The cryptocurrency market has retraced in the past few days, losing over $250 billion of total capitalization since March 14. This movement created potentially good entry points for cryptocurrencies with a strong long-term momentum, acting as a buy signal.

Notably, the market remains strong despite the recent significant price correction, which is natural and expected in bull rallies. Finbold gathered the following data from CoinGlass on March 17.

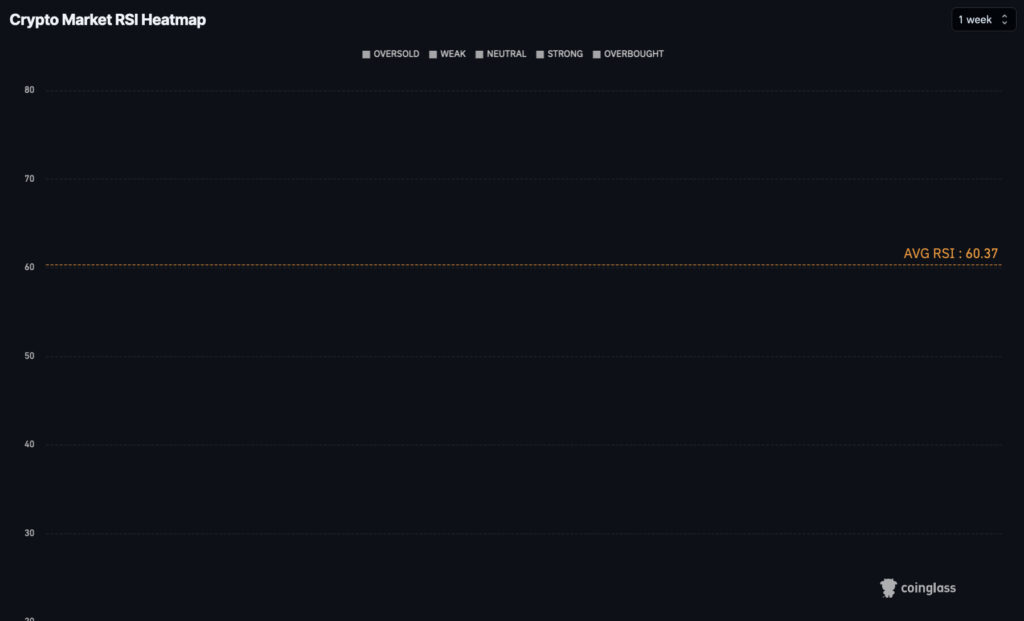

Looking at the weekly Relative Strength Index (RSI), we see an average of 60.37, in the “Strong” zone. Therefore, it is an important technical indicator of how most cryptocurrencies should still perform well in larger time frames.

Crypto market RSI weekly heatmap. Source: CoingGlass

In the search for a buy signal this week, Finbold looked at neutral RSI cryptocurrencies in the daily time frame. Yet, only for the ones holding strong above the weekly average. Essentially, we want digital assets that went through a sharp short-term correction while still showing long-term strength.

Cardano (ADA) has a strong buy signal

First, Cardano (ADA) is a solid layer-1 blockchain project that experienced a relevant correction in the past few days. In particular, ADA lost 7.63% of its value in the last 24 hours, dropping its daily RSI below neutral-50.

However, Cardano is still holding strong above the average weekly RSI among all cryptocurrencies. In this context, ADA is a potentially good buy at $0.67, if the market continues to grow and Cardano fundamentals remain positive.

Crypto market RSI daily heatmap, ADA. Source: CoingGlass

Polkadot (DOT) entry point shows strength

Second, Polkadot (DOT) is deemed one of the first layer-0 blockchains in a similar situation to Cardano on its RSI.

The native token, DOT, has seen a price correction in the past few days moving its daily RSI right to the edge of neutrality, at 51.95. In the last 24 hours, DOT lost 6.4% but is set to retake short-term strength under proper favorable conditions.

Polkadot still shows a strong weekly Relative Strength Index of 67.23, suggesting long-term continuation.

Crypto market RSI daily heatmap, DOT. Source: CoingGlass

Interestingly, there are more cryptocurrencies in a similar situation to these two. Savvy investors should look for solid fundamentals, a strong long-term perspective, and relevant short-term corrections to find good buy signals in the market.

Nevertheless, cryptocurrencies are highly volatile and unpredictable assets, with no guarantees of positive investment returns. Remaining cautious is essential to avoid significant losses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.