The price of XRP has been under scrutiny for mainly remaining in a consolidated phase amid the ongoing legal battle with the US Securities and Exchange Commission (SEC) and Ripple.

Beyond the potential influence of the legal outcome, the XRP community is considering other fundamental factors, including the prospect of an exchange-traded fund (ETF). This comes after Ripple’s CEO, Brad Garlinghouse, expressed openness to an XRP ETF, which could positively impact the asset’s price.

Meanwhile, as attention remains on the next price trajectory, significant on-chain transactions have emerged, potentially affecting the XRP’s overall trajectory. In particular, on February 25, Whale Alert data revealed the unlocking of 400 million XRP (approximately $217.5 million) from escrow at Ripple.

XRP price analysis chart. Source: TradingView

A major concern highlighted by the analyst is the rejection at key Exponential Moving Averages (EMAs) – EMA10, EMA21, and EMA50 – on a weekly basis. While XRP moved above these levels last week, a rejection this week is considered a failed signal, with Santana noting that such a rejection holds twice the significance of a normal signal.

The trading expert adopted a bearish perspective, suggesting a potential 35% drop in the XRP price. He also issued a cautionary note, indicating that the situation could worsen.

XRP price analysis

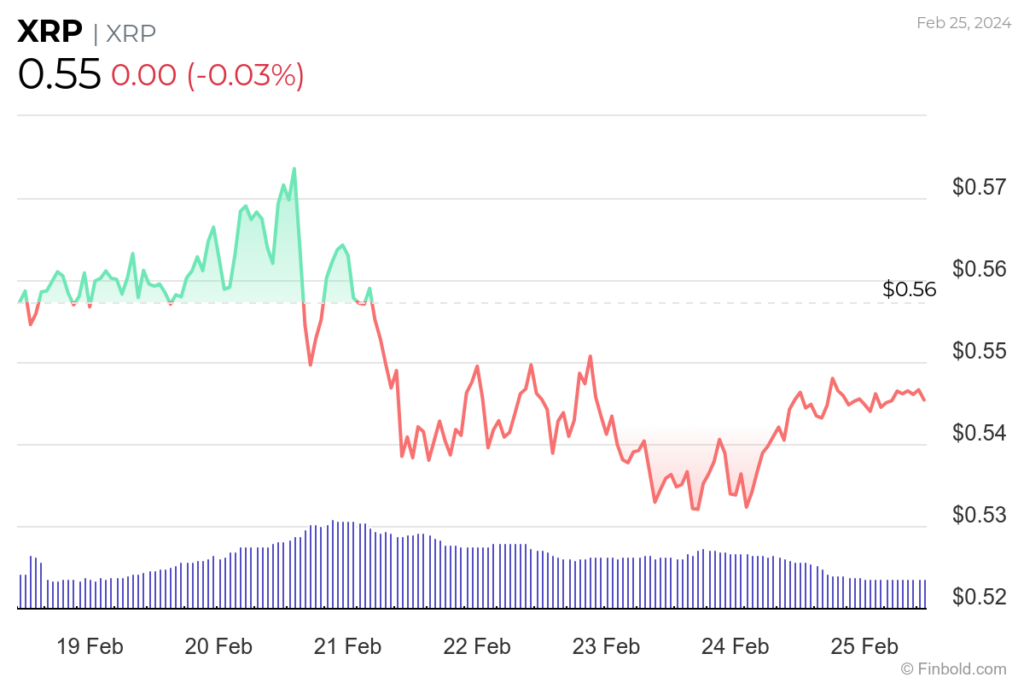

By press time, XRP was trading at $0.55, experiencing daily losses of less than 0.1%. On the weekly chart, XRP has declined by over 2%.

XRP seven-day price chart. Source: Finbold

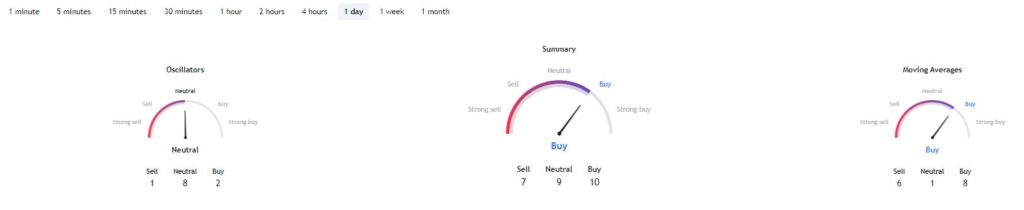

In terms of technical indicators, bullish sentiments prevail for XRP. One-day gauges retrieved from TradingView show a summary aligning with a ‘buy’ sentiment at 10. This sentiment is mirrored in moving averages at 8, while oscillators indicate a ‘neutral’ stance at 8.

XRP technical analysis chart. Source: TradingView

While general market sentiments influence the prospects of XRP, the asset is also likely to be impacted by the outcome of the ongoing legal case. The legal proceedings have progressed beyond the discovery stage, with both parties working on their remedies-related briefs.

Critical upcoming deadlines include March 13, when the SEC is expected to file remedies-related briefs; April 12, the deadline to submit motions opposing remedies proposals; and April 29, the final deadline for remedies submissions.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.