The cryptocurrency market is currently experiencing a bullish sentiment driven by Bitcoin (BTC), aiming to retest the $50,000 mark. Notably, Bitcoin has surged by almost 10% in the past week, reaching $47,298 at press time.

Amid this positive market sentiment, several cryptocurrencies display signs of a short squeeze phenomenon in the near term. Notably, a short squeeze occurs when short-sellers face liquidation due to a price increase.

These liquidations compel traders to repurchase the cryptocurrency, causing a price surge, triggering further liquidations, and potentially leading to a significant upward movement.

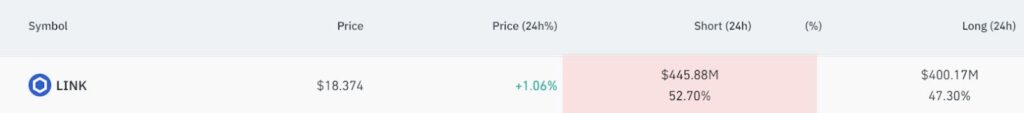

LINK short and long positions. Source: Coinglass

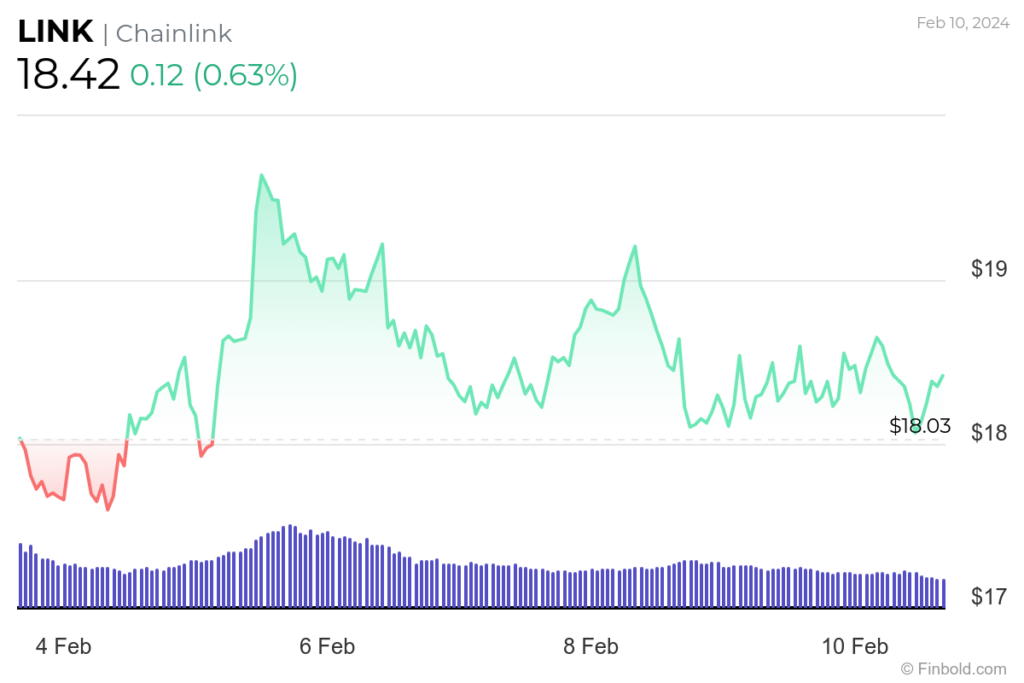

By the time of writing, LINK was trading at $18.42, reflecting a weekly gain of almost 3%.

LINK seven-day price chart. Source: Finbold

Cardano (ADA)

The decentralized finance (DeFi) platform Cardano (ADA) is among cryptocurrencies experiencing increased network activity, aiming to fulfill its role as a potential ‘Ethereum (ETH) killer.’ Recent days have seen heightened investor enthusiasm, particularly as the token reclaimed the $0.50 support zone.

These gains are noteworthy, considering ADA endured a period of price stagnation despite previous recovery attempts following a bounce off the support at around $0.45 in late January.

ADA’s future outlook is closely tied to network activity, especially as it advances into the Voltaire Era, marked by strides in implementing an on-chain governance model. This phase allows ADA holders to influence the network’s direction actively, capturing investor attention.

Projects like the user-friendly Cardano Light Wallet Lace enhance ADA’s appeal, offering solutions for storage and transactions. The Cardano developer community consistently introduces upgrades, ensuring a positive user experience and sustaining investor interest amid increasing smart contract adoption.

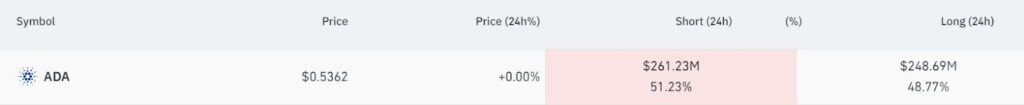

Regarding short squeeze potential, data from Coinglass indicates $261.23 million (51.23%) in short positions opened in the last 24 hours, compared to 48.77% in long positions within the same timeframe.

ADA short and long position. Source: Coinglass

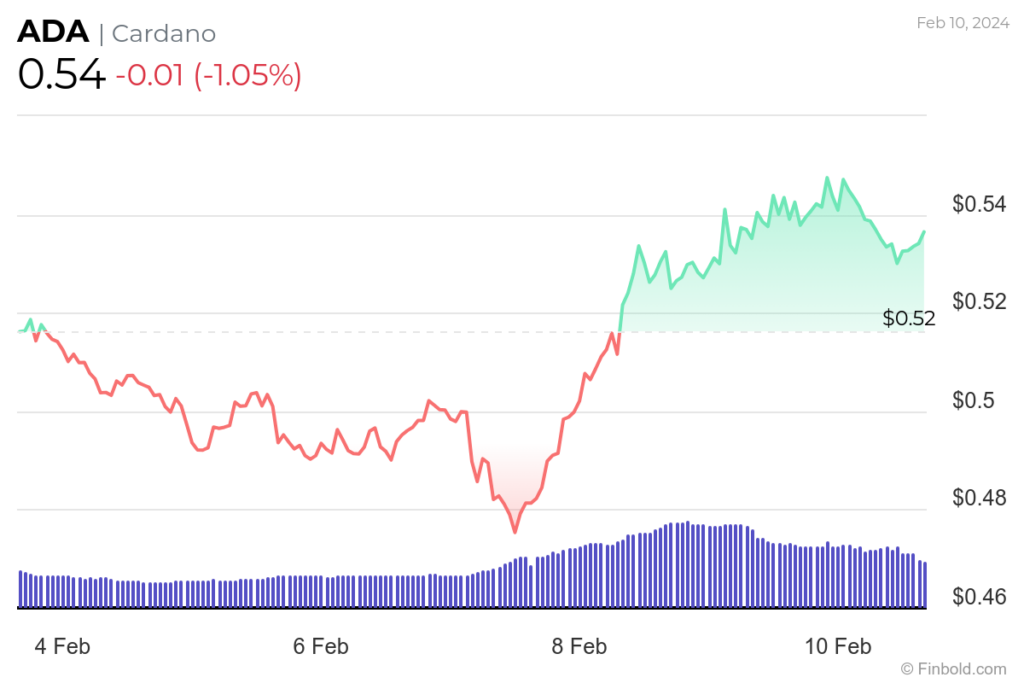

ADA has rallied almost 4% in the past seven days, currently trading at $0.54.

ADA seven-day price chart. Source: Finbold

While these highlighted cryptocurrencies show short-squeeze potential, their susceptibility to the overall market trajectory is worth noting.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.