Avalanche (AVAX) has a challenging week ahead with a sell-off of nearly $400 million worth of tokens. This is part of Avalanche’s unlocks from the Genesis distribution, summing up to the usual proof-of-stake (PoS) issuance.

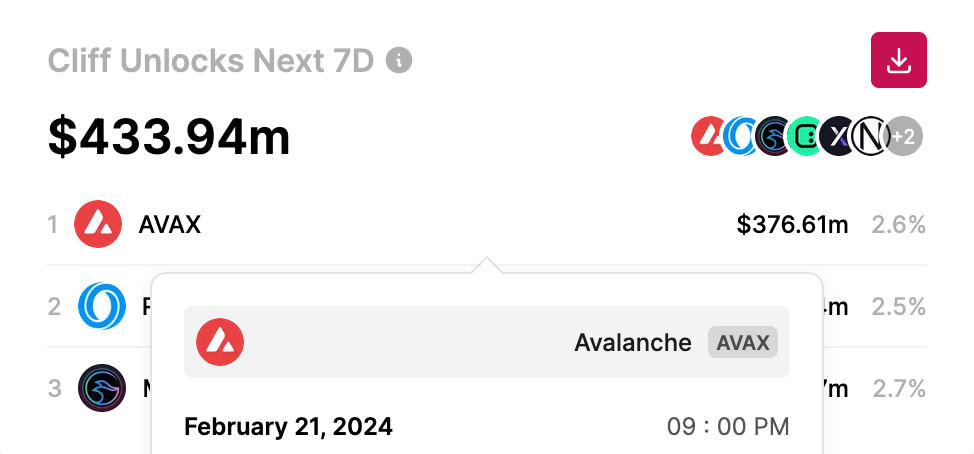

On February 21, vesting contracts will release 9.54 million AVAX worth $376.61 million at press time prices. Finbold retrieved this data from TokenUnlocksApp on February 17.

Notably, Avalanche dominates the platform’s total cliff unlocks of $433.94 million for the next seven days by over 86%.

Cliff unlocks next 7D: Avalanche (AVAX). Source: TokenUnlocksApp

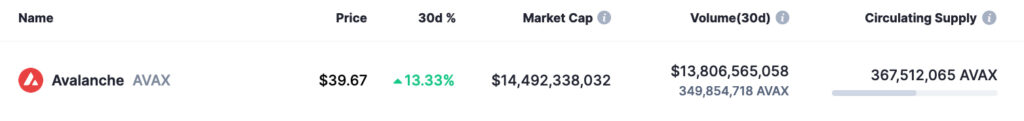

In particular, this massive unlock amounts to 2.6% of Avalanche’s current circulating supply of 367.51 million AVAX. Additionally, it is 27 times larger than the 24-hour exchange volume of $13.80 billion, according to CoinMarketCap.

Avalanche (AVAX) market data. Source: CoinMarketCap

Avalanche token sell-off distribution

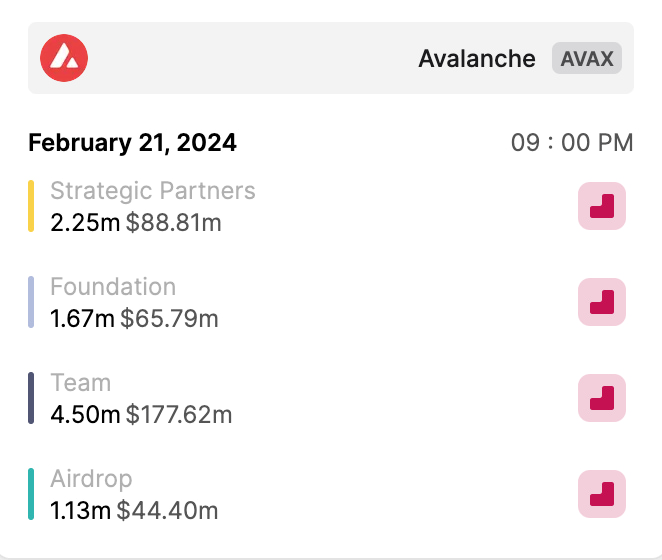

As for the distribution, the ‘Team’ will receive 47% of this year’s half unlock. After February 21, team members will be able to liquidate 4.50 million AVAX, currently worth $177.62 million.

Furthermore, ‘Strategic Partners’ and the ‘Foundation’ will increase their treasury by 2.25 million and 1.67 million AVAX, respectively. This will open for a future sell-off threat of over $154.6 million by these entities alone.

However, the most liquid unlock will be 1.13 million AVAX ($44.40 million) for community airdrop.

February 21 AVAX unlock distribution. Source: TokenUnlocksApp

AVAX price analysis

In the meantime, AVAX is trading at $39.46 per token at the time of publication. Avalanche has seen an impressive surge since October 2023, following DeFi’s surge in funds locked.

Nevertheless, history shows how badly AVAX was impacted in the last token unlock on August 26. Finbold published a similar alert to this one, warning investors of a sell-off worth $101 million for the same 9.54 million AVAX.

Avalanche dropped from $12.88 (August 1) to $10.81 (August 29) and further down to $8.90 on September 23. Essentially, AVAX lost over 30% from August 1 and 18% from a local top three days after the unlock to one month later.

AVAX/USD daily price chart. Source: TradingView (Finbold)

Therefore, Avalanche investors and cryptocurrency traders must speculate with caution in the following days. The crypto market is volatile and unpredictable, moved by whales and market makers looking for the highest possible profits.

In summary, such a massive unlock could trigger a huge sell-off that might impact AVAX’s short-term prices.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.