Cryptocurrencies are problem-solving tools, more than volatile speculative assets that can reward investors. Actually, the biggest rewards exist by finding value within a cryptocurrency’s capacity to solve problems and accrue demand.

Some cryptocurrencies have “no-brainer” fundamentals when compared to their market capitalization. Therefore, spotting these asymmetries creates good buying opportunities for capital multiplication.

In this article, Finbold looked at the top 100 cryptocurrencies to find three no-brainer problem-solving projects.

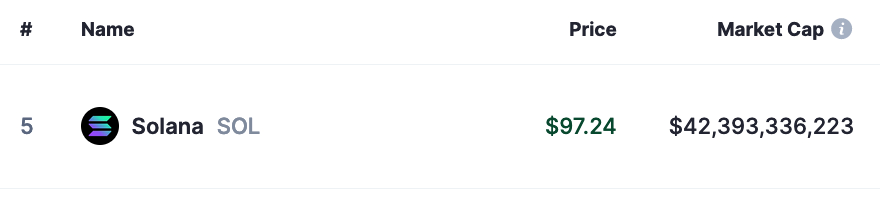

Solana (SOL) price and market cap. Source: CoinMarketCap

Chainlink (LINK)

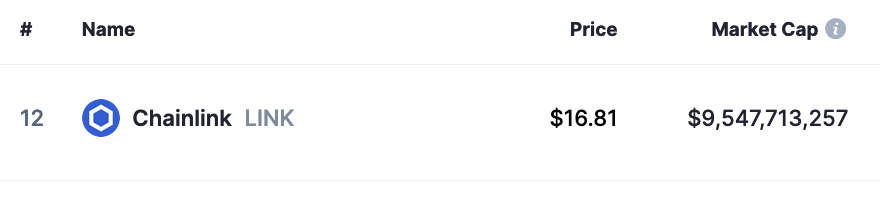

Second, there is Chainlink (LINK), which has a unique proposition of connecting real-world data with the digital realm of cryptocurrencies. The leading Oracle platform could find a huge appeal in the market as traditional finance giants join Web3.

For example, BlackRock sees value in tokenizing real-world assets, which could require Oracle solutions like Chainlink’s. An increased adoption could fuel the demand for LINK, making it a no-brainer cryptocurrency for February and 2024.

Notably, LINK is a $9.53 billion market cap asset, traded at $16.79 by press time.

Chainlink (LINK) price and market cap. Source: CoinMarketCap

Pendle (PENDLE)

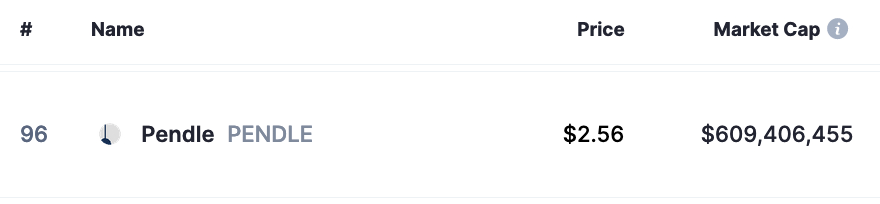

Finally, Pendle (PENDLE) is our third and riskier no-brainer pick, considering it is a relatively new project. According to CoinMarketCap description:

“Pendle is a protocol that enables the tokenization and trading of future yield. With the creation of a novel AMM that supports assets with time decay, Pendle gives users more control over future yield by providing optionality and opportunities for its utilization.”

Pendle (PENDLE) price and market cap. Source: CoinMarketCap

PENDLE is ranked 96th with a $609.40 million capitalization, changing hands by $2.56 at the time of publication. Notably, cryptocurrency whales like Arthur Hayes are betting enthusiastically in this use case, making the token’s price recently skyrocket.

Nevertheless, these cryptocurrencies might expose investors to high short- or mid-term risks despite being no-brainer projects. All three are known for huge supply inflation, resulting in expressive sell-offs by early investors from time to time. It is important to invest cautiously and avoid falling for “FOMO” narratives by these players looking for exit liquidity.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.