Pepe (PEPE) is performing as the cryptocurrency market‘s top daily and weekly gainer with a massive surge. However, the meme coin could face a long squeeze this week, leading to a price crash.

In a generalized meme coin euphoria, the biggest gainer of the week, PEPE price increase, has rewarded early investors with millions of dollars. This attracted cryptocurrency traders looking to mirror these inspiring stories, opening many long positions in the derivatives market.

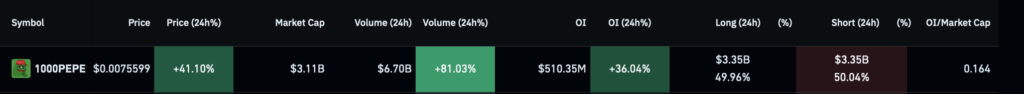

Currently, PEPE has over $510.35 million of open interest for 16.4% of its $3.11 billion market cap. The open interest measures the volume of remaining opened contracts, showing the relevancy of derivatives trading on the memecoin.

1000PEPE derivatives market data. Source: CoinGlass

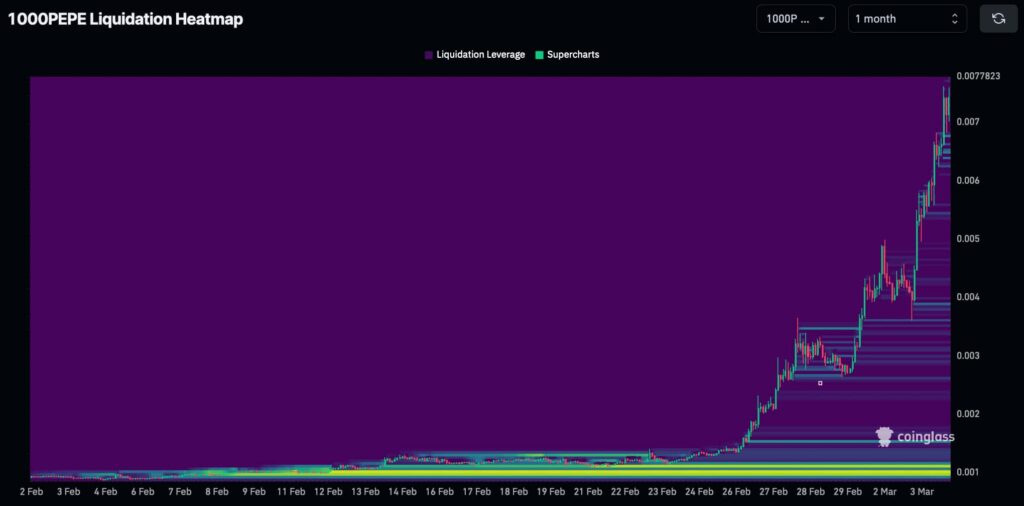

PEPE’s liquidation heatmap suggests an imminent crash

Notably, for each new long position opened, traders deposit collateral assets and agree upon a liquidation price below the current zone.

Therefore, the contract will liquidate the traders’ positions if PEPE drops above these levels, forcing a sell-off of the token, which can drive the price further down in a spiral crash – or a long squeeze.

In particular, CoinGlass’ monthly liquidation heatmap shows meaningful liquidity pools at the $0.000001 price zone. This area could be a magnet for smart traders and market makers trying to capitalize on the hype.

Additionally, there are smaller liquidity pools in previous levels on the way down. Thus, a sudden drop could trigger liquidation events in a cascade. Further, fuelling more liquidations in a long squeeze towards $0.000001, for a potential 85% crash.

1000PEPE liquidation heatmap. Source: CoinGlass

In retrospect, this is a historically common retracement for memecoins after euphoria episodes.

Still, the token could continue upward if enough capital flows into it in the following days. Cryptocurrency traders and memecoin speculators must understand the volatile nature of these digital assets and act cautiously moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.