance, making MicroStrategy’s fortunes sensitive to market fluctuations.

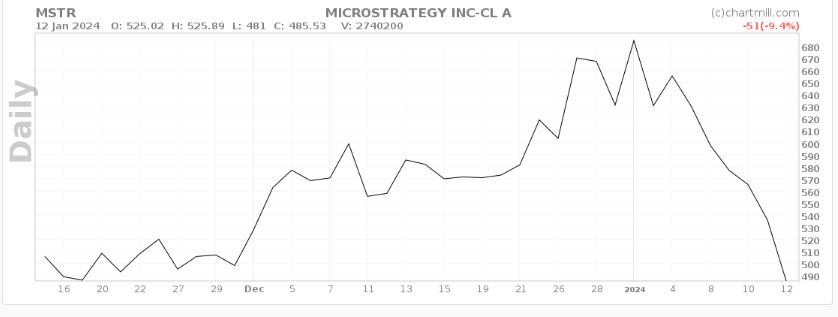

MSTR stock plunged 20% after the ETF approval within 48 hours. However, the drop was partly tied to the general sell-off in the stock market.

At the moment, MSTR YTD losses stand at 29% valued at $485.53 by the close of markets on January 15.

MSTR one-month stock price chart. Source: ChartMill

Riot Blockchain Inc. (NASDAQ: RIOT)

Google Bard pointed to Riot Blockchain (NASDAQ: RIOT), as a leader in Bitcoin mining, emphasizing its efficient operations and commitment to renewable energy. Riot Blockchain has successfully captured market share in the competitive mining landscape. The potential for growth lies in the company’s ability to capitalize on a rising Bitcoin price and the growing demand for mining services.

Nevertheless, Google Bard noted that Riot Blockchain is not immune to challenges. Fluctuations in Bitcoin mining difficulty and electricity costs pose potential hurdles. Environmental concerns related to the energy consumption of Bitcoin mining and regulatory uncertainties in the mining industry add complexity to the investment landscape.

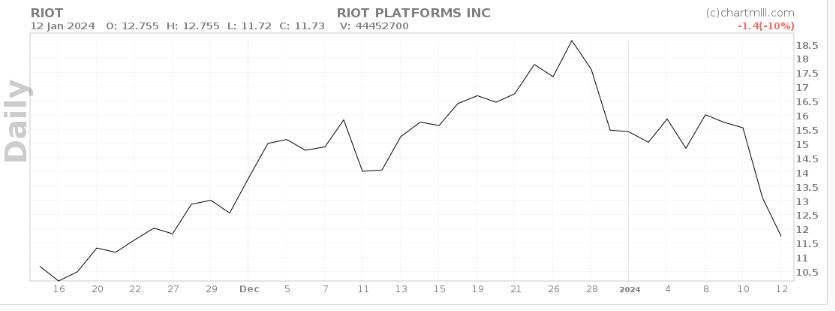

By press time, RIOT was valued at $11.73, experiencing year-to-date losses of 23%.

RIOT one-month stock price chart. Source: ChartMill

In conclusion, despite the identified stocks having potential, they have started 2024 on a negative note, in line with the overall crypto market sell-off.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.