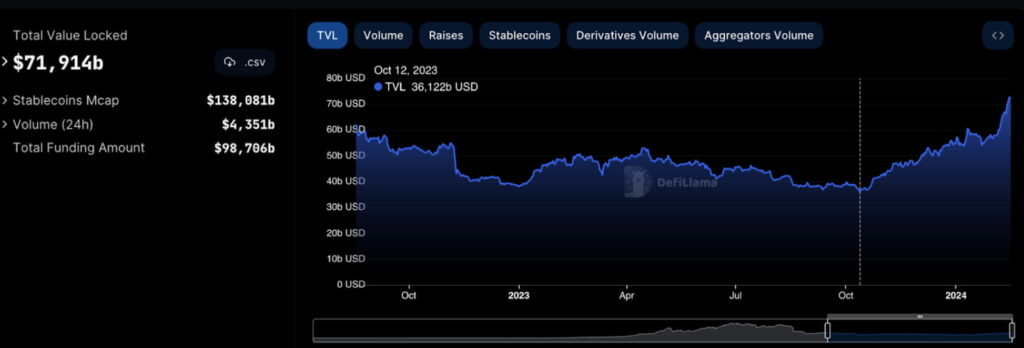

The decentralized finance (DeFi) landscape has been consistently growing since late 2023, after a fall that started in May 2022.

In particular, the total value locked (TVL) in DeFi surged nearly 100% in the past four months. On February 17, TVL reached a 2-year high of $71.914 billion. This is close to a double-up from the local bottom at $36.122 billion on October 12, 2023.

Total Value Locked (TVL) in Decentralized Finance (DeFi). Source: DefiLlama

Part of this growth directly results from a price pump in USD of each locked cryptocurrency inside the protocols. However, another relevant aspect was an increased adoption and organic amount of the funds locked, measured in cryptocurrencies.

Top 10 blockchains in DeFi by TVL. Source: DefiLlama

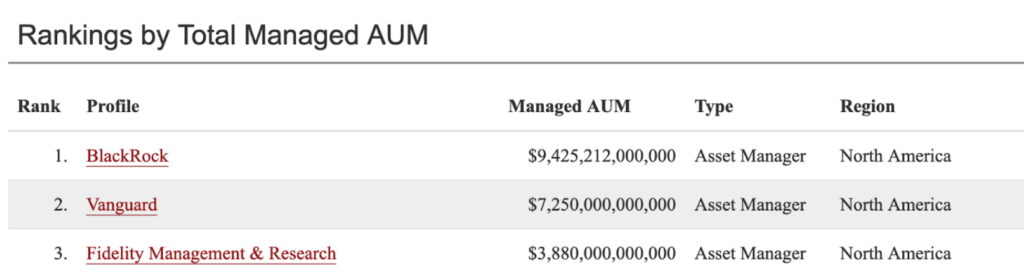

The total value locked in DeFi equals 1% of Vanguard’s AUM

In this context, the funds locked in DeFi now equal nearly 1% of Vanguard’s assets under management (AUM). Vanguard is the world’s second-largest asset manager with $7.25 trillion AUM, just behind BlackRock Inc. (NYSE: BLK).

Rankings by Total Managed AUM. Source: SWF Institute

On a side note, the finance titan shocked the market by refusing to offer the approved Bitcoin ETFs to its brokerage’s customers. On January 11, Vanguard prevented its customers from gaining exposure to BTC through legally approved ETFs.

Still, the anti-Bitcoin institution is also a major shareholder in Bitcoin mining companies, as reported by Finbold.

In conclusion, cryptocurrencies have been growing and conquering different investment profiles over time. Decentralized finance is a promising segment that will likely continue to grow in 2024 and in the future, challenging traditional finance dominance as investors’ preference.

Nevertheless, the ‘Legacy’ also moves towards gaining more share and influence over the crypto market, as warned by Charles Hoskinson. In the meantime, speculators drive the capital flow in and out of each of their systems of choice.