As March comes to an end, cryptocurrency traders look for insights on cryptocurrencies with the potential to skyrocket in April. Among valuable indicators, the open interest in the derivatives market hints at possible short squeezes in the following weeks.

In particular, the current domination of short positions could trigger massive liquidations in specific cryptocurrencies, proportionally pumping their prices.

This happens because traders agree upon a liquidation price to open shorts against a cryptocurrency they are bearish with. If the underlying asset reaches the liquidation price, the position is closed through the asset’s repurchase.

ETH Futures open interest in USD. Source: CoinGlass

This has created relevant liquidity pools in two different price levels. First, there are liquidations in the $3,700 price zone and later at above $4,100. Reaching these targets has the potential to trigger a short squeeze and pump the price upwards.

Therefore, ETH could reward short-term traders with 2.5% to nearly 14% gains from the current $3,600 region.

ETH liquidation heatmap. Source: CoinGlass

Short squeeze alert for XRP

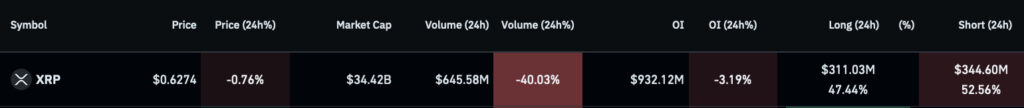

Meanwhile, the 24-hour volume of short positions is dominating XRP’s open interest by 52.56%, with $344.60 million. The token was trading at $0.627 by press time and is on the edge of more volatility.

XRP derivatives market data. Source: CoinGlass

Interestingly, XRP has liquidity pools in both directions, with the closest ones to the downside for a possible long squeeze. These traders could face sudden liquidation if Ripple’s April sell-offs serve to ignite a momentary crash.

However, there are also short liquidations on the upside of the monthly chart, with emphasis on the $0.71 zone. This is aligned with technical indicators pointing to a possible downtrend breakout.

XRP liquidation heatmap. Source: CoinGlass

Despite the relevant potential, short-sellers futures liquidations do not guarantee a short squeeze will occur. The cryptocurrency market is highly volatile and drastically changes every minute.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.