As Bitcoin (BTC) is approaching its next halving event, the hype surrounding it is heating up, and experts have offered insights on what this means for the price of the flagship decentralized finance (DeFi) asset before, during, and after the major reward reduction, as well as by the end of 2024.

Indeed, Bitcoin is about to go through the event that will cut the reward for mining BTC, and that has demonstrated in the previous three occasions the strength to make tectonic shifts in the cryptocurrency market in the months that followed, and many in the crypto community expect no less this time around either.

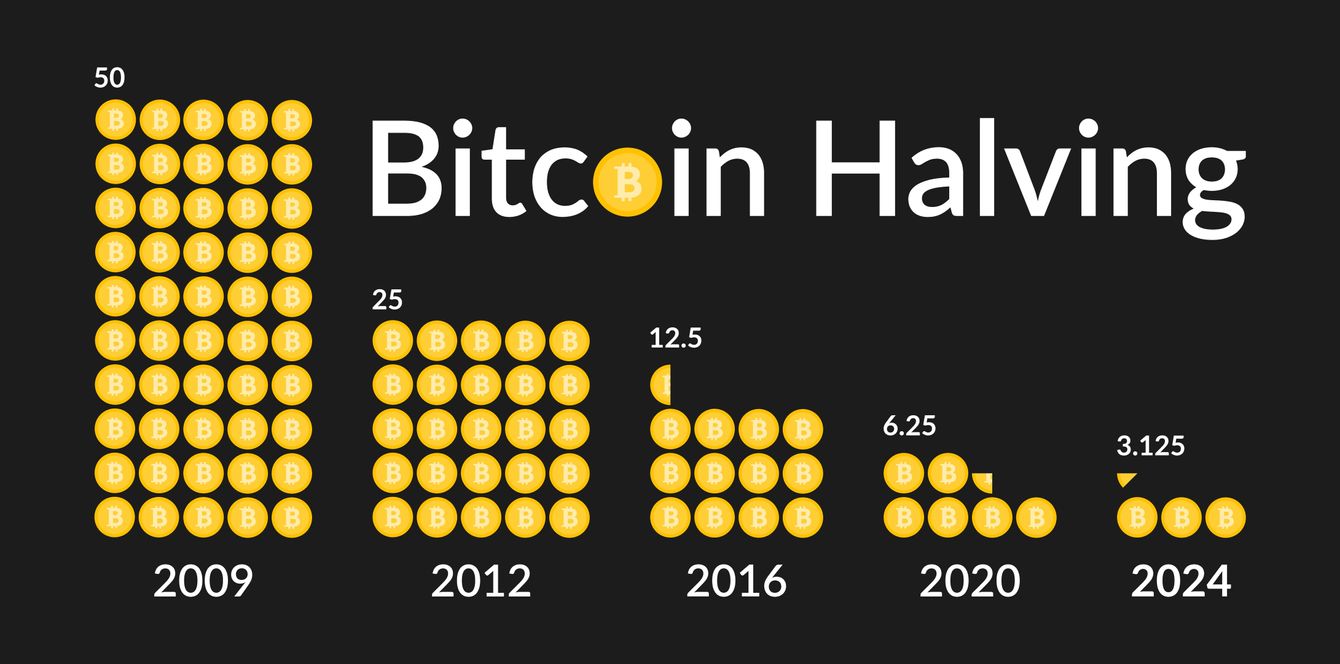

Specifically, during this time, the maiden crypto asset’s algorithm will cut the reward for Bitcoin mining (which currently amounts to 6.25 BTC) in half in an effort to counteract inflation by maintaining scarcity, which takes place roughly every four years or after every 210,000 blocks created on its blockchain.

Bitcoin reward reduction during halvings. Source: Kitco NEWS

$100,000 in the cards?

According to a recent survey by the crypto trading platform Bitget, 84% of respondents believe that, after the halving, Bitcoin will exceed the 2021 bull market all-time high at around $69,000, with 41% of the surveyed investors in Western European countries expecting it to surpass $100,000.

Commenting on the price increase expectations in the context of the Bitcoin halving, Kerel Verwaerde, the CMO at crypto exchange Cryptology.com, told the finance and crypto market news outlet Kitco NEWS that this event traditionally exerted a positive influence on the price of Bitcoin.

However, he voiced his view that “predicting precise price movements post-halving” was a challenging and “speculative” effort, as it would “take several weeks, if not months, to observe significant effects, potentially accompanied by bull traps along the way.”

“The bullish trend is expected to unfold gradually over several months, if not longer. It’s essential to acknowledge that these market cycles are cyclical and not perpetual, but there’s an anticipation that new highs and lows will surpass previous ones.”

At the same time, Lucas Kiely, CIO of digital wealth management platform Yield App, also noted Bitcoin’s performance in previous halvings, sharing his expectation that the largest digital asset by market capitalization could hit the high price mark at $100,000 this year. As he explained:

“If growth rates during previous halving years are anything to go by, and given Bitcoin’s stellar performance over the past couple of months, we will reach that coveted $100K all-time high within 2024.”

Furthermore, Taras Kulyk, founder and CEO of SunnySide Digital, a leading provider of data center hardware and infrastructure servicing the Bitcoin mining industry, shares Kiely’s expectations, seeing Bitcoin between $60,000 and $100,000 by the year’s end, “based on the historical pricing impacts of halvings.”

Bitcoin price analysis

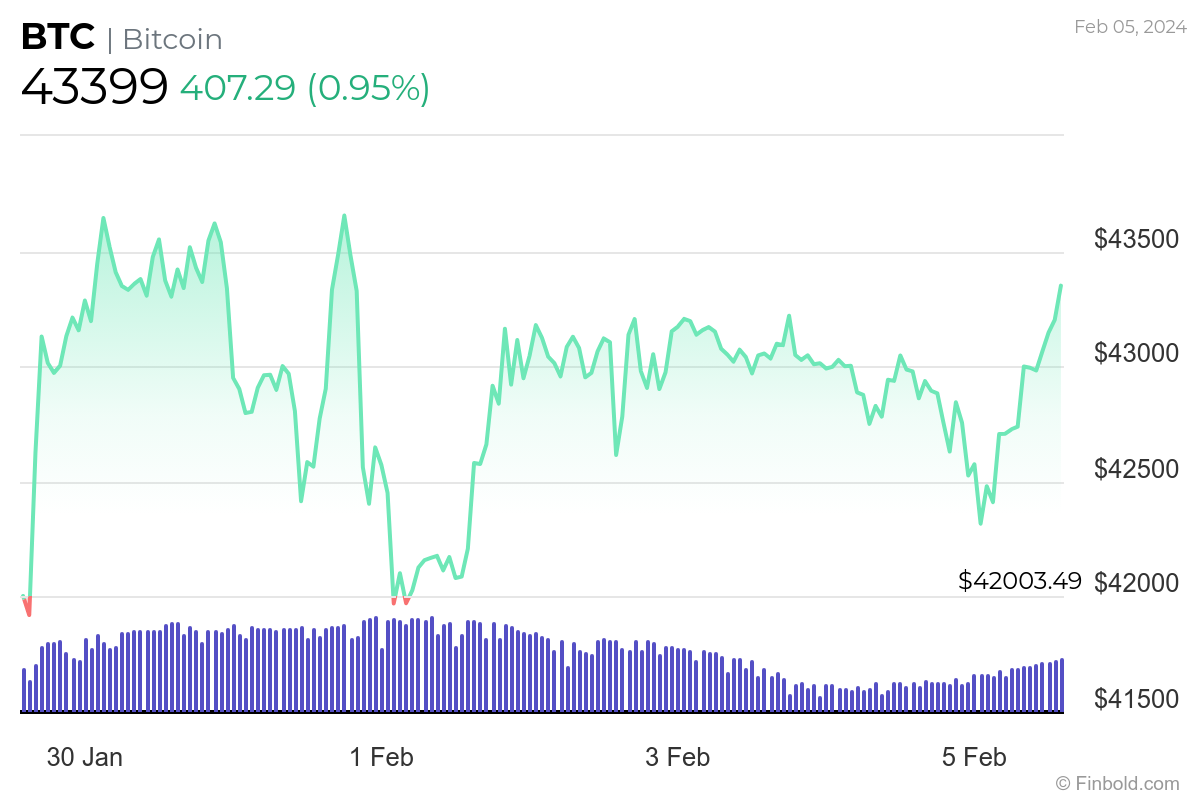

Meanwhile, Bitcoin was at press time changing hands at $43,399, recording an increase of 0.95% in the last 24 hours, as well as advancing 3.13% across the previous seven days, as it moves to offset the modest loss of 0.51% from its monthly chart, as per data on February 5.

Bitcoin 7-day price chart. Source: Finbold

All things considered, Bitcoin might fulfill the expectations and race in the weeks and/or months following its halving event and, although predicting specific figures is a difficult task, could actually surpass the coveted price mark at $100,000 sometime this year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.