After a long-awaited spot-Bitcoin ETF approval, the price trajectory hasn’t panned out for investors as they thought it would. Bitcoin’s (BTC) price experienced a downturn, which sent its price below the $40,000 threshold. And it might just be the beginning.

A weekly chart close below the $38,000 mark may indicate a potential downturn for Bitcoin, with a focus on the robust support cluster situated around $33,000.

This critical region incorporates multiple technical components, including the lower boundary of a parallel channel, the 0.5 Fibonacci retracement level, and the 50-week simple moving average, as per a post on X from cryptocurrency analyst Ali Martinez on January 24

Potential further lows for BTC. Source: Ali Martinez

The convergence of these factors establishes a noteworthy line of defense that has the potential to impede further declines in the price of maiden crypto.

Historical movement as a possible prediction

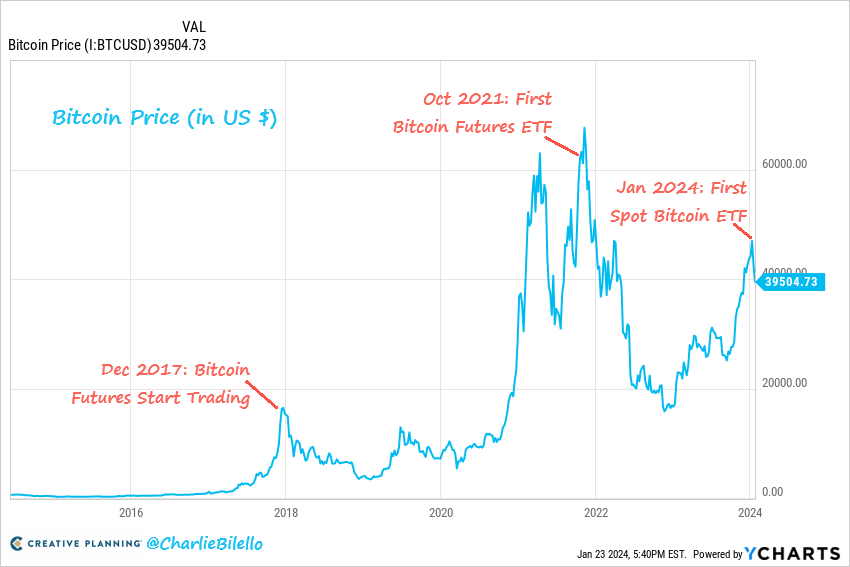

Historical price movement might be a nice indicator for investors, as it can potentially retrace the same pattern as it did after previous notable events.

In December 2017, BTC experienced a surge in value in anticipation of the commencement of Bitcoin futures trading, only to undergo an 84% correction subsequently. A parallel occurrence transpired in October 2021, when flagship crypto witnessed an upward trajectory preceding the approval of the Bitcoin futures ETF, resulting in a subsequent correction of 78%, per a post from investor Charlie Bilello on January 23.

Historical price movement of BTC after notable events. Source: Charlie Bilello

In January 2024, a similar pattern unfolded as price rallied before the approval of the inaugural spot-Bitcoin ETF, albeit with a more moderate correction of 20% thus far.

Could whales be to blame for correction?

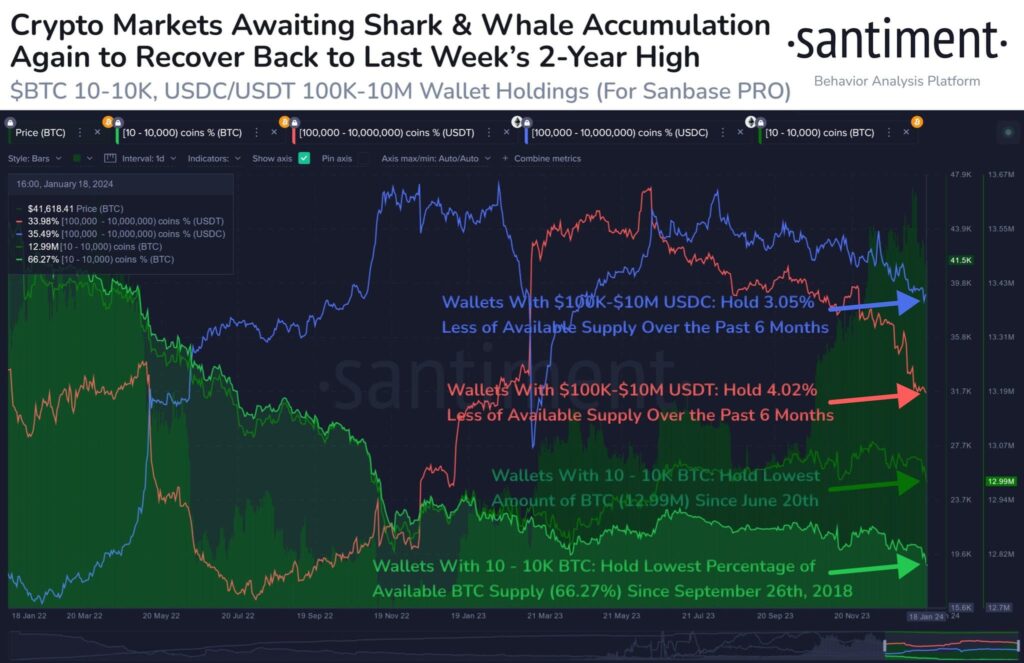

Addresses that hold a large amount of specific digital asset (known as whales) might directly impact the price of cryptocurrency due to their trading moves.

The latest data indicates notable activities among cryptocurrency whales in different holding brackets. Wallets with values ranging from $100,000 to $10 million have experienced a 3% drawdown over the past six months, while those in the $10,000 to $10 million range show a 4% reduction since August, per a post from crypto educator Wise Advice on January 20.

Whales BTC selling activity among different-sized wallets. Source: Wise Advice

Interestingly, wallets holding 10,000 to 10 million BTC maintain their lowest amount since June 2023, suggesting a potential trend of selling or distribution by these holders.

Bitcoin price analysis

At the time of press, BTC was trading at $39,926 after adding 1.25% the previous day, contrary to losses of -6.52% in the past week and downside of -8.50% in the last month.

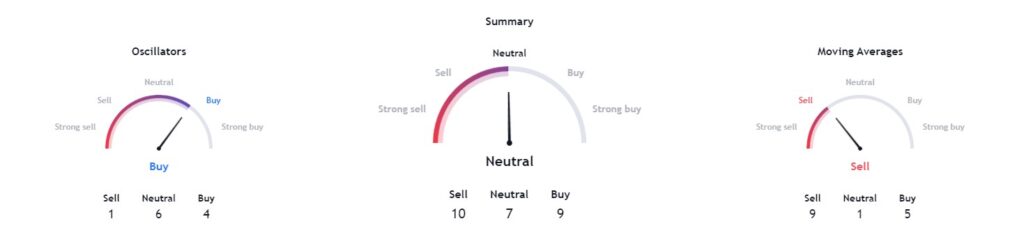

BTC 24-hour price chart. Source: Finbold

Technical indicators paint a contrasting picture, with an overall rating of ‘neutral’ at 7 and moving averages tilt towards ‘sell’ at 9. Meanwhile, oscillators move towards ‘buy’ at 4.

Technical analysis of BTC price. Source: TradingView

With the historical data, trading sentiment, and price analysis making a case against Bitcoin, it is probable to expect further dips, which might provide an opportunity as an entry point for investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.