With the constant fears of inflation and potential recessions that could significantly influence the job market, production, and large companies’ performance, it is not unusual for investors to look for alternative savings methods, like Bitcoin (BTC).

When the times get rough, potential turmoil and uncertainty drive investors towards more orthodox commodities investments such as gold and silver, Bitcoin emerges as a modern-day alternative to centralized finance, immune to inflation, and a haven for traders.

Federal Reserve Chair Jerome Powell, whose comments on the U.S. economy are thoroughly tracked by the trading community, recently made remarks in his interview with 60 Minutes that may prompt stock traders to turn their attention towards maiden crypto.

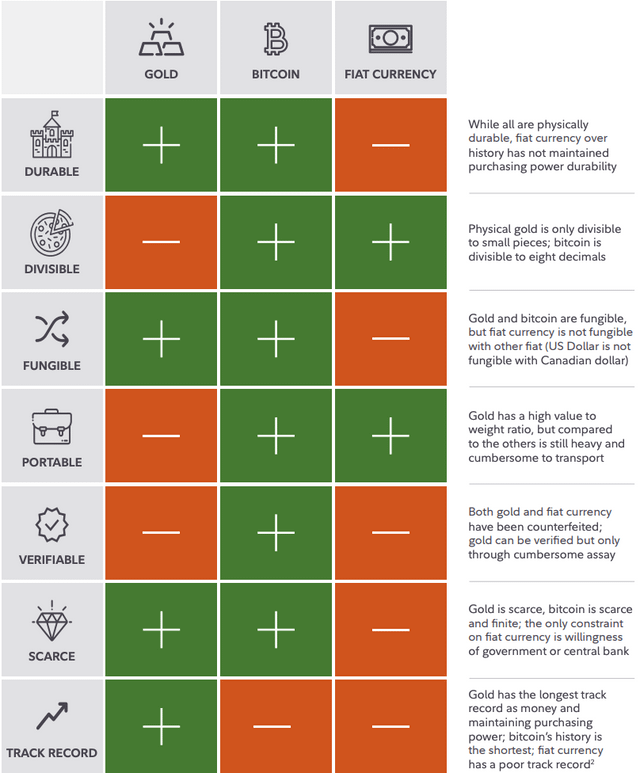

Comparison between gold, Bitcoin, and fiat currency. Source: Fidelity

Looking at the comparison between the most popular options and the arguments behind each one, it is hard not to opt for Bitcoin, as it beats its competitors in most categories. However, it is essential to note that investors should conduct thorough research before allocating their resources.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.