Ripple is a known institution that controls a significant amount of XRP’s token supply and regularly sells hundreds of millions of tokens on a monthly basis.

In particular, Ripple unlocked 1 billion tokens in March and reserved 200 million of these new tokens to sell. The company locked the remaining 800 million in new escrow contracts for July and August 2027.

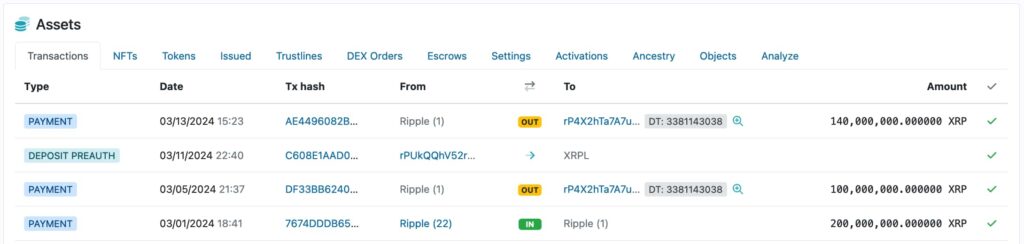

However, the institution had already sold all 200 million plus 40 million XRP of its previous reserve by March 13. This is a huge and unusual sell-off in less than 15 days, which raises concerns and questions.

‘Ripple 1’ account summary: Transactions. Source: XRPScan

What’s next for XRP following Ripple’s sell-offs

Notably, the 240 million XRP is currently worth over $150 million, with the token trading at $0.63. This represents nearly 0.45% of XRP’s $34.10 billion market cap.

Economically, Ripple’s sell-offs can significantly impact the token’s price by realizing the effects of supply inflation. Each dump creates selling pressure that erases buying orders at lower prices of order books in the chosen crypto exchanges.

This effect is evidenced in the daily chart, with price crashes on each Ripple’s selling day.

XRP/USD daily chart. Source: TradingView (Finbold)

On the other hand, XRP might have a clear ascending path for the rest of March if Ripple stops dumping. Nevertheless, erasing this month’s reserves is not a conclusive guarantee of a halt in its March activity since the company still has hundreds of millions of XRP in liquid accounts under its control that can be sold at any moment, as proven in the past few months.

While the institution remains one of the largest XRP whales, cryptocurrency investors must closely monitor its activities to prevent surprises due to massive financial movements.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.