The cryptocurrency market turned red in the past few days with the largest losses happening in the last 24 hours. This retracement came amid concerns about what some investors suggest are signals of crypto reaching a local top.

In particular, over $230 billion vanished from crypto’s total market cap amid over $650 million in liquidations.

First, TradingView’s Cryptocap 4-hour chart index shows the market has lost $233.33 billion of capitalization in 24 hours. The total market value dropped from $2.508 trillion to as low as $2.275 trillion by press time.

4-hour charts: Total crypto market cap index and BTC market cap. Source: TradingView (Finbold)

Over $655 million crypto liquidations in 24 hours

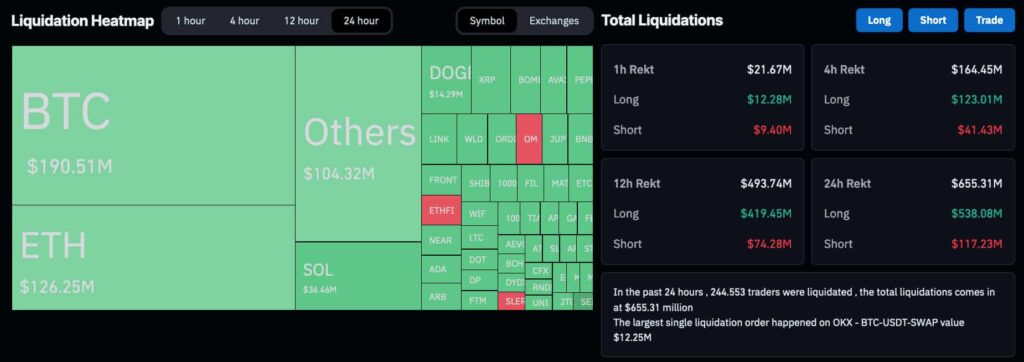

In the meantime, the crash liquidated more than 244,000 cryptocurrency traders in the past 24 hours, according to CoinGlass data. Over $655.31 million worth of liquidations registered the bloodbath traders experienced.

Interestingly, over $538 million were in long positions, causing a long squeeze Finbold has been warning about since early March.

Liquidation heatmap in 24 hours. Source: CoinGlass

Moreover, nearly $500 million out of the $655 million happened in the past 12 hours, with $419 million of them also from longs.

Expert raises concerns for crypto ‘top signals’

In this context, investors speculate whether cryptocurrencies have finally reached a local top after months of a bull rally.

The meme coin boom could have been one of these “top signals,” as reported by Finbold during the weekend. However, other well-known investors and finance experts have revealed similar concerns as the market crashed.

For example, Scott Melker says he can now spot relevant “top signals” that he usually looks for when not under high emotions like the Fear of Missing Out (FOMO). Melker cites the meme coin boom as a signal but also overbought altcoins and bearish divergences in multiple technical indicators.

I have some concerns. Fundamentally, with the ETF interest and the cycle ramping up, I want to believe that we go much, much higher. However… most of the top signals I would normally look for when I am not FOMOing are present – meme coins going insane, huge run on alts to…

— The Wolf Of All Streets (@scottmelker) March 18, 2024In conclusion, the market could have reached a local top despite the Bitcoin ETFs’ increased popularity. Meanwhile, Scott Melker and other investors believe retail is yet not paying attention to the “top signals” as they should.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.