Decentralized finance (Defi) platform Solana (SOL) continues to be one of the best-performing cryptocurrencies in the short term, attracting increased buying pressure.

The heightened interest has elevated Solana’s market capitalization to reach $42.5 billion by press time, reflecting an inflow of $4.4 billion or 11.5% growth from the $38.1 billion recorded on January 22.

SOL seven-day market cap chart. Source: CoinMarketCap

Indeed, Solana’s recent gains have coincided with the short-term market uptick led by Bitcoin (BTC). Notably, most cryptocurrencies capitalized on Bitcoin’s gains amid slowed profit-taking from the Grayscale Bitcoin Trust (GBTC) spot exchange-traded fund (ETF).

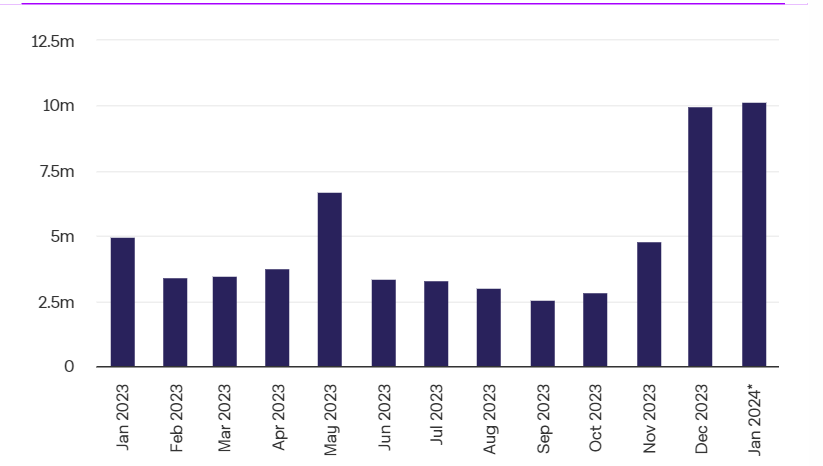

SOL number of new addresses chart. Source: IntheBlock

Solana price analysis and chances to hit $100

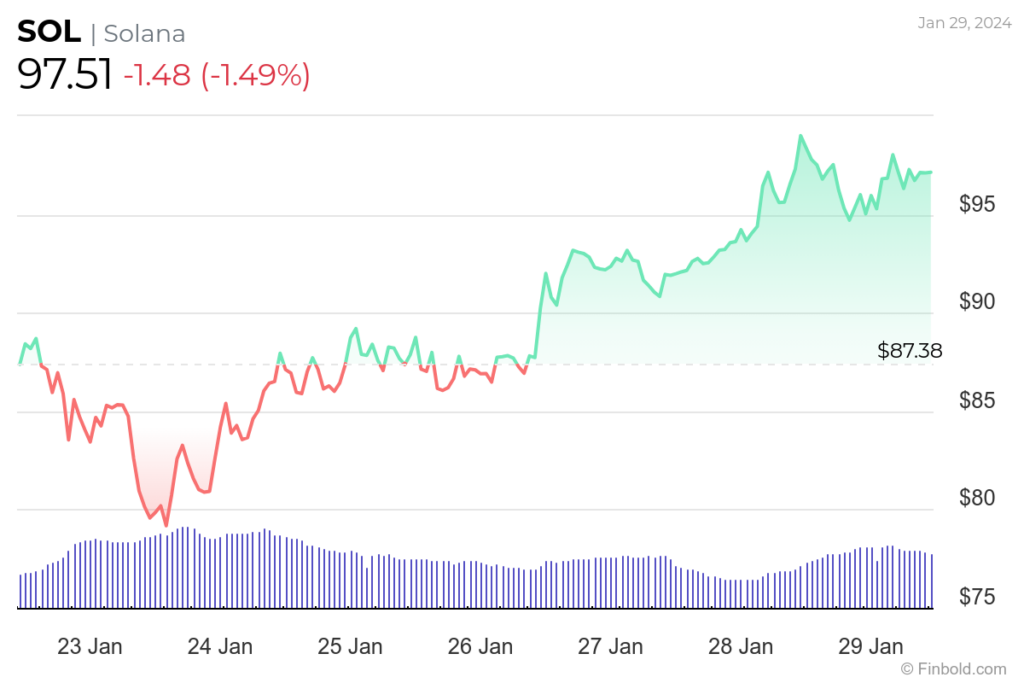

By press time, SOL was trading at $97.13, marking a weekly gain of over 10%. It’s worth noting that SOL reached a weekly high of $99 before experiencing a brief correction.

SOL seven-day price chart. Source: Finbold

Observing the current price movement, Solana appears to have retraced its previous year’s rally, characterized by consistent upward momentum and long green candles in daily trading.

On the other hand, crypto trading analyst Jelle, in a post on X (formerly Twitter) on January 26, suggested that investors should anticipate an extended SOL rally, projecting that the token might soon reach $200. He cited the token’s strength against Bitcoin as a factor to consider for sustained gains.

SOL price analysis chart. Source: TradingView

Indeed, based on fundamentals, SOL seems poised to reclaim the $100 mark, and the token will also be seeking a general boost from the overall trajectory of the crypto market.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.