In the cryptocurrency market, smart traders are pseudonym addresses with a profitable record trading cryptocurrencies. Usually, other speculators follow these smart traders to collect insights and, sometimes, mirror strategies.

Recently, a meme coin boom dominated the crypto landscape in March, creating new profitable traders who made millions of dollars. In particular, the Solana (SOL) account ‘14c7f…3KwJn’ has profited over $1.3 million trading more than 350 meme coins.

The smart trader achieved this impressive result in a month-to-date (MTD) time frame, according to Lookonchain’s post on X (Twitter).

Solana (SOL) price and market cap. Source: CoinMarketCap

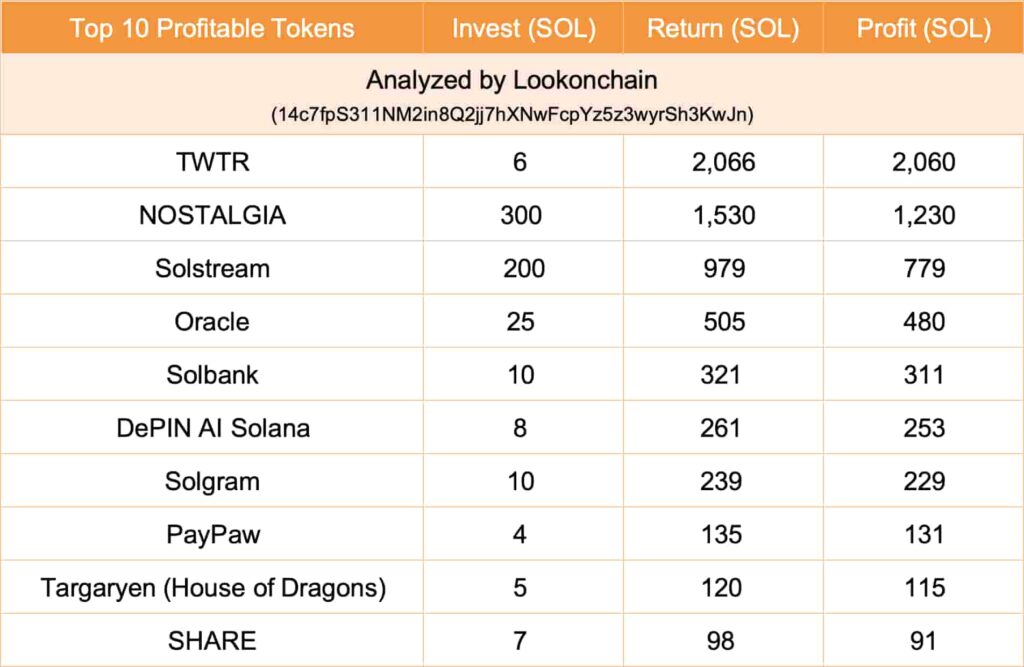

Top 10 meme coin trades by the $1.3 million profit smart trader

Looking further, the analysis consolidated the other nine most profitable meme coin trades by ‘14c7f…3KwJn’. NOSTALGIA resulted in a profit of 1,230 SOL, worth $215,250, while Solstream 779 SOL ($136,325).

The other seven meme coins sum to a total of 1,610 more Solana to the smart trader, valued at $281,750.

Top 10 profitable tokens of 14c7fpS311NM2in8Q2jj7hXNwFcpYz5z3wyrSh3KwJn. Source: Lookonchain

Interestingly, these speculative maneuvers happened during a huge meme coin boom in March. The cryptocurrency landscape saw a generalized shift toward fun tokens, with Solana Network at the forefront of this mania.

However, meme coins are not advised assets to hold in an ideal crypto portfolio. This class of cryptocurrencies lacks solid fundamentals to sustain any acquired demand in the long term. Finance experts usually describe meme coin speculation risks according to “The Greater Fool Theory,” which says:

“The Greater Fool Theory is the idea that, during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because it will always be possible to find someone who is willing to pay a higher price. An investor who subscribes to the Greater Fool Theory will buy potentially overvalued assets without any regard for their fundamental value. This speculative approach is predicated on the belief that you can make money by gambling on future asset prices and that you will always be able to find a “greater fool” who will be willing to pay more than you did. Unfortunately, when the bubble eventually bursts (which it always does), there is a large sell-off that causes a rapid decline in the asset values. During the sell-off, you can lose a great deal of money if you are the one left holding the asset and cannot find a buyer.”

– Harford Funds blog post: “The Greater Fool Theory: What Is It?”Therefore, speculators joining the speculative frenzy late, following ‘smart traders,’ may end up with liquidity issues or face potential crashes, losing most of their short-term acquired profits. To avoid these consequences, investors should focus on projects with solid fundamentals and sustainable long-term demand.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.