As the luxury watch market has going through a difficult period that saw average prices of the likes of Rolex and Omega’s timepieces decline across the industry in the last 12 months, a glint of sunlight is stirring hopes of its recovery – the cryptocurrency sector’s resurgence.

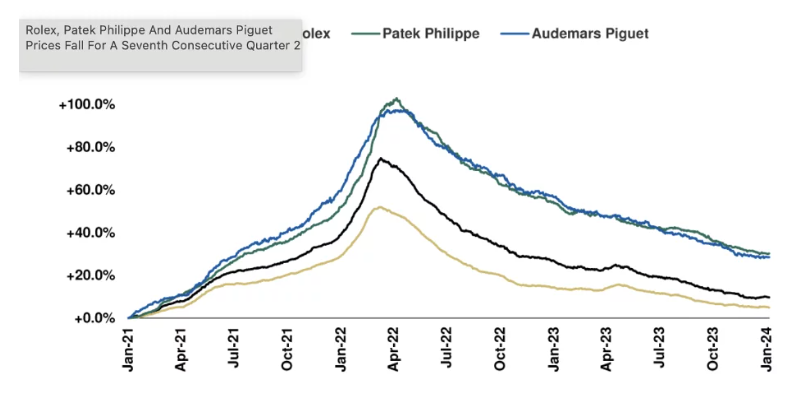

Specifically, late last year, Business Insider’s Joseph Wilkens observed the “great Rolex recession” was taking place, with the luxury watch market itself declining by 37% since its March 2022 peak and still not fully recovered, according to the ‘Luxury Watch Market Report’ shared with Finbold on March 4.

Luxury watch prices since January 2021. Source: New Bond Street Pawnbrokers

Indeed, some of the most famous high-end watches are currently selling well below retail, including Rolex with a 68% difference, Audemars Piguet with 66%, and Patek Philippe at 48%, despite the secondary luxury timepiece market being worth around $25 billion.

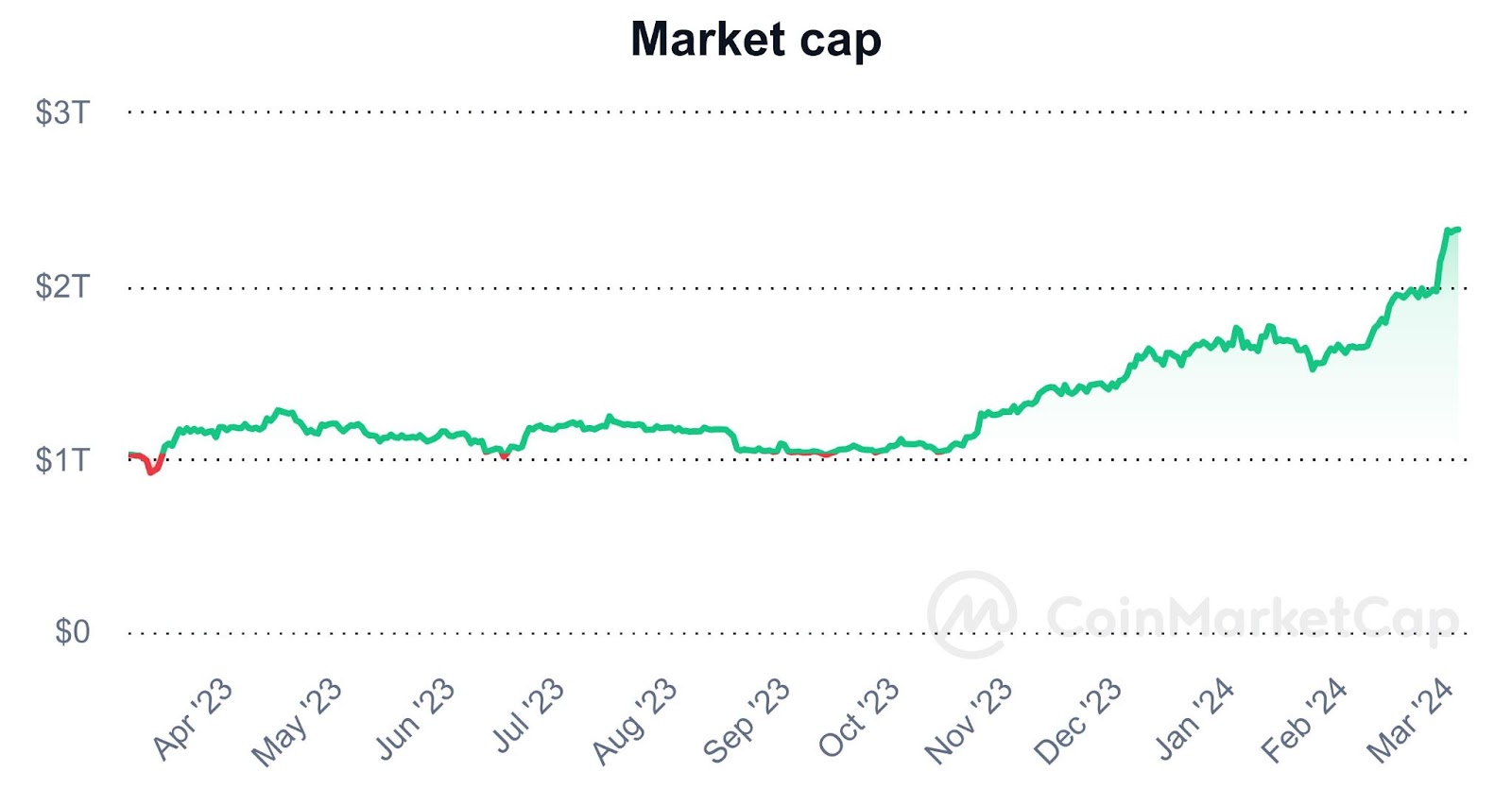

Total crypto market cap 12-month chart. Source: CoinMarketCap

With such massive advances, the wealthy crypto market participants might soon be willing to direct a portion of their new riches into rare timepieces, taking into account the similar trend of some of them becoming new luxury investors in the lead-up to the widespread crypto decline in 2022.

It is also worth noting that the opposite happened during the 2022 crypto crash, which saw an increase in the supply of the most sought-after luxury watches on the second-hand market, putting downward pressure on prices of coveted models, as Finbold reported at the time.

All things considered, in the words of the award-winning watch broker New Bond Street Pawnbrokers, “the return of crypto fortunes could see the supply side of pre-owned luxury watches get a little lighter,” as well as help bring the market back to its former glory and, with it, its prices.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.