A mostly bullish sentiment dominates the cryptocurrency market, following Bitcoin’s (BTC) run to above $50,000. This level of greed encourages traders to massively open long positions, which could soon lead to a long squeeze.

Essentially, a long squeeze is the opposite of a short squeeze, happening when long positions are liquidated in series. When traders open longs, it creates liquidity pools to the downside that can become targets for whales and market makers.

If the price suddenly drops, reaching these liquidity pools, bull traders are liquidated and forced to sell their positions, dropping the price even further. For this reason, savvy investors usually argue that we should trade in opposition to the overall sentiment.

BTC 1-week liquidation heatmap on February 13. Source: CoinGlass

However, there is still some remaining liquidity to the upwards, at $50,500, its current price resistance. This means BTC could see another brief run to this zone before retracing to $44,000 in a long squeeze.

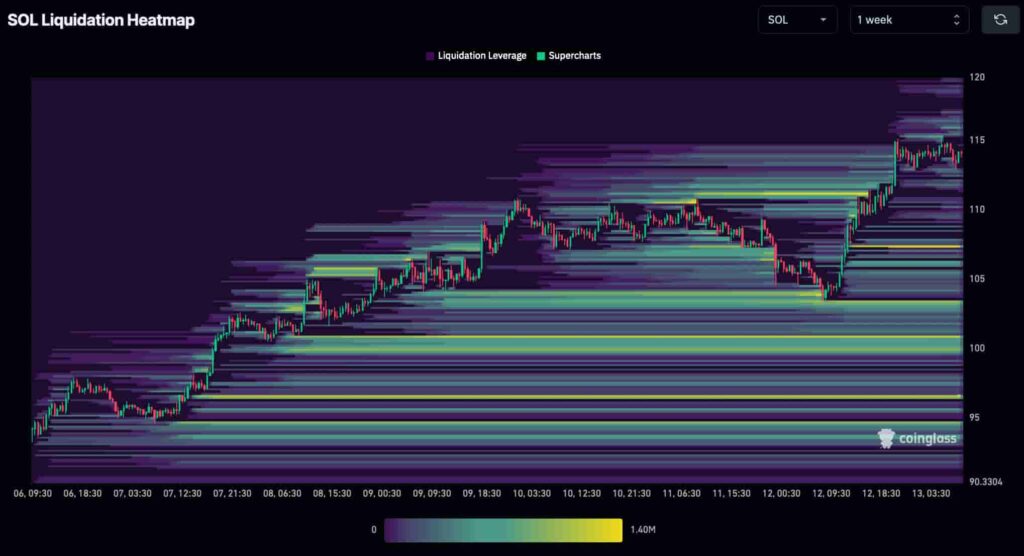

Solana (SOL) could crash below $100 this week

Solana (SOL) is another candidate for a retracement due to a recent increase in long positions. The leading Ethereum (ETH) competitor has outperformed most of the market since 2023, awakening the greed of crypto investors worldwide.

Nevertheless, Solana’s and other altcoins’ heatmap is not as loaded as Bitcoin’s. Therefore, they need BTC to crash first in a long squeeze before following its leadership.

SOL has liquidity pools at $107.40, $103.25, $100.70, and $96.40. All these prices are possible targets in the case of a retracement this week.

SOL 1-week liquidation heatmap on February 13. Source: CoinGlass

In summary, Bitcoin and Solana are trading at $49,900 and $113.70 by press time, respectively. Both cryptocurrencies could fall to as low as $44,000 and $96 if a long squeeze happens under the proper conditions.

Still, the crypto landscape is unpredictable and highly volatile, meaning this scenario can change anytime. Positive news and developments could keep these projects’ strength this week, fueling higher prices instead of lower. Investors must trade cautiously and avoid over-exposure in any direction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.