The European Central Bank (ECB) posted a new blog on February 22 criticizing Bitcoin (BTC). Notably, the last time it happened, on November 30, Bitcoin was trading at $17,000, three times less than the current $51,500.

In this recent post, the authors compare the Bitcoin ETFs’ approval in the United States to “the naked emperor’s new clothes.” Citing that Bitcoin has failed as a global decentralized digital currency:

“Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.”

– Ulrich Bindseil and Jürgen Schaaf, writing for the ECB

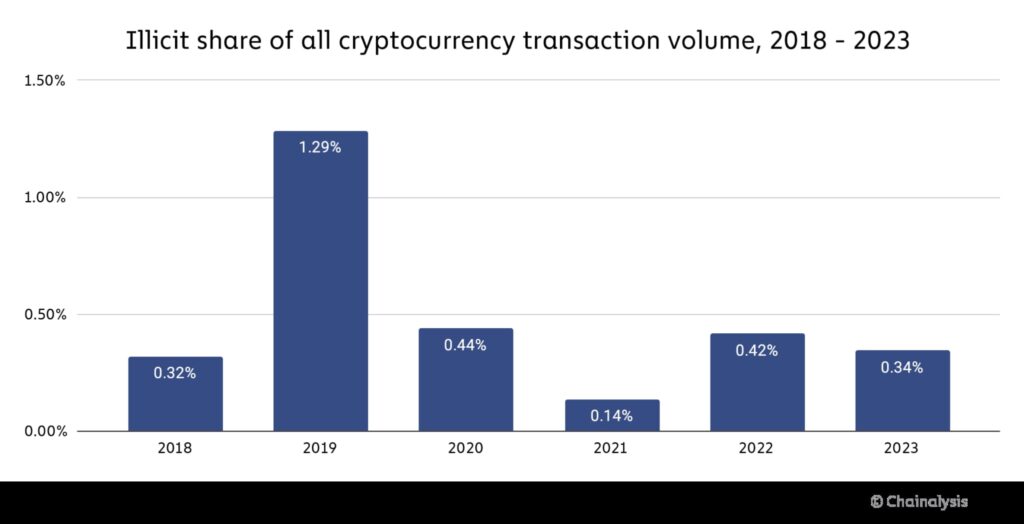

Illicit share of all cryptocurrency transaction volume, 2018 – 2023. Source: Chainalysis

Additionally, the central bank slammed Bitcoin as “not suitable as an investment” and warned on the issues related to mining and proof of work.

Manipulation and speculative bubble

Moreover, the European Central Bank raises a serious accusation of historical price manipulation “and other types of frauds.”

The post mentions scams and fraud perpetrated by centralized entities. Also, allegations of fake centralized exchange volume suggest these issues appear when centralized influence over the cryptocurrency market exists.

A report by Forbes previously explained that more than half of Bitcoin trades were fake in 2022.

“More than half of all reported trading volume is likely to be fake or non-economic. Forbes estimates the global daily bitcoin volume for the industry was $128 billion on June 14. That is 51% less than the $262 billion one would get by taking the sum of self-reported volume from multiple sources.”

– ForbesIn conclusion, the ECB warns that “price level is not an indicator of its sustainability,” calling BTC a speculative bubble. The European Central Bank urges Bitcoin investors to be cautious and centralized regulatory interference.

Interestingly, the latter have not prevented criminal activities, fraud, manipulation, or speculative bubbles in other highly regulated financial markets or fiat currencies over the history of humanity. Instead, facilitated them through lobby, cartelization, and the maintenance of monopolies.