A sentiment shift took place in the cryptocurrency market, pivoting from mostly bullish to mostly bearish in a few days. A $230 billion crash in 24 hours liquidated over 240,000 traders in more than $500 million long positions.

In this context, cryptocurrencies saw a relevant increase in the volume of short positions, creating imbalances that now threaten a short squeeze. If the open interest remains dominated by Bitcoin short-sellers, they could be the next victims of massive liquidations.

Nevertheless, such a state can create opportunities for savvy traders who know where to look. For this reason, Finbold turned to liquidation data on CoinGlass and identified three cryptocurrencies likely to experience a short squeeze.

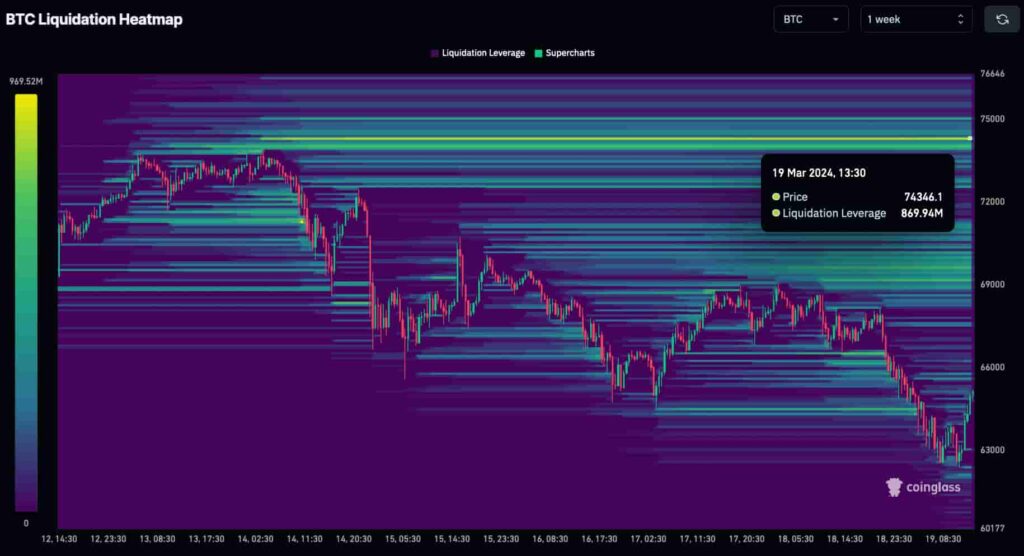

BTC weekly liquidation heatmap. Source: CoinGlass

Additionally, MartyParty spotted $8.1 billion of liquidations at $75,500, making it a relevant zone to consider.

There are now $8.1b worth of shorts to liquidate at Bitcoin $75500 ? pic.twitter.com/SYkS537TlU

— MartyParty (@martypartymusic) March 19, 2024Litecoin (LTC)

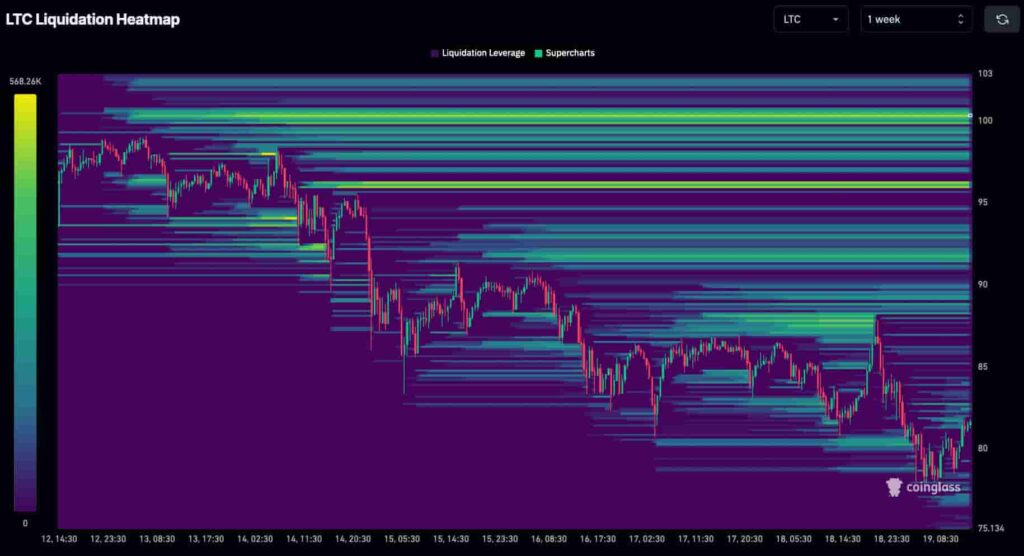

The second most likely cryptocurrency to see a short squeeze is Litecoin (LTC), with a proportionally high accumulation of short positions.

Notably, market makers could first target a liquidity pool above $95. Next, meaningful liquidations await the bloodbath in the $100 region, which plays an important psychological resistance.

LTC weekly liquidation heatmap. Source: CoinGlass

Ethereum (ETH)

Meanwhile, Ethereum (ETH) also has some pump potential with many liquidity pools to the upside. However, ETH’s liquidation volume is proportionally smaller, weighted to its market cap and historical liquidations.

Still, some price levels gain the spotlight with higher leverage margin calls. On that, $3,600, $3,700, and above $4,000 are likely targets for a short squeeze.

ETH weekly liquidation heatmap. Source: CoinGlass

As observed, opening leveraged short positions exposes traders to liquidations and incentivizes the market to go in the opposite direction of what most speculators are biased toward.

The cryptocurrency market is highly volatile and professional traders take advantage of this nature to increase their profits. Therefore, caution is needed when speculating and trading cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.