The cryptocurrency bull market continues to attract fresh capital from investors worldwide, trying to navigate this impressive rally.

In this context, the global crypto open interest reached an all-time high on Sunday at $47.43 billion. Currently, the derivatives market has $44.56 billion in opened trading contracts, according to Coinalyze’s data. These can be made of long or short positions, creating liquidity pools and increasing volatility.

Aggregated open interest global [ALL]. Source: Coinalyze

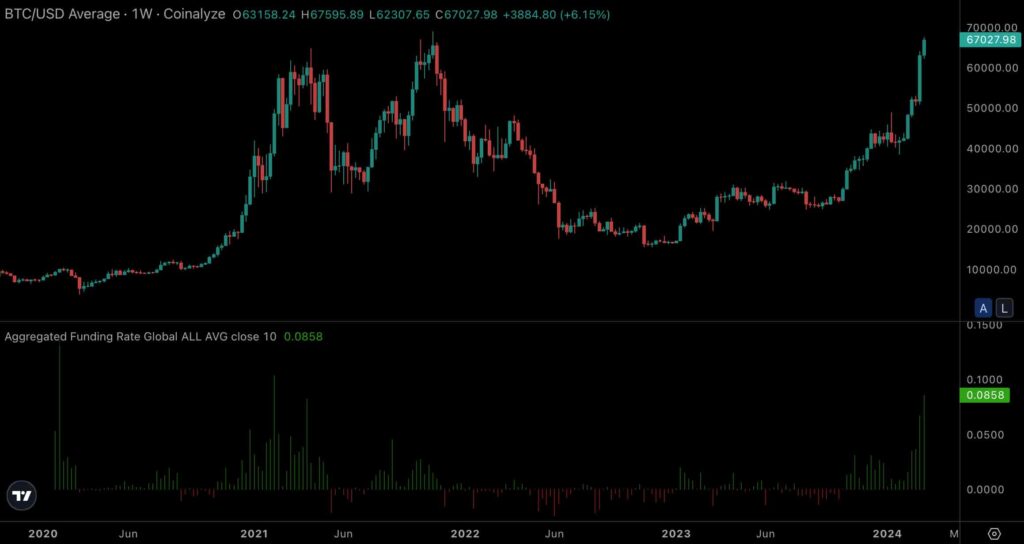

In particular, Coinalyze’s account on X reported an open interest increase superior to $3 billion in the last 24 hours. This remarkable surge follows the Bitcoin (BTC) rally from $61,000 to $67,000, aiming for the leading cryptocurrency’s all-time high at $69,000.

Aggregated funding rate and Bitcoin weekly price chart Source: Coinalyze

Long squeeze liquidations ahead in the crypto market

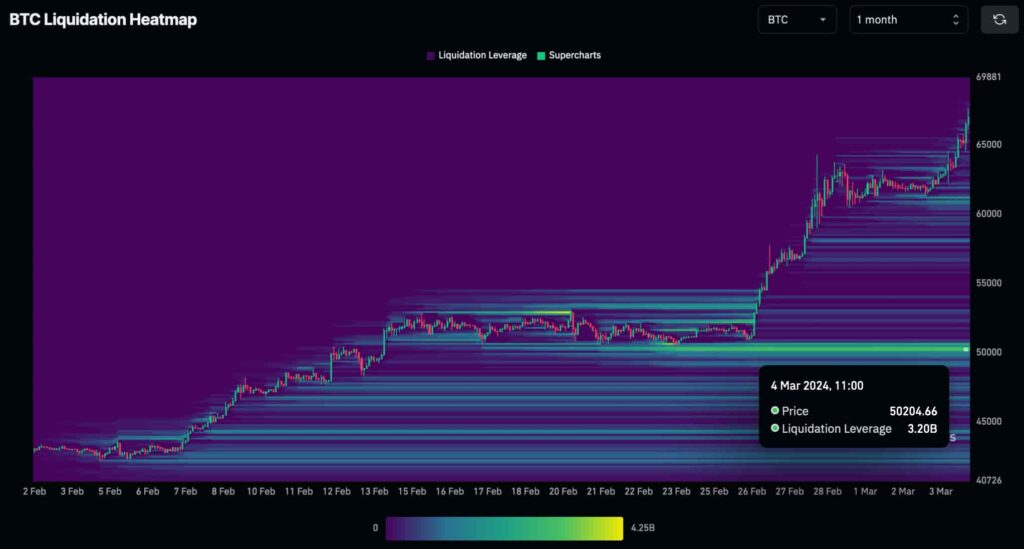

However, this imbalance created massive liquidity pools to the downside, made by traders’ liquidation prices due to opening longs. Therefore, BTC and most cryptocurrencies face the threat of an imminent long squeeze that could trigger a short-term drop.

This scenario is easily observed on CoinGlass’s liquidation heatmap, with over $3 billion long liquidations at $50,000. Moreover, this price zone plays an important psychological resistance, increasing the odds of a retracement seeking these open interest targets.

BTC liquidation heatmap, 1 month. Source: CoinGlass

In summary, the all-time high open interest indicates an increased capital inflow to the crypto market but comes with risks and a high cost. Such an inflow, heavily weighted to long positions, creates imbalances that smart traders and market makers can exploit.

For Bitcoin, this could mean a retracement of around 25% from $67,000 to $50,000. On that note, this would be a historically common correction during bull runs. Thus, investors must trade cautiously and apply proper risk management when speculating with derivatives.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.