Decentralized finance (DeFi) is a lively and competitive ecosystem moving billions of dollars daily in decentralized exchanges (DEX).

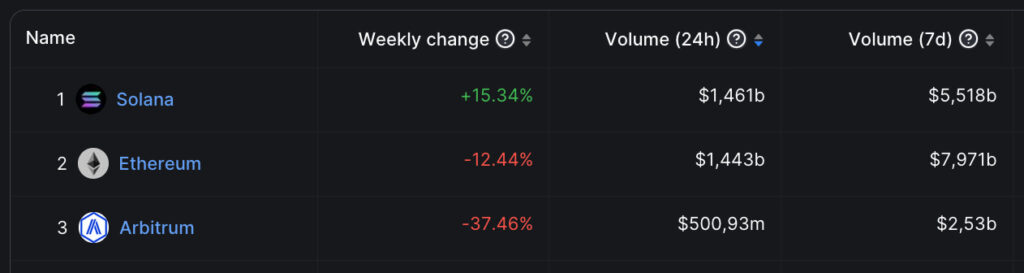

Notably, Solana (SOL) recently dethroned Ethereum (ETH) in the 24-hour DEX volume, according to data from DefiLlama on February 1. The two competitors have been fighting a long battle to attract traders and investors in the past years.

In particular, Solana shined with a weekly volume increase of 15.34%, while Ethereum lost 12.44% of its own. Nevertheless, SOL’s ecosystem is still behind the second-largest cryptocurrency in the 7-day DEX volume despite the recent surge.

DEX volume by chain. Source: DefiLlama

Orca leads Solana’s DEX volume

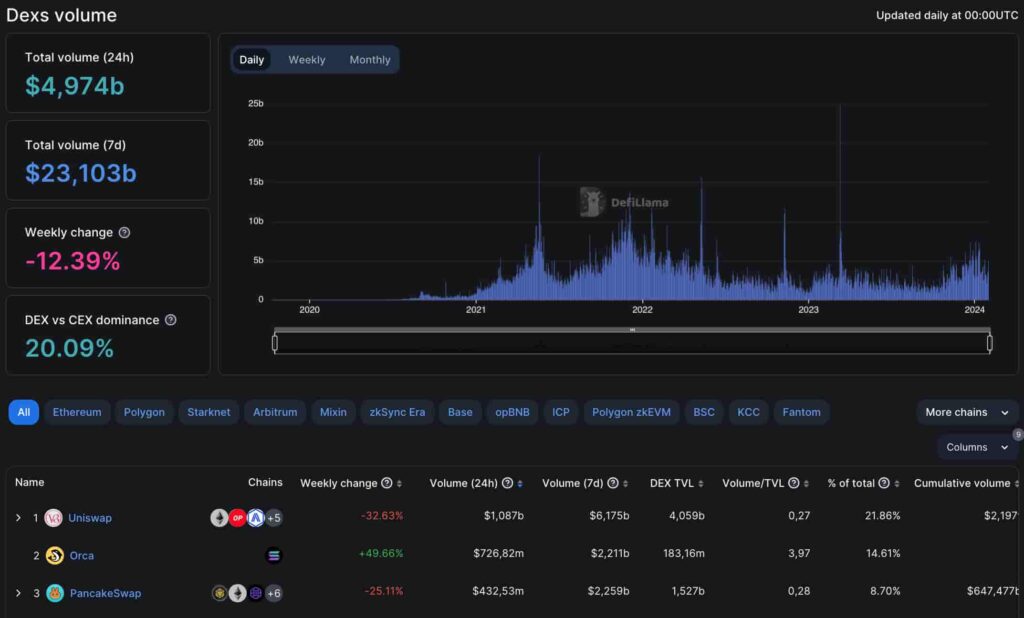

The protagonist in this accomplishment is Orca (ORCA), Solana’s leading decentralized exchange. Essentially, Orca’s weekly DEX volume increased by nearly 50% to $2.211 billion traded on its platform.

This puts ORCA as the third-largest DEX by weekly volume, just behind Uniswap (UNI) and PancakeSwap (CAKE). Each has $6.175 billion and $2.259 billion traded in the last seven days, respectively.

Moreover, Orca dominates the second place in the 24-hour volume among all decentralized exchanges with $726.83 million. This makes the protocol responsible for half of Solana’s entire volume.

DEX volume by protocol. Source: DefiLlama

In this context, Solana was responsible for nearly one-third of the total daily volume of $4.974 billion in DeFi. Meanwhile, ORCA scored close to 10% of the global weekly DEX volume of $23.103 billion.

If Solana and Orca continue to show this steady growth, their native tokens, SOL and ORCA, could benefit further. Ethereum and Uniswap have dominated DeFi for a long time, but two tough competitors now threaten this leadership.

While SOL has experienced a slight downturn of 4.46% in the past 24 hours, bringing its price to $95.35, the broader picture offers a more promising outlook. The token has seen an increase of 10.10% over the past week, indicating a resilient and potentially growing interest in the Solana ecosystem.

This uptick aligns with the increased DEX volume and the platform’s strategic positioning within the DeFi space, as highlighted by the recent surge in activity. Given these dynamics, the current dip could be viewed as a temporary retracement within a broader growth trend.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.