The general cryptocurrency market is predominantly trading in the green zone, led by Bitcoin (BTC), which has hit a new all-time high, while altcoins are also rallying.

Looking ahead, the majority of market consensus posits that the bull run is likely to continue throughout 2024, supported by factors such as the upcoming Bitcoin halving and the potential rollout of a spot Ethereum exchange-traded fund (ETF).

These elements are likely to trigger a capital inflow into the market, with several assets positioned to potentially record significant growth in their capitalization multiple times over.

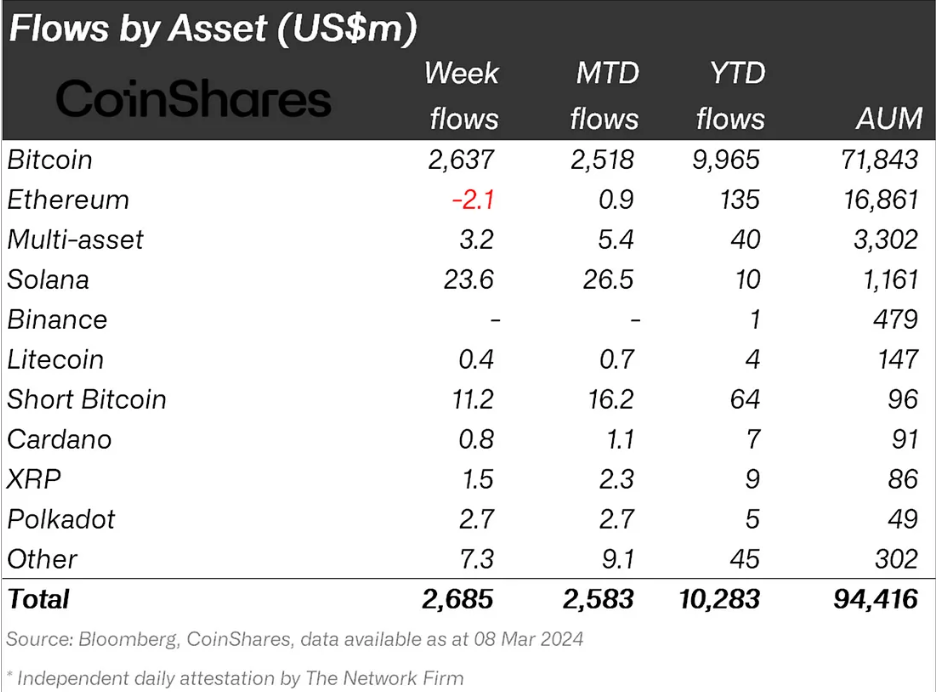

Digital assets capital flow YTD. Source: CoinShares

Furthermore, according to Token Terminal, Polkadot appears undervalued based on its price-to-sales (P/S) ratio. Polkadot’s lower P/S ratio indicates potential undervaluation compared to historical averages, signaling potential to rally in the future.

DOT daily market cap vs. daily P/S ratio. Source: Token Terminal

Chainlink (LINK)

Chainlink (LINK) operates as a decentralized oracle network, facilitating secure and dependable data feeds for smart contracts. This capability enables smart contracts to interact with real-world data, unlocking a multitude of possibilities in areas such as DeFi and supply chain management.

Given this foundation, LINK has the potential to see a fivefold increase in market capitalization.

Notably, data oracles by Chainlink have the potential to drive massive interest in the asset. For example, BlackRock Inc. (NYSE: BLK), the world’s largest investment management firm, has acknowledged the significant value of tokenization for the market. This suggests that data oracles capable of processing off-chain information from the on-chain space may benefit from this perceived value.

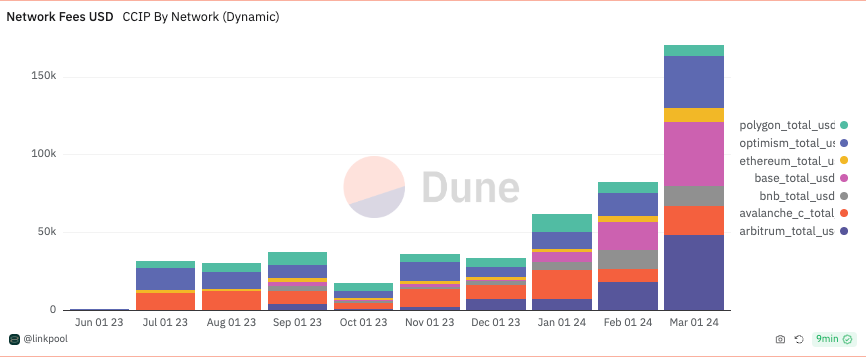

Furthermore, revenue for Chainlink’s Cross-Chain Interoperability Protocol (CCIP) has surged by 180% over the past two months, driven by the rising adoption of the multichain bridging platform. Fee revenue for CCIP has escalated from approximately $61,000 total for January to over $171,000 in just the first two weeks of March.

Cross-Chain Interoperability Protocol revenue. Source: Dune

With a current market cap of $11.47, a fivefold growth could propel its value to nearly $60 million. This sentiment is supported by Chainlink’s increasing adoption as highlighted by the CCIP revenue. At the moment, LINK is changing hands at $19.30 with the token targeting the $20 resistance zone.

Solana (SOL)

Solana (SOL) continues to soar as one of the top-performing cryptocurrencies, aiming for a new all-time high.

Marketed as a faster and cheaper alternative to Ethereum, the blockchain began to gain traction in November last year, an event that was fueled by various factors: developers appreciated its speed and cost-efficiency, prominent brands like Visa (NYSE: V) expressed interest in its blockchain, and meme coin traders were attracted to new projects such as Bonk (BONK) launched on the platform.

While Solana is trading below its previous all-time high of nearly $260, the decentralized finance token has seen its market cap soar to a new high of almost $90 billion amidst the current rally.

Additionally, with growing interest in the Saga smartphone, Solana appears poised for a sustained rally that could potentially drive its market cap to nearly $450 billion by 2024.

By press time, the asset is trading at $196 with 24-hour gains of over 15%.

SOL seven-day price chart. Source: Finbold

Overall, while the mentioned cryptocurrencies exhibit potential for a surge in their market cap, they remain susceptible to market swings.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.