Bitcoin (BTC) is back to the $65,000 price level amid a nearly 9% drop since April started. Cryptocurrency traders and investors wonder if BTC has reached a price top this cycle, or what signals to watch for.

Forecasting market tops and bottoms with precision is tricky and deemed a difficult task even for the most successful traders. However, experienced investors can look for historical indicators, patterns, and signals to make educated guesses based on the event’s probability.

In particular, Charles Edwards, founder of Capriole Investments, raised 13 Bitcoin top signals to watch for this cycle. The experienced trader posted these top signals in a thread on X (formerly Twitter) on April 2, explaining their relevance.

Hodler Growth Rate. Source: Glassnode (Capriole Investments)

Dormancy Flow

Second, Capriole Investments’ founder has seen increased activity by dormant Bitcoin wallet addresses, which is concerning in his opinion.

“Quite concerning today, Dormancy Flow has peaked significantly suggesting the average age of coins spent is significantly higher in 2024. Peaks in this metric (z-scored) typically see cycle tops just 3 months later.”

– Charles Edwards

Bitcoin Dormancy Z-Score. Source: Glassnode (Capriole Investments)

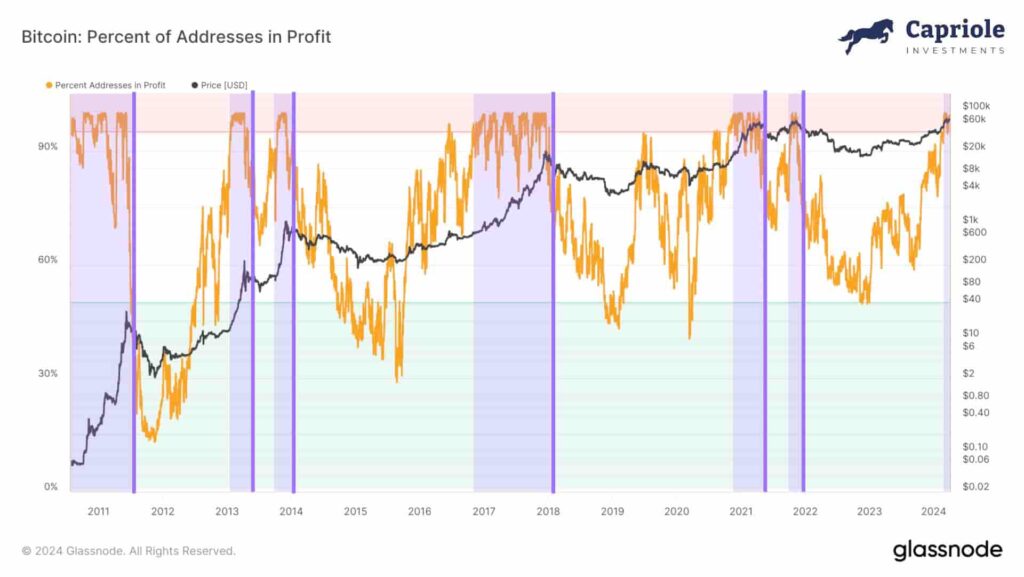

Percent of Bitcoin Addresses in Profit

Third, the analyst is looking at over 95% of Bitcoin addresses in profit, which is also a relevant top signal. Essentially, the more holders in profit, the more likely it is for a massive profit realization activity to ignite.

Charles Edwards points out that the new all-time highs over the last month have accelerated this process, that already started. If Bitcoin price starts to drop and, thus, the percentage of addresses in profit, the market could soon see a bearish trend taking place.

Bitcoin: Percent of addresses in profit. Source: Glassnode (Capriole Investments)

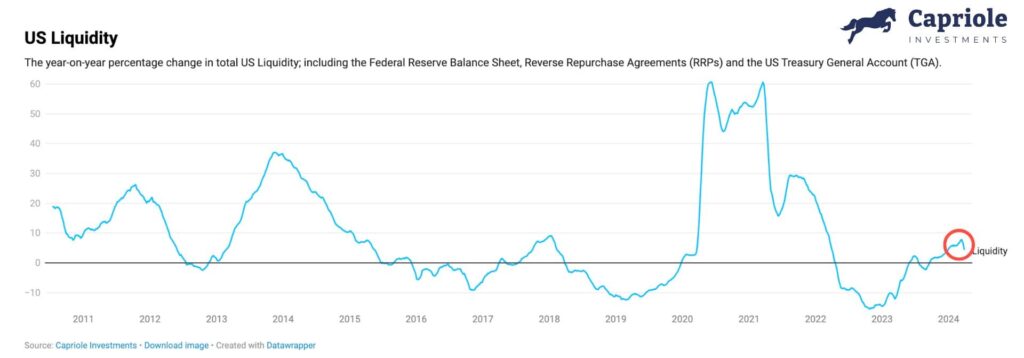

U.S. Liquidity

Finally, the fourth high-risk metric pointing toward a top signal for Bitcoin is the year-over-year liquidity change of United States financial institutions.

“Liquidity drives markets. There’s a very strong correlation with this chart and Bitcoin’s price history. Up is good for Bitcoin, down is bad. In the last two weeks we have possible signs of a (local) top. If this downtrend persists, that would be concerning.”

– Charles Edwards

US Liquidity. Source: Capriole Investments

In conclusion, the expert investor warns of starting signals of a possible top to Bitcoin and cryptocurrency prices this cycle. Nevertheless, these metrics are still not in a critical phase and Capriole Investments sees a likely further bull market mid-term.

Yet, investors should start to monitor these and other relevant top signals to make long-term profitable decisions while investing in Bitcoin and other cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.