As gold has again broken its price record, with gold spot price currently standing at around $2,260, its staunch advocate and Bitcoin (BTC) skeptic Peter Schiff has taken to social media to explain why he believes the precious metal to be far more superior to the flagship decentralized finance (DeFi) asset.

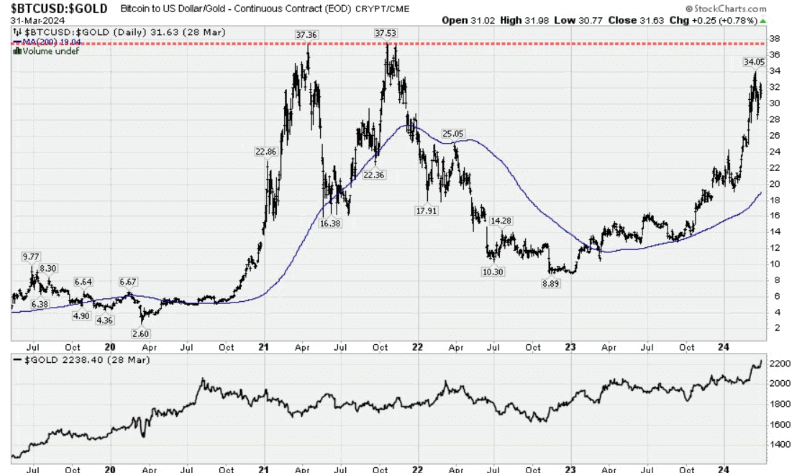

Specifically, Schiff pointed out that Bitcoin has recently made its own all-time high (ATH) priced in United States dollars, but has not managed to hit a new ATH priced in gold, asserting that this diminishes the ‘digital gold’ argument, according to his X post on March 31.

“While Bitcoin made a new high priced in dollars, it failed to make a new high priced in gold. Perhaps it never will. That undermines the case for Bitcoin being digital gold.”

Bitcoin gold price chart. Source: Peter Spina

More recently, Schiff slammed “Bitcoin pumpers (…) making fun of tonight’s ‘meager’ $25 rise in the price of gold,” stating that “following Friday’s $39 rise, this 3% two-day gain equates to about $450 billion of total market capitalization,” and that Bitcoin would have to increase to $94,000 “to match that dollar gain.”

Peter Schiff Twitter arguments

As a reminder, the economist has earlier issued a warning to young people that their preference for the digital asset over gold could have consequences in the future, suggesting that Bitcoin’s popularity among this group stems mainly from “ignorance and lack of experience.”

According to Schiff’s view:

“By the time they gain the wisdom that comes with age, Bitcoin will have collapsed and they will prefer gold.”

He also predicted a “catastrophic crash” for the largest crypto asset by market cap due to its increased vulnerability as more BTC enters into spot exchange-traded funds (BTC ETF) that the US Securities and Exchange Commission (SEC) approved this year, as Finbold reported on March 19.

Meanwhile, Bitcoin was at press time changing hands at the price of $69,658, recording a slight daily decline of 0.95%, but still holding onto the 4.15% gain across the week and a 12.16% increase in the last month, while advancing 64.72% this year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.