Although he recently pointed out the problem of the seemingly unlimited supply of mined precious metals like gold and silver, the famous investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has recently argued that silver could be the best bargain.

Specifically, explaining his reasoning on the matter, Kiyosaki stated that silver was “not only a precious metal,” but also “an industrial metal and a strategic metal,” demand for which was soaring due to wars erupting all over the world, as he pointed out in an X post on March 19.

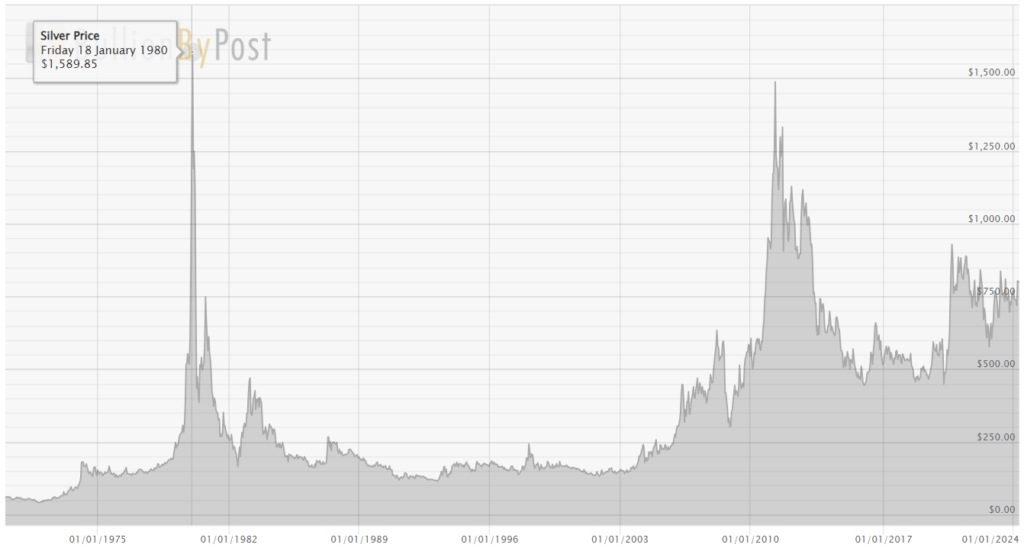

Furthermore, Kiyosaki highlighted the fact that Elon Musk’s company Tesla (NASDAQ: TSLA) had recently “secured rights to several silver mines” to extract the metal for the production of Tesla’s electric vehicles (EVs), adding that the silver price today was still well below its all-time high (ATH).

Silver price per kilogram all-time chart. Source: BullionByPost

But how much is silver per ounce? In terms of ounces, the silver price at the time of publication stood at $24.81, recording a decline of 0.35% on the day but nonetheless increasing by 2.44% across the previous week and gaining 7.88% to its value in the last month.

All things considered, Robert Kiyosaki is correct in his estimations that silver is still a very affordable precious metal that has the capability to double its price from its current state, and its increased demand in technology and industry could, indeed, push its price higher.

That said, investing is a risky business, which is why it is crucial to carry out one’s own research before devoting a significant part of the portfolio to any asset, be it a precious metal or cryptocurrency like Bitcoin (BTC) – which, incidentally, is one of Kiyosaki’s other favorite assets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.