Bitcoin (BTC) is currently striving for a sustained rally as it seeks a new all-time high following a period of volatility at the beginning of the year. Notably, Bitcoin has set its sights on the $50,000 mark, with market players highlighting the recently approved spot exchange-traded fund (ETF) and the upcoming halving as key catalysts.

In this context, Hunter Horsley, the CEO of the crypto index fund manager Bitwise Invest, suggested that 2024 is poised to unveil the true valuation of Bitcoin in the capital markets.

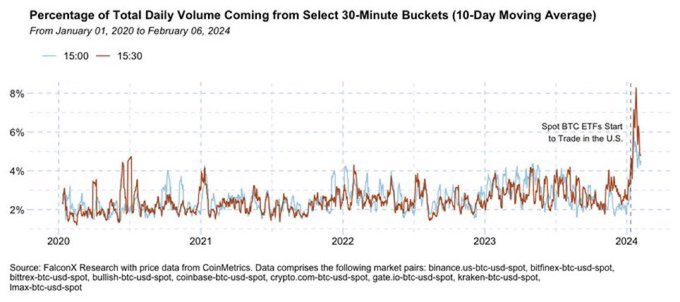

In an X (formerly Twitter) post on February 9, Horsley noted that the advent of Bitcoin ETFs has significantly altered the landscape of Bitcoin pricing, allowing a broader market participation that was previously limited.

Spot Bitcoin ETF trading volume. Source: Falcon X

Indeed, the two experts’ perspectives on the upcoming Bitcoin price trajectory emerge as BTC faces positive sentiments linked to a potential slowdown in outflows from the Grayscale Bitcoin Trust ETF. It’s worth noting that Bitcoin failed to rally after the ETF approval, with analysts pointing to profit-taking from GBTC.

Meanwhile, Bitcoin was trading at $48,130 at press time, showing daily gains of nearly 2%.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.