Bitcoin (BTC) has once again captured the spotlight this week, exhibiting significant fluctuations in its price amidst a complex backdrop of global economic shifts and cryptocurrency-specific developments.

As of April 2, 2024, Bitcoin‘s price hovers at $65,816 down by approximately 7.97% over the past week. This recent downturn has pushed the market capitalization of Bitcoin to $1.293 trillion.

Bitcoin 7-day price chart. Source: Finbold

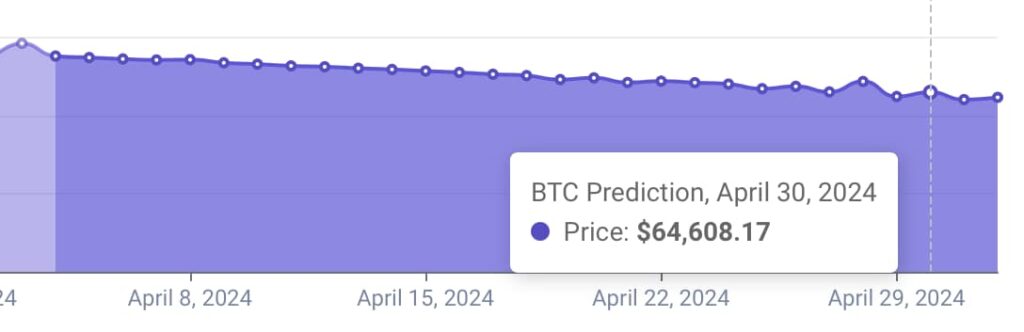

BTC Prediction, April 30, 2024. Source: PricePredictions

The impact of global economic factors on Bitcoin

A significant factor contributing to Bitcoin’s recent price movements is the strengthening of the US dollar. Following upbeat US factory data, the dollar index (DXY), which measures the greenback’s strength against a basket of major fiat currencies, surged past the 105 mark, reaching its highest level since mid-November.

This four-week gain of 2.58% has made dollar-denominated assets like Bitcoin and gold more expensive and potentially less attractive to investors, leading to decreased demand.

Moreover, the continued strength of the dollar is anticipated to induce financial tightening globally, diminishing the appetite for riskier investments such as cryptocurrencies. Despite these challenges, some analysts remain optimistic, suggesting that the increasing fiscal debt might compel the Federal Reserve to rapidly lower interest rates, potentially providing a significant boost to crypto markets.

This optimism is set against the backdrop of the Fed’s aggressive rate hikes from zero to 5.5% within 16 months up to July 2023, a move that played a part in Bitcoin’s 80% price crash in 2022.

The Role of Cryptocurrency-Specific Factors

Beyond global economic indicators, Bitcoin is also navigating through critical events specific to the cryptocurrency domain. The impending quadrennial mining reward halving later this month adds another layer of uncertainty and volatility to Bitcoin’s price dynamics.

Crypto expert Michael van de Poppe commented on the situation, noting the likelihood of the price peaking pre-halving, followed by a period of consolidation and subsequent continuation.

#Bitcoin consolidating and #Bitcoin peaking pre-halving.Two essential ingredients and I think we won't be seeing a new ATH pre-halving.If Bitcoin dips further in the Summer, I'll be happy to be buying it at $56-60K.It's still altcoins time. pic.twitter.com/CongTohvNA

— Michaël van de Poppe (@CryptoMichNL) April 3, 2024Additionally, behavioral analysis from the platform Santiment indicates a robust community response to the recent price drops. Despite a retracement in Bitcoin and even more significant losses in altcoin market caps to kick off April, the crypto community has shown resilience.

? Is #crypto still in a #bullmarket after #Bitcoin's +144% price return since October 15th? Well, according to the crowd, the belief has fizzled out significantly. Historically, less long-term optimism increases the probability of a continued market rise. https://t.co/J4o0RdgEuT pic.twitter.com/4C7ooFl1r7

— Santiment (@santimentfeed) April 2, 2024The sentiment is notably bullish, with discussions around purchasing Bitcoin doubling those related to selling. Historical trends suggest that such sentiment could signify an opportune moment for investors to buy the dip, often resulting in a redistribution of assets from smaller wallets to more substantial investors, known as whales and sharks.

With several job reports and other critical indicators on the horizon such as the Bitcoin halving, the coming weeks are poised to be a critical period for Bitcoin and the broader cryptocurrency market. Investors and observers alike will be keenly watching how these various factors play out in influencing Bitcoin’s value and the cryptocurrency landscape at large.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.