Throughout its history, Bitcoin (BTC) has many times been deemed a failure and declared dead by critics and skeptics. Interestingly, Bitcoin’s price has increased by $21,000 since the last time it happened in 2024.

From traditional finance investors to business owners, government entities, and other high-influence figures, Bitcoin “has died” 476 times since 2010. This data is from 99Bitcoins’ obituaries.

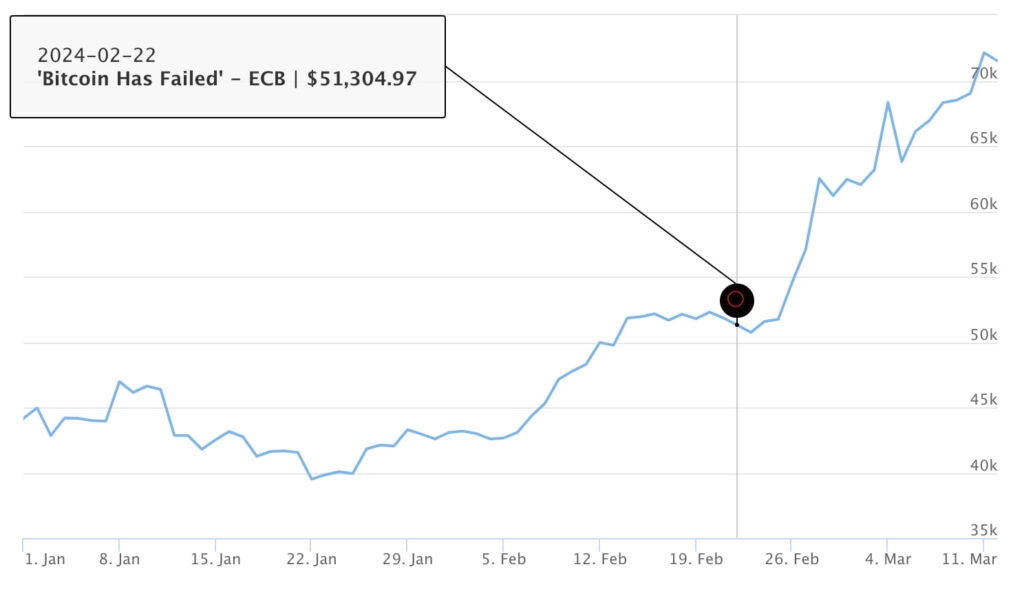

The leading cryptocurrency was declared dead once in 2024. In particular, through a blog article by the European Central Bank (ECB), which said, “Bitcoin has failed.” On this occasion, BTC was trading at $51,304, now up over 40% at $73,000 by press time.

Bitcoin obituaries in 2024. Source: 99Bitcoins

Previous times when Bitcoin was declared dead

Previously, 2023 was a year of eight death declarations to Bitcoin, with the last one happening on December 27. At that time, Forbes stated that BlackRock would “completely destroy Bitcoin.”

Notably, BlackRock Inc (NYSE: BLK) has constantly invested in the leading cryptocurrency ecosystem. Currently, the financial giant owns the largest Bitcoin spot ETF in the market and is a major shareholder in all United States mining companies.

Bitcoin obituaries in 2023. Source: 99Bitcoins

It is worth noting that 99Bitcoins describes Bitcoin deaths and obituaries as follows:

The content itself (not just the headline) must be explicit about the fact that Bitcoin is or will be worthless (no “maybe” or “could”).The content was produced by a person with a notable following or a site with substantial traffic.Bitcoin criticisms and points of failure

Despite the hyperbolic nature of a “Bitcoin death” statement, many of its obituaries contain thoughtful and valid criticisms.

Unfortunately, instead of considering the fundamental thesis behind its occurrence, the leading cryptocurrency advocates create memes and throw personal attacks against its critics. This is a cultural inheritance from a movement called “toxic maximalism.”

For example, it is true that BlackRock’s endeavor in the cryptocurrency world comes with risks of higher centralization. Additionally, the network itself has shown signals of a centralization trend over time, often overlooked by the so-called “Bitcoin maximalists.”

Also, the ECB’s failure statement in 2024 points out the failure of Bitcoin as a currency or a means of payment, which is already mostly accepted by its most vocal supporters, like Michael Saylor. On March 11, MicroStrategy’s (NASDAQ: MSTR) former CEO said, “[Bitcoin] doesn’t have to be a currency,” in an interview for CNBC.

#Bitcoin is Digital Property. It is superior to other investments such as Gold, Equity, or Real Estate because it is digital, available, global, ethical, & useful to millions of companies and billions of people. pic.twitter.com/738dblB0Zt

— Michael Saylor⚡️ (@saylor) March 11, 2024Therefore, investors must be open to deeply studying and understanding Bitcoin or other assets in which they are investing. Bitcoin may not “die,” but it certainly has points of failure and potential improvements.