Greed, FOMO, and an overall bullish sentiment dominate the cryptocurrency market, following Bitcoin’s (BTC) run to above $70,000. This landscape encourages traders to open long positions, which could lead to a long squeeze.

On that note, a long squeeze is the opposite of a short squeeze, happening when long positions are liquidated in series. When traders open longs, they create liquidity pools to the downside that can become targets for whales and market makers.

If the price crashes, reaching these liquidity pools, these positions are forced to close through liquidation, selling the underlying asset. For this reason, smart investors usually argue that we should trade in opposition to the current dominating sentiment.

DOGE derivatives market data. Source: CoinGlass

This mentioned state is observed on the monthly liquidation heatmap, with massive liquidity pools to the downside. Therefore, DOGE could suffer a long squeeze at any moment if the price starts reaching the smaller liquidity pools.

Such an event would find its crash peak in the $0.08 to $0.076 price range for over 50% losses.

DOGE liquidation heatmap. Source: CoinGlass

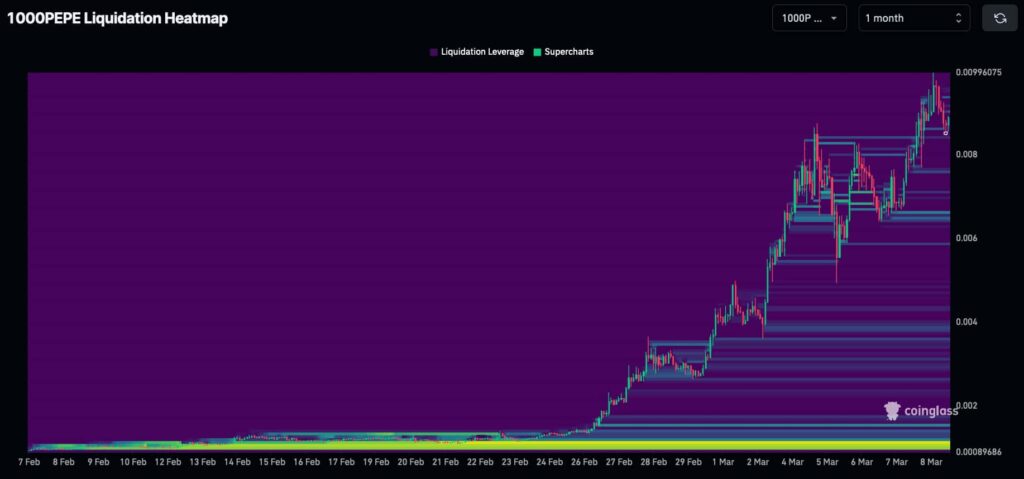

Pepe (PEPE)

Second, Pepe (PEPE) could suffer from a similar but worse fate as Dogecoin. Recently, PEPE shocked the market with an impressive come-back, performing as the week’s top gainer.

Similarly to DOGE, this movement left huge liquidity pools behind, which market makers can now exploit through a long squeeze. Notably, the largest liquidations would start at $0.0000011, an 87.5% crash from $0.0000088 by press time.

1000PEPE liquidation heatmap. Source: CoinGlass

However, the crypto landscape is unpredictable and highly volatile, meaning this scenario can change anytime. Positive news and developments could keep these projects strong next week, fueling higher prices instead of lower ones. Investors must trade cautiously and avoid over-exposure in any direction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.