As Bitcoin (BTC) is fast approaching its next halving event, during which the algorithm will cut in half the reward for mining the cryptocurrency, many crypto traders and investors are wondering about the price of the flagship decentralized finance (DeFi) asset once this happens.

With this in mind, Finbold has consulted GPT-4, the fourth iteration of the OpenAI brainchild ChatGPT, to provide insights regarding the price of Bitcoin after the 2024 halving, taking into account the importance of this event, as well as its price movements in the previous halving events.

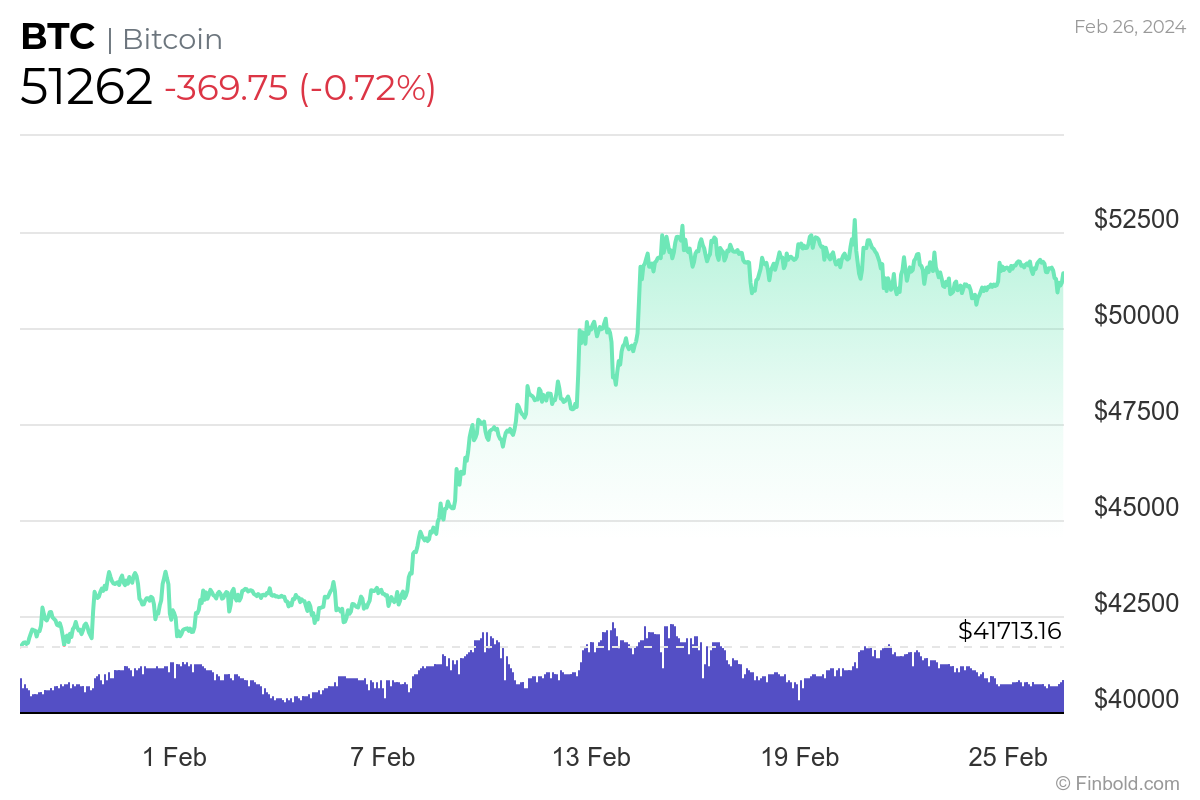

Bitcoin 30-day price chart. Source: Finbold

At the same time, the price of Bitcoin currently stands above all of its exponential moving averages (EMAs), suggesting a ‘strong buy,’ with the support level at around $48,180 and the next nearest resistance in the zone around $53,783, according to the latest data retrieved by Finbold on February 26.

All things considered, Bitcoin might be looking at a significant price increase in the year after the next halving, perhaps even to ChatGPT-4’s target of close to $180,000, as the amount of BTC entering the market will reduce at this point, thus increasing the demand and, with it, the price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.