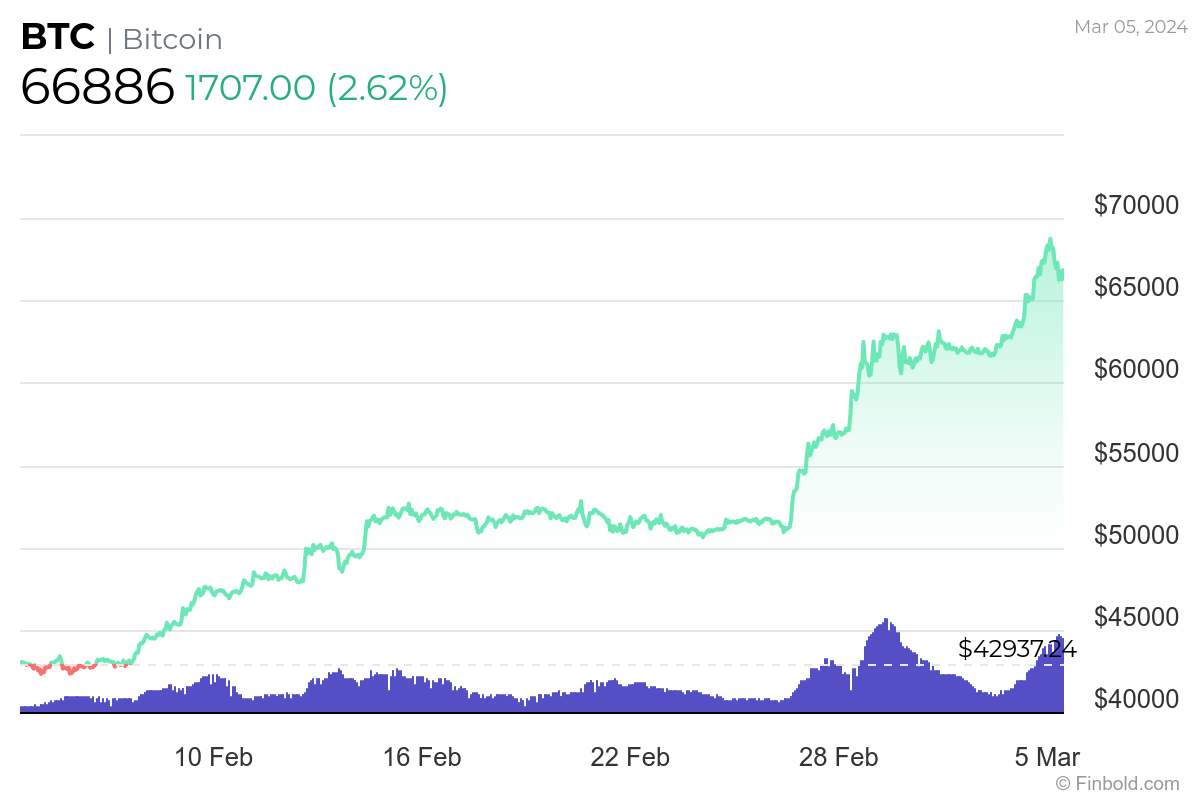

Slightly over a week after the European Central Bank (ECB) experts slammed Bitcoin (BTC) and cryptocurrencies as speculative, worthless, and a tool for criminal activities, warning of its “social dangers,” the flagship decentralized finance (DeFi) asset is still rallying and nearing its all-time high (ATH).

As it happens, ECB’s director general of market infrastructure and payments, Ulrich Bindseil, and Jürgen Schaaf, an adviser for market infrastructure and payments, wrote that the “fair value of Bitcoin is still zero” in a blog post titled “ETF approval for Bitcoin – the naked emperor’s new clothes” on February 22.

In their view, the January approval of spot Bitcoin exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC) did not mean that BTC investments were safe and the “collateral damage” from the recent Bitcoin price boom “will be massive.” As they wrote:

Bitcoin 30-day price chart. Source: Finbold

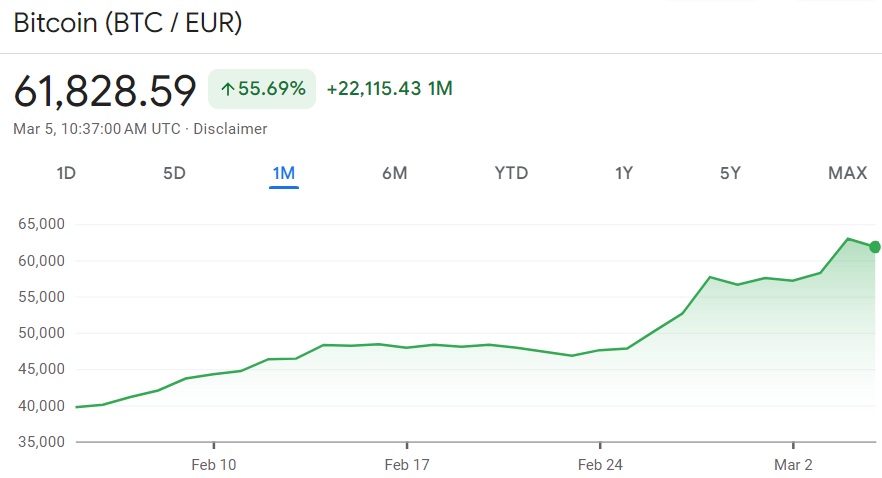

Meanwhile, it is also worth mentioning that, ironically for the ECB, Bitcoin has already hit its all-time high in euros (EUR), as it reached the price of €63,417.67 today and is currently trading at €61,828.59, as per the latest information retrieved on March 5.

Bitcoin price in EUR 30-day price chart. Source: Google Finance

On top of that, the crypto community on social platform X was quick to point out that the son of ECB president Christine Lagarde had invested in crypto assets himself, for which his mother chastised him during the crypto winter back in November 2023 in an ‘I told you so’ manner.

Live view of the son pic.twitter.com/EAliLbWnFs

— Rizzo (@pete_rizzo_) March 4, 2024As a reminder, Lagarde said her son had “ignored me royally” and “lost almost all the money that he had invested” in crypto assets, or specifically “about 60% of it,” as she reiterated her criticism, adding she had a “very low opinion of cryptos,” as Reuters reported on November 24, 2023.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.