Ethereum (ETH) has reached yet another remarkable achievement, dominating decentralized finances (DeFi) total value locked (TVL) by 80%. Meanwhile, its native token, Ether, aims at the $3,000 price zone, threatening a short squeeze soon.

Remarkably, the total value locked on Ethereum’s first layer surged 231% in the last 24 hours to $100.31 billion. This sums up to recent increases, resulting in 255% and 283% changes in the last seven and 30 days, respectively.

Total value locked on the top 5 DeFi chains. Source: DefiLlama

It is worth mentioning that the above data, retrieved by Finbold from DefiLlama, does not include Ethereum’s second layers. For example, Arbitrum (ARB) has its own $2.62 billion in total value locked, ranking fourth among the DeFi chains.

Pie chart: Total value locked in all chains. Source: DefiLlama

Ethereum’s total value locked is distributed among 1004 DeFi protocols, contributing to its ecosystem.

Ethereum price analysis

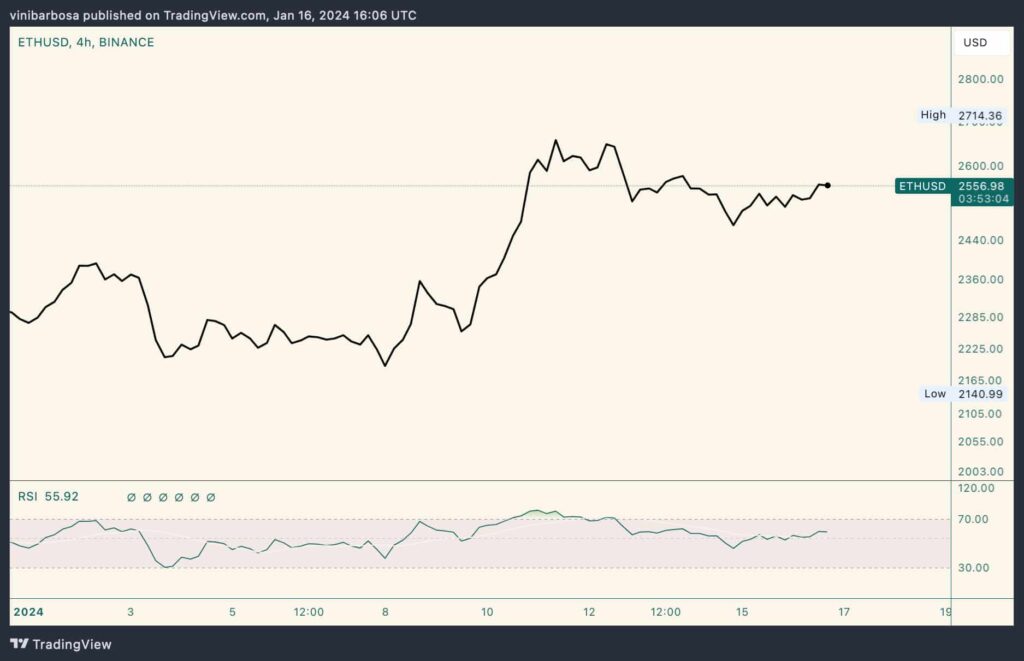

Meanwhile, ETH is trading at $2,554 per token by press time, slightly up 2% in the last 24 hours. Ether reached $2,714, its highest price of 2024, so far. On the other hand, $2,140 was the lowest for the first month of the year.

ETH/USD 4-hour price chart. Source: TradingView

Ethereum has around $307.09 billion of market capitalization at these prices. This is three times more than its DeFi ecosystem has in total value locked, evidencing how meaningful its dominance is among other chains.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.