With the bullish momentum in the larger part of the cryptocurrency sector starting to slow down, Dogecoin (DOGE) is following the general sentiment, but the past several weeks have recorded massive transaction activity for the world-famous dog-themed crypto asset and its network.

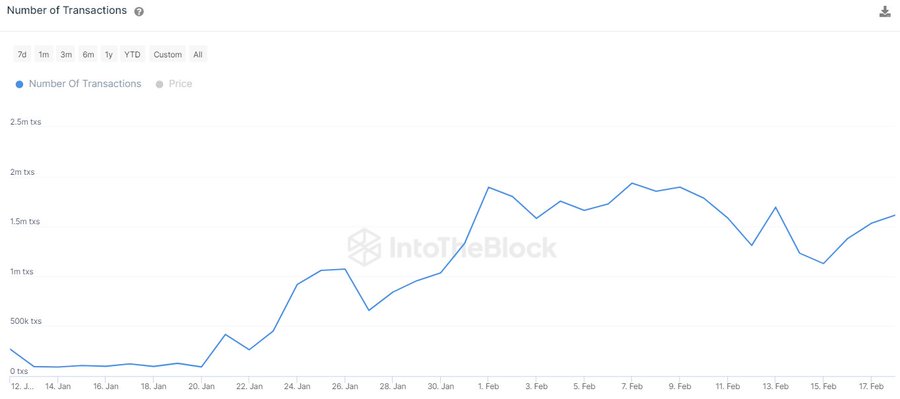

Specifically, since January 30 and throughout the month of February, the DOGE blockchain has been recording more than 1 million transactions per day, according to the data shared by the decentralized finance (DeFi) market intelligence platform IntoTheBlock in an X post on February 19.

Indeed, as the chart demonstrates, transactions in the DOGE ecosystem witnessed a significant uptick that started on January 28 and picked up the pace on January 30, nearing 2 million daily transactions until mid-February, when it dropped below 1.5 million and then recovered again towards February 19.

Number of DOGE transactions. Source: IntoTheBlock

Dogecoin price analysis

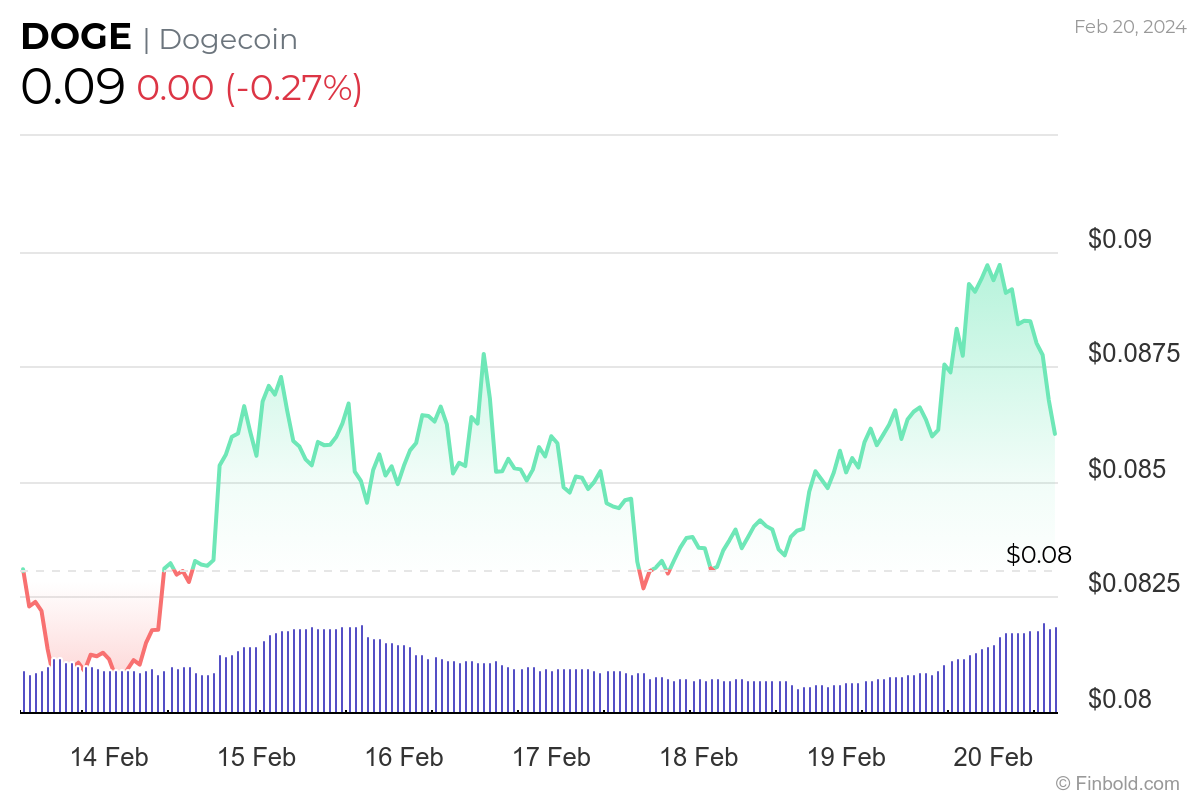

Meanwhile, the currently 10th-largest asset in the crypto sector by market capitalization was at press time changing hands at the price of $0.086, which suggests a 0.27% decline in the last 24 hours but nonetheless is a 4.06% gain across the previous seven days and a 1.14% advance over the month.

Dogecoin 7-day price chart. Source: Finbold

All things considered, a massive uptick in 24-hour transaction volume is often a bullish sign for the involved crypto asset – in this case, Dogecoin – as it indicates intensified use of its network and growing adoption, possibly resulting in increased investor interest, which could send it above $0.15.

On top of that, DOGE is currently holding above the three key bull market indicators backed by the 20-day exponential moving average (EMA), the 50-day EMA, and the 200-day EMA, as well as the moving average convergence divergence (MACD) indicator, all suggesting a ‘buy’ for DOGE.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.