Over the last several months, the Nigerian naira (NGN) has intensified its years-long downward trend against the United States dollar (USD), recently plummeting to a new record low as the country suffers foreign-currency shortages and despite its central bank’s efforts to counter the problem.

Indeed, the national currency of Africa’s largest economy “is falling to new all-time lows against the US Dollar,” exacerbating the trend that has been steadily happening for nearly a decade, according to the chart data shared by the markets analytics platform Barchart in an X post on February 29.

Nigerian Naira vs. US Dollar. Source: Barchart

NGN/USD trading pair all-time chart. Source: TradingView

Inflation continues to rise

Meanwhile, the recent depressing figures in one of the nation’s worst economic crises in years arrive despite the central bank intervening with dollar sales by selling $100 million last week, bringing total interventions to $300 million in a single week, according to a Reuters report on February 23.

Elsewhere, the currency’s devaluation, leading the inflation to almost a 30-year high of 29.9% and making it the third-worst performer among 150 currencies tracked by Bloomberg, has affected not just the West African nation but also corporations worldwide, including London-based lender Standard Chartered, which has lost millions.

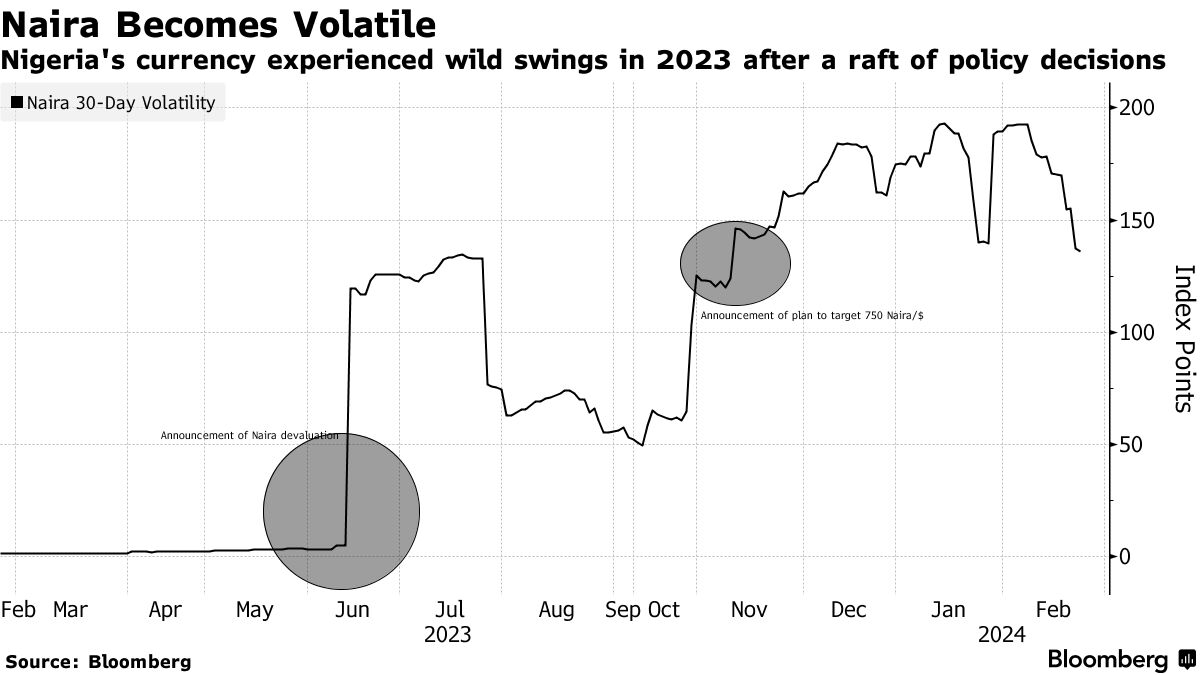

Naira’s volatility in 2023-2024. Source: Bloomberg

Government policies fail

Overall, the challenging situation in Nigeria is partially the result of its government’s policies that limited access to the dollar for importers of certain items in an attempt to stabilize the economy following the 2014 price drop of crude oil, the country’s largest foreign exchange earner.

That said, this course of action led to rampant theft and pipeline vandalism that caused a drop in crude oil sales and contributed to further destabilization of the naira by giving rise to a parallel black market for the dollar, where the currency was trading at a much lower rate.

Interestingly, the naira devaluation has also given rise to cryptocurrency platforms, leading to a government crackdown on these websites and the detainment of two senior executives at crypto trading platform Binance, upon which the crypto exchange halted trading of the naira against Bitcoin (BTC) and Tether (USDT).

Start trading forex and stocks CFDs today with Plus500 – a regulated broker with no commissions

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.