In an interesting turn of events, the short interest in MicroStrategy (NASDAQ: MSTR) has reached a massive figure of $3 billion, or 20% of its float, suggesting that the investors doing the short selling are exceptionally bearish on its future price, but also indicating the possibility of a mega short squeeze.

Indeed, despite a recent rally for Bitcoin (BTC), to which MicroStrategy grants indirect exposure, some investors are betting a lot of money against MSTR, with the short bets accounting for about 20% of the company’s total available shares, as observed by Andrew Kang in an X post on March 4.

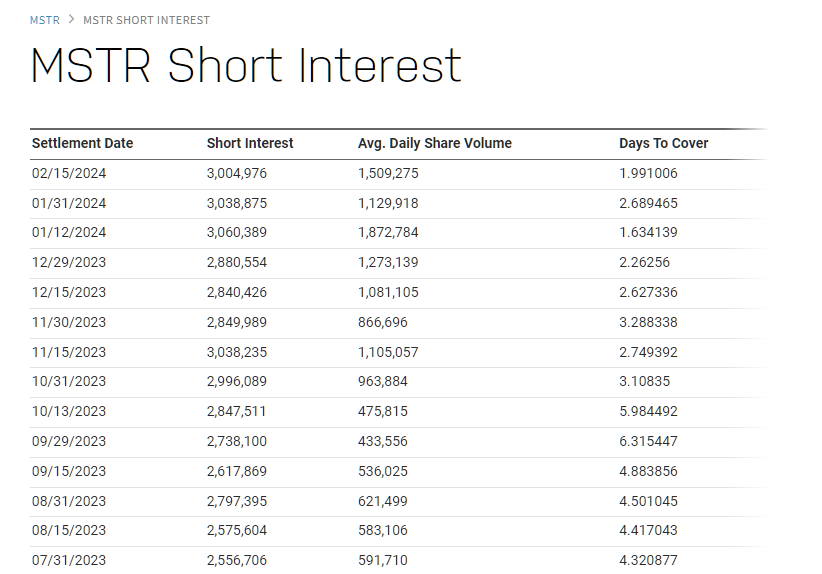

MSTR short interest. Source: Andrew Kang

According to the cryptocurrency entrepreneur, many of these bettors are “angry TradFi boomers trying to capture the premium to [net asset value (NAV)],” but the premium went from 50% before the spot Bitcoin exchange-traded fund (ETF) approval to 13% after it, only to recover to the highs of the current 70%.

MicroStrategy stock price 1-week chart. Source: TradingView

On top of that, it is outperforming 97% of the other 279 stocks in the software industry, as well as making a new 52-week high, which is in line with the performance of the rest of the market, in addition to recording a healthy liquidity of 1.5 million traded shares per day.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.