After weeks of huge volatility, some crypto assets are left with significant imbalances that could cause drastic changes. In particular, Finbold spotted two possibly overbought cryptocurrencies in what might be a sell signal for April.

The overbought signal is usually identified through a technical indicator called the Relative Strength Index (RSI). Essentially, it measures the momentum of an underlying asset based on past price action, considering multiple factors.

A strong momentum, above 60 index points is usually positive and indicates an uptrend or a bull market. However, going for extreme strength can often sign the cryptocurrency is due to a correction or trend reversal.

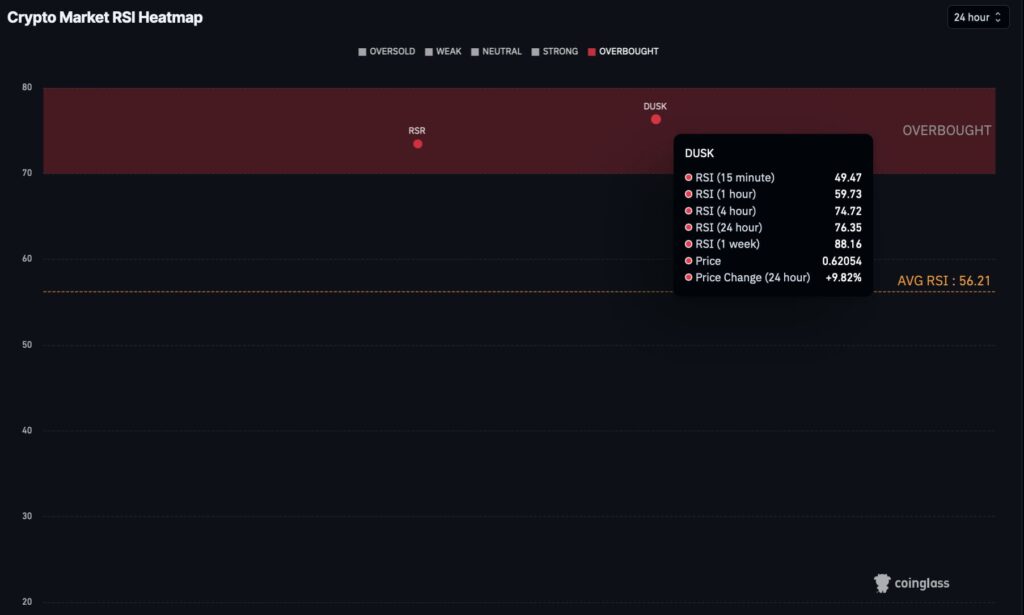

Crypto market 24-hour RSI heatmap: RSR. Source: CoinGlass

This status threatens a massive correction for the supposedly overbought ERC-20 token, which has one of the highest weekly Relative Strength Indexes as of today.

Sell signal for Dusk (DUSK)

Second, Dusk (DUSK) has a similar weekly and daily RSI to the Reserve Rights token. With a 76.35 and 88.16 overbought status, respectively, traders should be aware of a sell signal for DUSK.

The token belongs to a layer-1 blockchain founded in 2018, focusing on real-world assets (RWA) compliance for institutional investors.

Interestingly, DUSK rose over 9.82% in the last 24 hours, coming from a few weeks of positive price action. BlackRock’s recent move toward a tokenization fund and RWA enterprises have fueled the demand for this project, which could now face a short-term retracement.

However, positive developments in the institutional landscape would favor further growth for Dusk, invalidating this technical analysis.

Crypto market 24-hour DUSK heatmap: RSR. Source: CoinGlass

All in all, RSR’s and DUSK’s RSI data suggest a sell signal for these two overbought cryptocurrencies in April. Yet, fundamental aspects could influence an uptrend continuation and investors must trade cautiously in both scenarios.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.